An important consideration of investing, and your finances more broadly, is being sure of how much tax you pay when you sell shares in Australia.

We were recently asked to answer the question below and we go through some of the important factors when assessing how much tax you will need to pay when you sell some or all of your shares.

“I have sold shares so that I can gift $60,000 to my daughter and her husband to install a pool for their family. I know I will pay tax on my shares, however, can I transfer $60,000 to them without tax implications for them or me? I am not on a pension I don’t feel I ever will be.

-Ann from Griffith, NSW

Hi Ann – well first of all I’d love to have a mum like you! 😊 $60,000 for a pool is a most generous gift.

The question on how much tax do you pay when you sell shares in Australia will depend on a number of factors. These include:

- How your shares are currently owned

- What your taxable income is

- What if any capital gain you have on the shares you hold

- Whether you have owned the shares for longer than 12 months

- Whether you sell any other assets with a capital gain in the same financial year

- Whether you have any other assets you can sell that have a capital loss in the same financial year

I’ll break these down for you a bit.

1. How your shares are owned currently

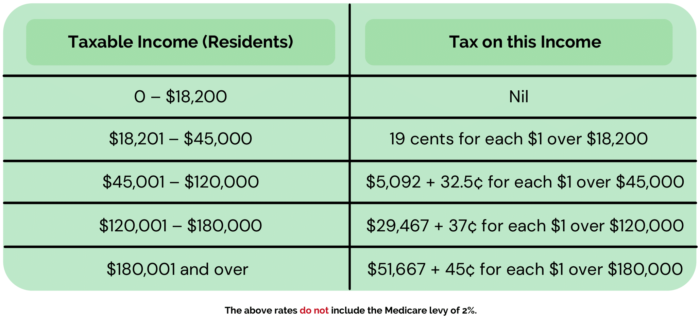

Assuming you own your shares personally, you are entitled to a tax-free threshold of assessable income, however, once you have earned in excess of this amount, you will begin paying tax at your personal marginal tax rate. If however your shares are owned in another entity like super for example, your tax could be as little as 0% or as much as 30%. Other structures have their own tax rates to consider too.

2. What your taxable income is

Your taxable income is the amount you declare to the tax man each year. This includes any income you may have earned through employment or investment income. I will assume that the shares you are selling are owned personally or at least taxable to you personally. This means that any income you receive throughout the financial year from your investments, including any assessable capital gains will contribute to your total taxable income and this will determine how much tax you pay overall.

3. What the capital gain is that you will incur on the sale of shares

It is not clear from your question, what the capital gain is you have made on the shares you are selling, but it is only the capital gain that is assessable and this will ultimately determine whether there is any tax payable.

4. Whether you have owned the shares for longer than 12 months

If you have owned your shares for longer than 12 months, you should be entitled to a 50% discount on the capital gain you have made. For example, if you bought the shares for a cost base of $40,000 and sell for $60,000, you have made a $20,000 capital gain. If you have owned these for longer than 12 months, you will get a 50% discount on the gain, meaning you will have $10,000 that will go towards your taxable income. How much tax you pay, if any, will then be determined by what your total taxable income for the financial year is assessed to be.

5. Whether you sell any other assets with a capital gain in the same financial year

It is important to realise that if you sell more shares or assets that have a capital gain in the same financial year, this will further add to your taxable income and influence how much tax you pay overall

6. Whether you have any other assets you can sell that have a capital loss in the same financial year

If you have any investments that have a capital loss, there may be a benefit in selling or realising a loss, as this will offset the equivalent capital gain

Fortunately, there should not be any tax implications for your daughter or son in law by gifting this money. Any tax liability will sit with you and be assessed considerate of what I’ve just outlined.

As a last point, I would suggest ruling out your pension eligibility first, if you have not already done so, as the way that Centrelink treat a gift of this size, is to assess part of it as an asset for 5 years, therefore reducing your pension entitlement if you are in fact eligible.