Get in touch with us

Book a FREE consultation and receive your complimentary eBook

Get started with a free strategy consultation and receive a copy of the Good Fortune Guide – written by James McFall, Managing Director Yield FP and 2020 National Finalist Certified Financial Planner of the Year to help educate you on your Financial Plan.

Book a FREE consultation and receive your complimentary eBook

Get started with a free strategy consultation and receive a copy of the Good Fortune Guide – written by James McFall, Managing Director Yield FP and 2020 National Finalist Certified Financial Planner of the Year to help educate you on your Financial Plan.

Every retirement story is unique, and a personalised plan is essential. In this page you’ll find comprehensively researched insights, including customised calculations from Yield, to help you begin your journey into retirement in 2024.

Planning for retirement is about visualising your best life after work and crafting a roadmap for achieving it. But, to make it happen, you must ask yourself, “How much do I need to retire?”. Right now, you may be looking for a retirement calculator to tell you the answer, but it goes way deeper than that.

In our conversations with clients, we help them to paint a vivid picture of their ideal retirement and life. The responses we receive are wonderfully diverse, from aspirations for regular travel, to simply enjoying the city they live in, with the people they love. Importantly too, what you want now, may be completely different than ten years from now.

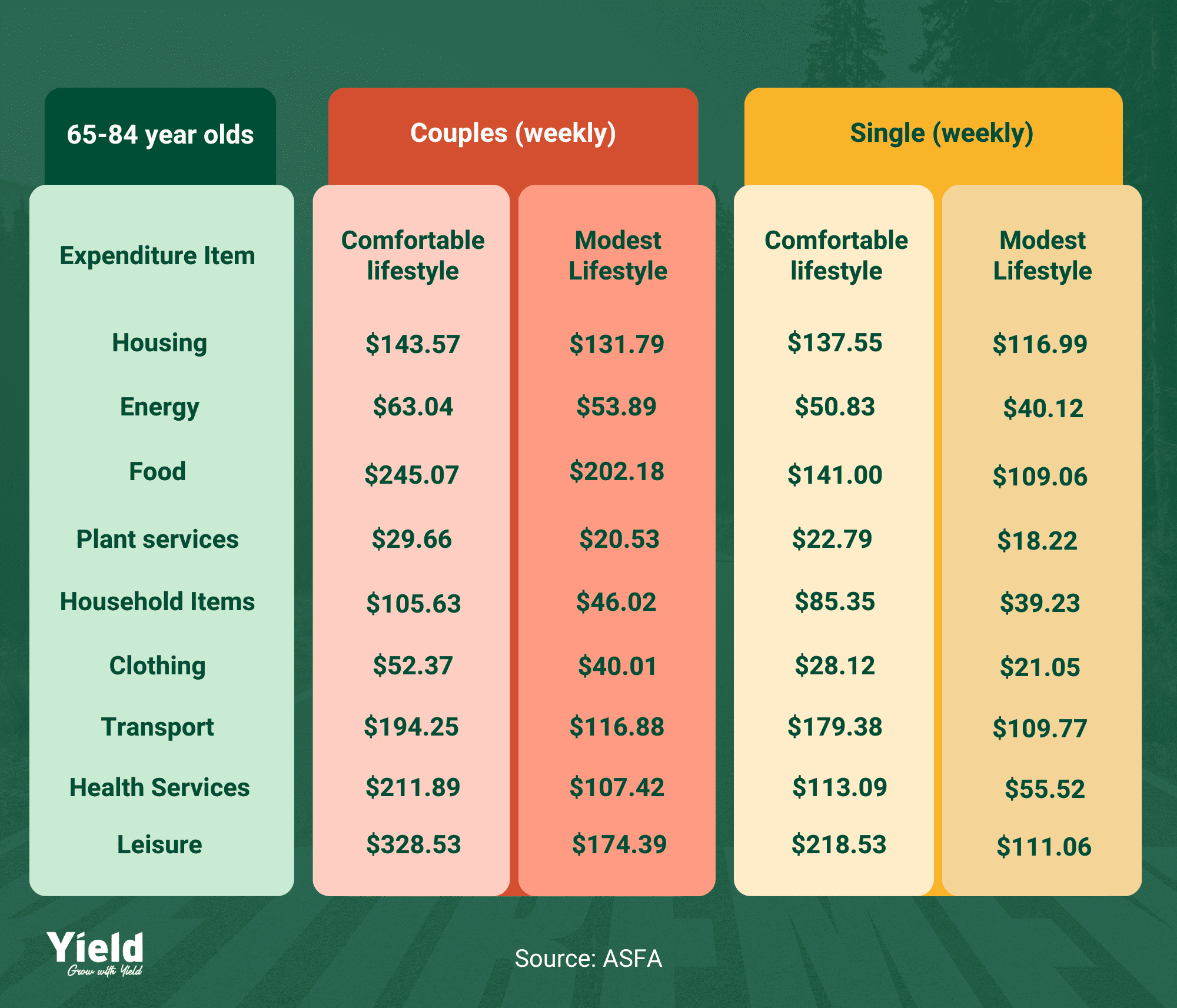

In the dynamic economic landscape of 2024, there are various considerations that must be factored in also, including the cost of living and geopolitical considerations. To get us going in answering the question, how much does retirement cost, a solid starting point is to look at research conducted by the Association of Superannuation Funds of Australia (ASFA). Each year, ASFA run a survey of retirees, that details the average weekly expenditure required for both single and couple retirees aged between 65 and 84.

The table to the right is from their most recent survey (September Quarter 2023) and provides a detailed average breakdown of the way retiree Australian’s spend their money, and they categorise people into two main lifestyle standards: ‘Modest’ and ‘Comfortable’.

Average Retirement Income Australia 2024

ASFA defines a modest lifestyle as offering a quality of life beyond dependence on social service payments, while a comfortable lifestyle affords retirees a more enriching experience, allowing for a diverse range of leisure and recreational activities.

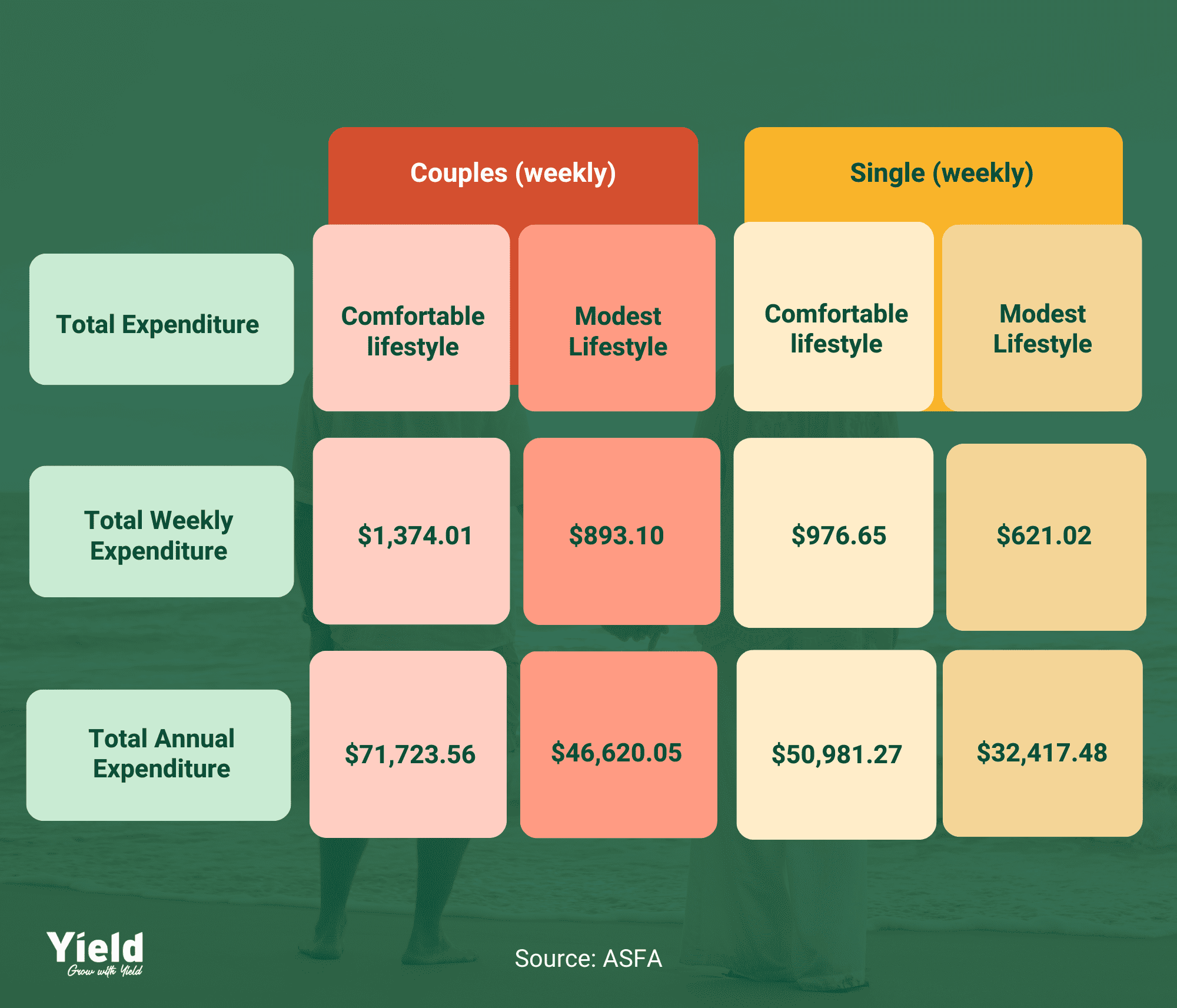

To simplify things, ASFA has gathered weekly and monthly expenses on the left, which provides the average retirement income in Australia.

An interesting observation to notice is that it is a lot more expensive for a single than a couple, on a per head basis. If couples were to spend the same each, that singles need for a comfortable retirement, they would have over $100,000 p.a.

This can be explained, because expenses like housing, energy, household items and transport, are largely shared. Adding these expenses up, you will see a couple only spends ~$52 pw more than singles on this. Whereas there is a more linear duplication of expenses on things like health, food, clothing, and leisure.

How Much Do I Really Need to Retire?

While ASFA data provides a valuable reference point, it’s important to note that these figures represent averages. It is reasonable to infer that the retirement needs of many individuals may broadly align with these numbers. However, when it comes to your income needs, it may vary significantly, depending on your unique situation and requirements.

In a recent survey undertaken by National Seniors Australia, insights were gathered from 5806 senior Australians (aged 50 or over) regarding their personal experiences with the prevailing cost of living crisis, a pressing issue across the country. The survey underscores the adverse effects on individuals’ finances, feelings of security, as well as their mental health and well-being. Moreover, respondents expressed the challenges of post-retirement living, including the limited affordability of the age pension, difficulties in mortgage repayment, and the necessity to re-enter the workforce even after retirement.

These shared experiences, highlight why it is important to plan your retirement. Having helped 100’s of Australians to retire comfortably, we know that as you enter retirement, your primary motivation will be to feel secure. The way to know how much you really need to retire, is to take the time to think about what you want your retirement to look like first. This will determine the lump sum you need to achieve your desired lifestyle and from there it is important to consider the strategies available to make your money work as hard as it can for you and there are lots of options for this.

Your Retirement Income Plan The Key Factors

Your Financial Balance

When evaluating your financial situation, you should first distinguish between your essential needs and your desires. By determining the minimum amount required to cover your basic necessities, you ensure financial stability throughout your life. Additionally, understanding your wants allows you to prioritise and allocate resources, to ensure that both needs and desires can be met.

Your Retirement Age

Determining what age you want to retire is a key factor in retirement planning. Naturally, the earlier you plan to retire, the larger the required lump sum will be, to sustain your lifestyle over the retirement period. Choosing your retirement age is also one of the things you have the most control over and should therefore be weighed up in the context of your position and financial goals and objectives.

Your Investment Strategy

The way you invest your money plays a pivotal role in determining your investment returns. Choosing between cash, shares, and property will impact the amount needed to achieve your financial objectives. Diversifying investments can affect the overall risk and return profile and it is essential that you maintain enough liquidity in your investment strategy, to fund your income needs and other personal objectives.

Age Pension Eligibility

Around 70% of retirees receive the Age Pension, underscoring the importance of incorporating it into any retirement income estimate. However, many retirement calculators tend to overlook age pension entitlement, because there are too many personal things that can change the results.

Planning for Lump Sum Expenses

Your money can be categorised into three main groups: lifestyle assets (home, car), financial assets (money for ongoing expenses), and a fund for one-time expenses (like a big vacation or helping out family). Plan for these to get a clear picture of your financial situation.

Leaving a Legacy

If you care about leaving behind a financial legacy, put a number on it. Your legacy becomes another chunk of money to consider when you’re working out your financial game plan.

How Much Do I Need To Retire In Australia? Including Age Pension

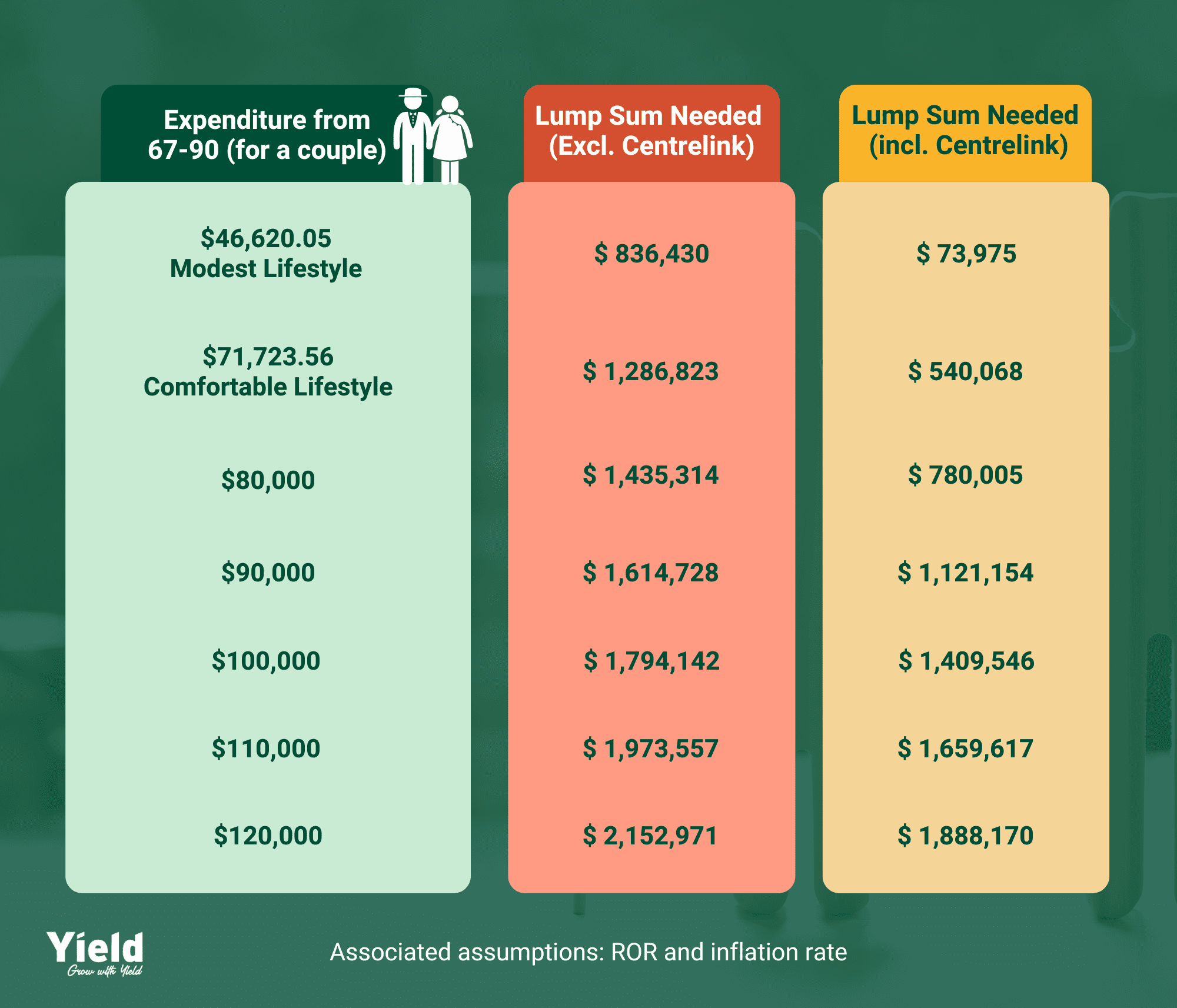

We have crunched the numbers on a range of retirement income needs, to help answer the question ‘How much do I need to retire comfortably?’. Importantly our calculations consider Age Pension entitlements.

As you peruse the estimates you will see the outcomes of our modelling to the questions, ‘How much do I need to retire on $80,000 a year?’ or ‘How much do I need to retire on $100,000 a year?’. On balance, with a range of income needs considered here, you will get a sense of what you might need in your retirement savings to match the income you’re aiming for each year.

Importantly, for you to know with accuracy ‘How much do I need to retire in Australia?’, you should only take this as a guide and explore your needs personally. Because how much retirement income you actually need, is shaped by your distinct needs and circumstances. We’ve worked with many clients to help them get retirement ready and can give you the personal advice you need to achieve the retirement confidence you are looking for.

How Much Super Do I Need to Retire?

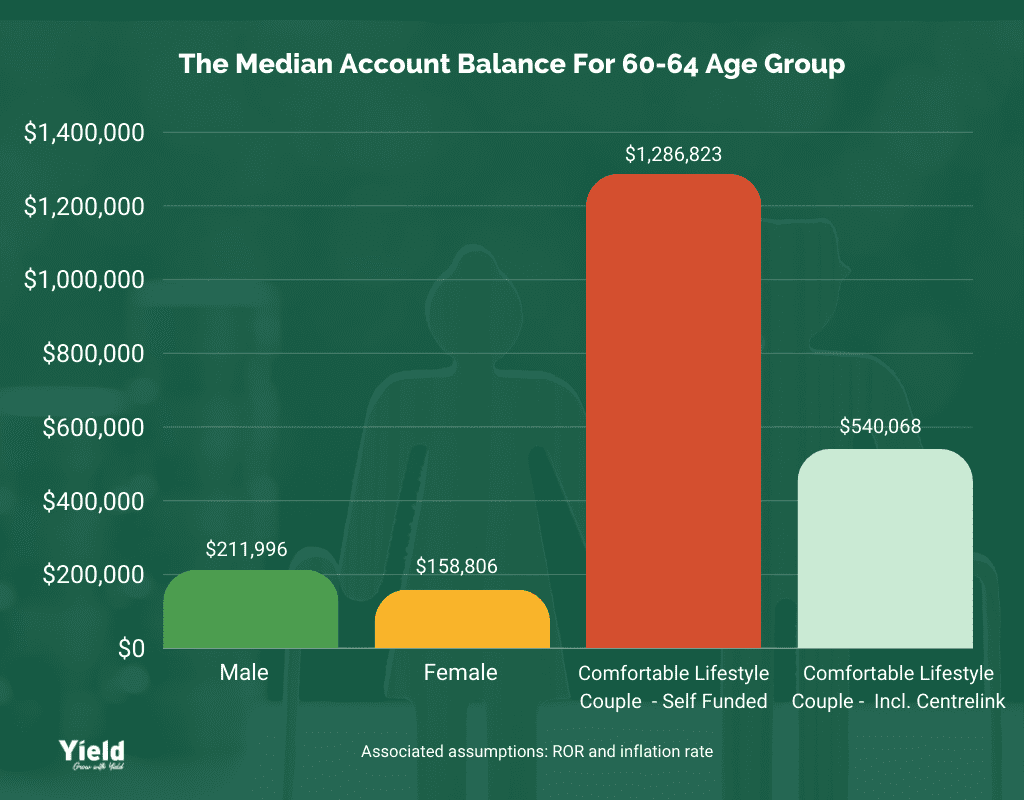

Superannuation is the biggest retirement asset most Australian’s have, so you are likely asking yourself: How much super do I need to retire? Superannuation is a purpose-built retirement structure and should normally play a central role in every Australians’ retirement. What our graph to the left shows however, is that the median super account balances for those aged 60-64 is far lower than what is needed, for a comfortable retirement. Especially compared to the estimates we have calculated, for what is needed with and without age pension.

A shocking statistic is that 1 in 4 males, and 1 in 3 women have no superannuation savings across all age groups in Australia. Furthermore, 25% of females and 13% of men are currently retiring with no Superannuation Savings. On a more positive note, median balances are expected to grow over time. This growth aligns with the maturation of the industry award-based superannuation system established in the 1980s. Legislative changes are also set to increase the contribution rate to 12% by 2025, indicating a bright outlook for future retirement savings.

The average superannuation values can partly be explained by the fact that many Australians’ also own investments personally like property, shares, and other alternative assets. However it may also be interesting to know, that much of the work we do with client’s financial plan for retirement, is focused on maximising superannuation for retirement, as super is usually the most tax effective place for money in retirement.

We trust you agree that this page provides valuable insights for your question – How much do I need to retire in 2024 – but to get a more precise answer tailored to your situation and to explore strategies that can boost your retirement prospects, you should seek professional advice from our team at Yield. Our team are retirement experts, and we are here to guide you toward a secure and comfortable retirement.

Tactical Insights

Get In Touch

Interested to discuss something?

Have a question or comment?

Submit your details and we’ll be in touch.

Free Consultation

Get started with a free strategy consultation and receive a copy of the Good Fortune Guide – written by James McFall, Managing Director Yield FP and 2020 National Finalist Certified Financial Planner of the Year to help educate you on your Financial Plan.