A Yield Client Case Study

Superannuation

$46,000 est. tax savings from concessional super contributions

Investment

$117,550 gain made at 65 investing approx. $180,000 over time

Superannuation

$1,400 – $1,974 co-contribution and spouse contribution benefit

Financial Planning

$184,854 financial position improvement at age 90, including recommended life insurance

Superannuation

$46,000 est. tax savings from concessional super contributions

Investment

$117,550 gain made at 65 investing approx. $180,000 over time

Superannuation

$1,400 – $1,974 co-contribution and spouse contribution benefit

Financial Planning

$184,854 financial position improvement at age 90, including recommended life insurance

Overview – Aligning all Financial Commitments

We overlayed a ‘debt-washing’ strategy that involves repaying non-deductible debt and redrawing these funds in a separate loan facility for the purpose of investment.

This helped to ensure the deductibility of any interest paid as a result of the investment, combined with looking over all financial commitments and goals they had.

The couple in their late 40s wanted to increase their nest egg for retirement and get advice on:

- Utilising their home equity for investment and a kitchen renovation

- If they were utilising their surplus cashflow effectively

- Updating their insurance for transition to retirement

- Taking advantage of the historically low interest rates in Australia

Outcome

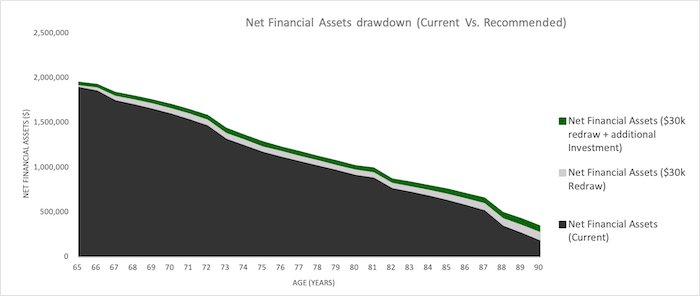

Our analysis indicated that by undertaking our recommended strategy, our clients could retire at their desired retirement age of 65, with an improved cash position of $184,854 by age 90.

Our advice included making an investment with home equity, increasing superannuation contributions, and taking on new insurance cover, to protect their downside against the risk of death and disability, which could otherwise derail their retirement.

Illustration of Outcomes – Home Equity and Tax Structures Work

Our scenario met all the couple’s goals of planning a kitchen renovation and a better-suited insurance policy, and we additionally saw that if they re-drew even more from their home equity, they could accelerate their wealth creation. We also identified that maximising concessional contributions whilst working and taking advantage of one of the client’s low income, allowed them to take advantage of Spousal contributions to reduce tax payable and the Government Co-contribution.

This graph illustrates the couple at retirement age and their current projected net financial assets, projected net financial assets with a $30K redraw, and projected net financial assets with a $30K redraw and our additional investment advice.