If you are investing in a ‘growth’ asset, like shares or property, it is widely acknowledged that an investment time frame of over 7 years is appropriate. This gives the asset time to ride through a cycle and improves the likelihood that the additional risk and volatility you take on with these assets produce a better overall level of return than just putting your money into the risk-free asset of cash.

However, even if you are prepared to leave your money there for 7 years or more, it remains true that it may serve you best to leave it for considerably longer than that in the end.

At the end of the day, money is there to provide for your lifestyle, and the biggest financial goal we all share is to be in a position to self-fund our retirement. Therefore, it always pays to reconsider why the investment is being made in the first place.

There can be a million justifications for shifting money around for short-term needs, but investing for a longer time frame has more value than just managing your risk. There is also the value of compounding. Most people will have heard Albert Einstien’s quote “Compound interest is the eighth wonder of the world. He who understands it, earns it. He who doesn’t, pays it” and yet it is often forgotten about when investing.

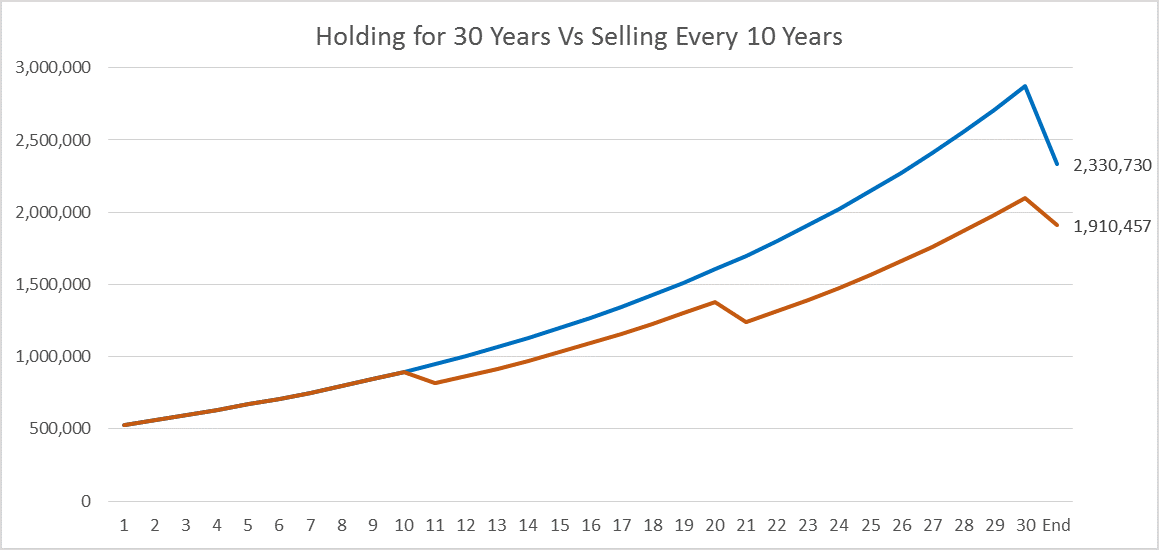

If we look at an example, say you bought a property or portfolio of shares for $500,000. The common prudent practice would be to invest with a 7 + time frame, but let’s look at the difference if you were to leave this for say 30 years or sell it and reinvest the money say even every 10 years.

Investment Property Example

Assuming return is 6% growth; Individual earns $80,000; Purchase price is $500,000 with $27,000 of purchase costs, tax based on today’s rates including Medicare levy, then the net amount they can afford to invest after each sale is reinvested.

The chart shows the net amount received upon sale after the 30th year.

As can be seen, the compounding benefit is huge and this is because you are not incurring the expenses that go with buying or selling an asset like agent fees or brokerage and stamp duty, but of even greater consequence is the deferral of capital gains tax.

Now what this does not consider is that there can be compelling reasons to alter your strategy. Possibly the investment does not look like it will deliver returns in line with the expectation or what you believe an alternative could provide, but it does demonstrate that there can be a lot of merit in leaving your investments alone to work for you throughout several asset cycles where possible.

We assist our clients to make informed investment decisions every day. Counseling about buying and selling and the emotion behind these decisions is one way we can add a huge amount of value if we can help ensure that you are making well-considered investment decisions that you are comfortable with.

Yield Financial Planners, will challenge your thinking and help you make well-informed choices that are within your risk comfort.

This article was also featured on the Financial Planning Association (FPA) website.