Retirement isn’t just a milestone, it’s like stepping into a whole new chapter of your life. This means you should be actively considering what your ideal retirement lifestyle could look like and what it may cost. At Yield, we typically support the needs of business owners and professionals and several of our clients ask us, how much do I need to retire on $200,000 a year in Australia? or ” how much to retire in Australia?”.

To answer the question properly, it is best to delve deep on what you want your life to look like and how you intend to use your money, including potential big changes, like upsizing or downsizing you home for example. This blog provides a great starting point to guide you on what you will need to achieve an annual income of $200,000 and create more clarity on whether this is the right number to target for your golden years.

Key Consideration for How Much Do I Need to Retire on $200, 000 a Year in Australia.

1.Your Desired Retirement Lifestyle

So have you ever paused to imagine how retirement could look? Maybe it’s spending time with family, traveling to new places, or pursuing hobbies you love. The place to start planning your retirement is to think about what your best life could look like, rather than constraining yourself to what you think you can afford. You can always look at what you may need to compromise on if its required, but the clearer your vision the better you can plan for a comfortable retirement. The good news is that $200,000 a year should objectively provide a great lifestyle.

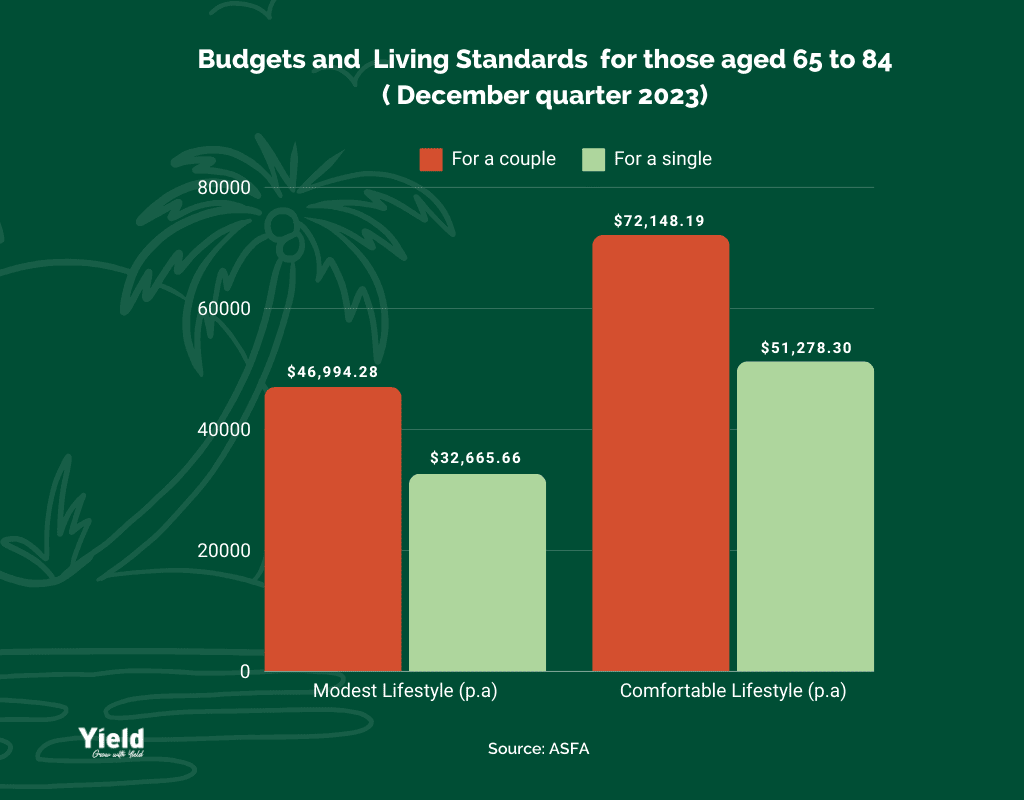

To compare your goal to the average cost of living in Australia, there is a large annual study done, by the Australian Superannuation Fund of Australia (ASFA) that gives insight into how many Australians live in retirement. ASFA’s latest data suggests that couples aged 65-84 aiming for a modest lifestyle typically budget around $46,994.28 annually, while singles may allocate approximately $32,665.66. For those seeking a more comfortable retirement, these numbers could rise to around $72,148.19 for couples and $51,278.30 for singles each year. This comparison offers insight into the financial dynamics of retirement in Australia and highlights that aiming for $200,000 a year provides a solid buffer above the average retirement standard.

However, let’s keep in mind that these figures are just averages. Your retirement plan needs to be tailored to fit your unique lifestyle goals and circumstances. So, take a moment to envision what your perfect retirement looks like, with $200,000 a year in mind. And if you ever feel overwhelmed or unsure about how to make it a reality, reach out to a retirement expert like Yield, that can guide you every step of the way.

2. Choose When to Retire and Factor in Your Life Expectancy

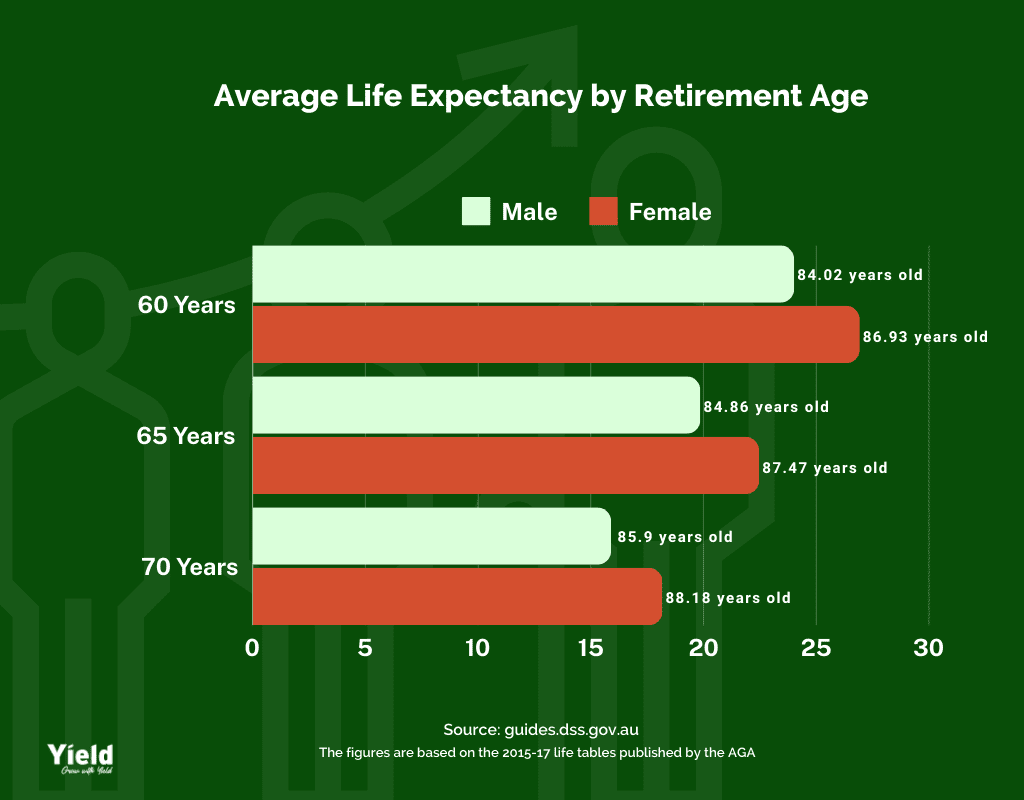

When it comes to planning for retirement, determining your life expectancy isn’t always straightforward. While data from the Australian Bureau of Statistics suggests that men typically live to 81 and women to 85, these numbers can vary depending on factors like when you retire and your overall health. If you’re in a financially dependent relationship, it’s essential to think about the younger partner’s life expectancy too.

The length of your retirement directly affects how much money you will need, and it is therefore vital to make reasonable assumptions about longevity. At Yield, we’re all about thinking ahead and base our calculations on age 90. This is a flexible starting point, which gives us the opportunity to adjust the strategy if needed along the way. By considering life expectancy in your retirement planning, you can ensure that your finances will last throughout your retirement years, no matter what life throws your way.

3. Age Pension

When you’re aiming for a retirement income of $200,000 a year, you probably assume that you will never be eligible for Age Pension. And in all reality, you would hope that you don’t qualify, as this means you will enjoy an extremely secure retirement and will have a lasting legacy to share with loved ones and/or your favourite causes. However, you may be pleased to know that Age Pension could still provide a valuable buffer to your retirement income goals. To qualify, you need to meet certain age and residency requirements, as well as pass income and asset tests. It’s important to understand these criteria in figuring out if and how much Age Pension you might receive.

Interestingly there is approximately 70% of retirees in Australia currently that receive some form of Age Pension support. When we crunched the numbers for optimising a retirement income draw down of $200,000 p.a., we identified that Centrelink entitlements could potentially offer additional support, amounting to $116,205 if your investments are entirely depleted. This highlights the valuable backstop Age Pension entitlements can have on your retirement income strategy.

For a more detailed understanding of Age Pension eligibility and potential benefit amounts relevant to your retirement goals, check out our latest blog: Can I Get the Age Pension.

4. Your Current and Future Expenses

Let’s talk about your expenses now and in the future, especially when it comes to planning for a $200,000 a year retirement. It’s essential to think ahead and consider how things might change over time – like healthcare expenses, inflation, or even if you’ll downsize your home. By keeping an eye on your spending habits and researching potential future costs, you can stay prepared and make adjustments as needed. While it’s hard to predict everything, planning for possibilities like downsizing can make a big difference in securing your financial future. At very least, we recommend factoring in an expected inflation rate, which our projections below have done.

5. Your Debt Levels

Having a lot of debt when you retire can really throw a wrench in your plans. It might mean you have less money to work with given the fact that interest rates can go up and down. It is always ideal therefore to have a clear debt reduction strategy before you retire. As some rules of thumb, start with non-deductible debt first and then move on to tax deductible.

Many of our clients are also property investors and it is not unusual to carry larger than average debts as a result. However, it is always preferable to enter retirement debt free and by managing your affairs well, you can ease your worries and give yourself more leeway in your budget. By staying on top of your debts before and during retirement, you can make the most of your $200,000 a year and have a smoother financial ride.

6. Your Super Balance

Think of your super balance as the backbone of your retirement income strategy. Throughout your working life you gradually save money to support yourself after you stop working and then as you get closer to retirement, you should be looking to really maximise it. For a retirement with an annual income of $200,000, you should ideally be looking to get what you can into super, as it is purpose built to fund retirement income, and up to certain thresholds is tax free.

There is also a lot of flexibility in the way you can invest your money, and once you are retired, you have complete flexibility to withdraw your money when you need it. By growing your super wisely, you can ensure that your retirement funds stretch further, giving you the peace of mind to enjoy a comfortable retirement on $200,000 a year. Importantly, superannuation advice is one way a financial advisor can really help a HNW investor like yourself achieve your goals securely.

Crunching Numbers: Retire on $200,000 a Year in Australia

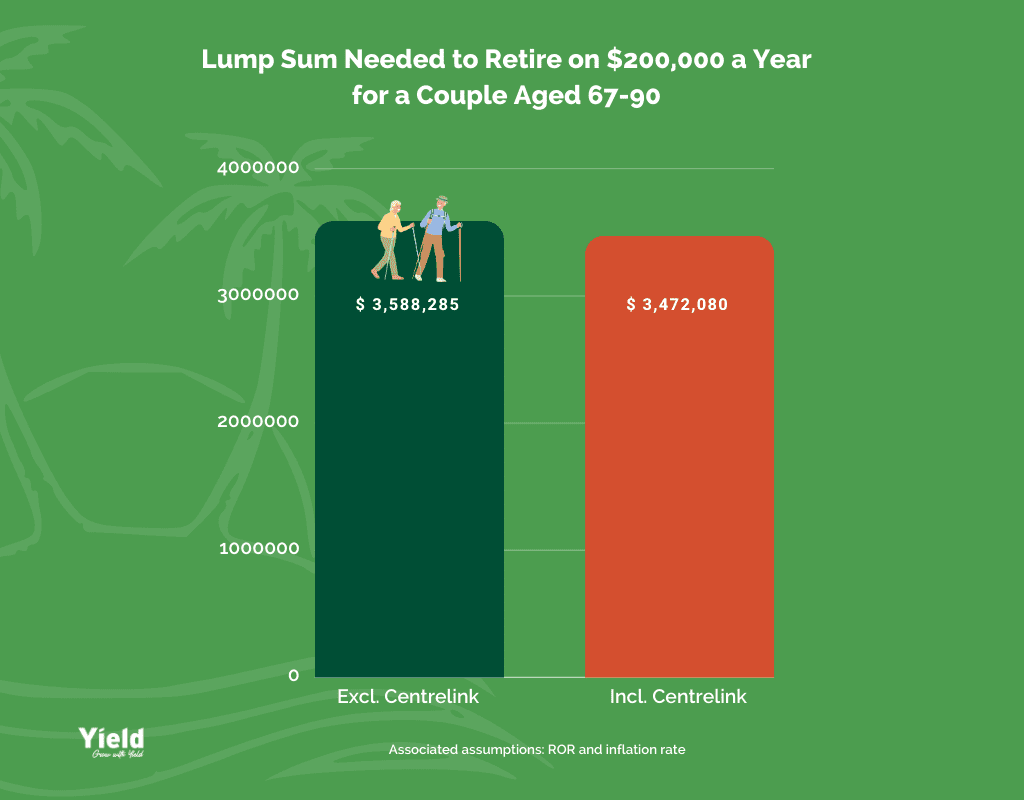

The following graph provides insights into the lump sum required today for a couple aged 67 to 90 to live comfortably on $200,000 a year in retirement. It assumes their investments are in superannuation, converted to a tax-free pension. The calculations consider scenarios with and without Centrelink benefits. Including Centrelink benefits reduces the necessary lump sum due to the added income support they offer.

While these figures offer a helpful starting point, remember they’re based on assumptions and might not perfectly align with your circumstances. So, when crafting your retirement plan and pondering, how much do I need to retire on $200,000 a year? It’s important to consider all relevant factors. For the best retirement plan that suits you perfectly, talk to a retirement expert. They’ll give you advice tailored just for you, considering everything unique about your situation. It’s like having a personal guide to help you navigate the path to a comfortable retirement.

Why Choose Yield?

At Yield, retirement isn’t just another step, it’s a major milestone in your life, one that deserves special attention. Planning for it can feel like a lot to handle. But don’t worry, we’re here for you every step of the way. With Yield, you’ll get a plan that’s all about you. We take the time to really listen to what you want and what you’re worried about, so we can create a retirement plan that’s just right for you.