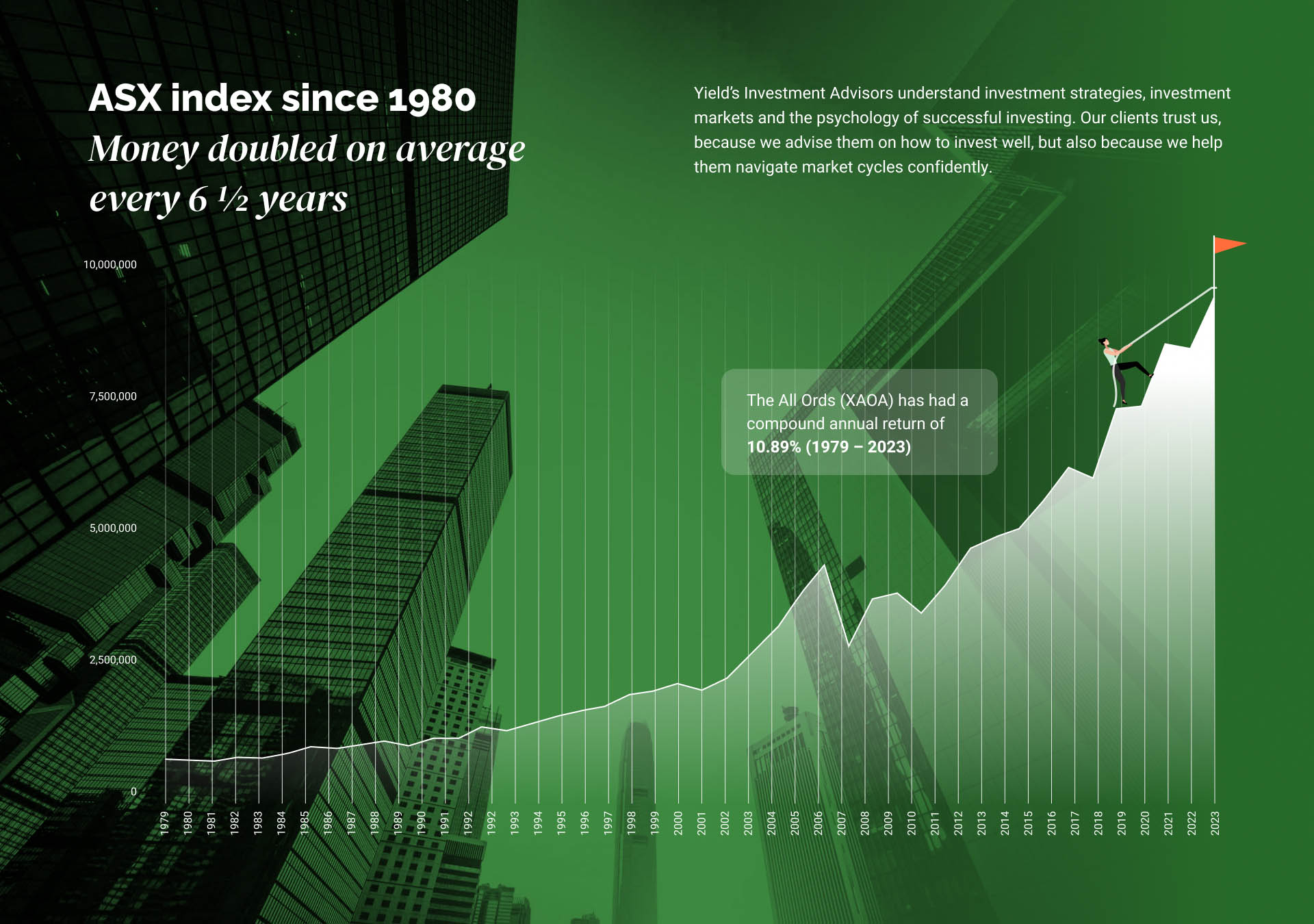

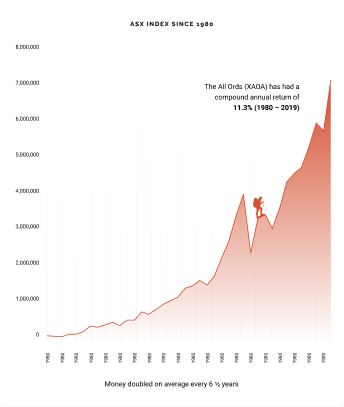

What is wealth creation?

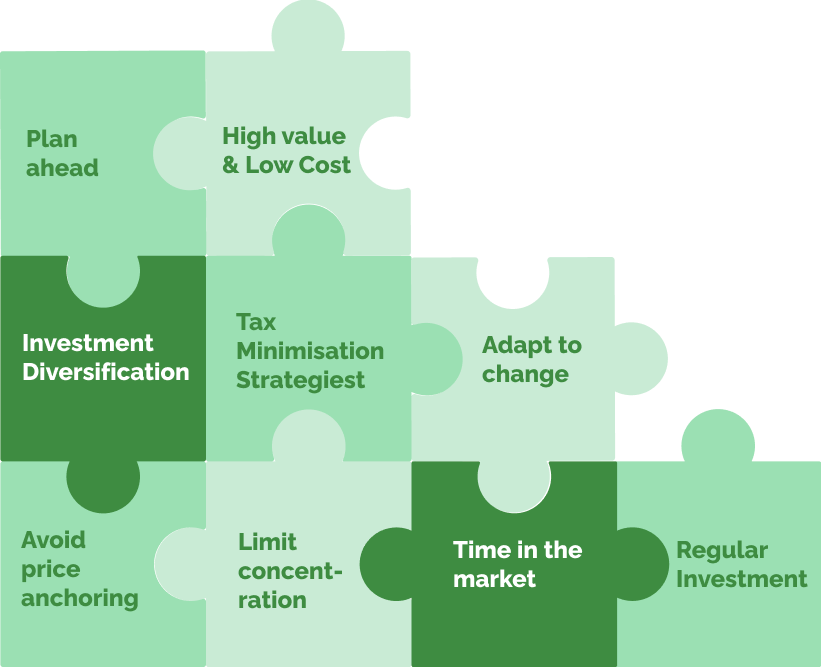

Wealth creation is all about building up assets and generating income streams that help grow your net worth over time. It involves making strategic financial decisions to grow your wealth through various means such as investing, starting a business, real estate, and other income-generating activities. It’s not just about choosing the right investments but also giving them time to grow and choosing the right structure, so that you optimise your after-tax returns.

The key is to maintain a balanced approach, manage risks wisely, and stay committed to your long-term financial objectives.