An analogy for high net worth wealth management, is that it is like planning a wedding. No two weddings are the same and similarly no two high net worth (HNW) plans are the same either. They both require deep consideration, and are always highly personalised.

For high net worth wealth management, it is essential to have a detailed appreciation of tax strategies, debt planning and investment selection. Equally important is balancing wealth creation with wealth protection.

In my role as a certified financial planner, I specialise in advising high net worth individuals and families. Our team have extensive experience creating financial plans that are bespoke. And we are always considerate of building on what you already have in place.

In this extensive guide, we delve into the intricacies of high-net-worth (HNW) wealth management in Australia, and the value that qualified financial planning provides.

Wealth Management For High Net Worth Families

In Australia, HNW wealth management applies to families with substantial financial resources. Investopedia cites that to be classified as high net worth, you will typically have more than $1m of liquid assets. Amongst our clients at Yield, we generally define HNW as having greater than $2.5 million assets (excluding the primary residence).

If you are seeking advice, it is really important to find a suitably qualified financial planner. This is because high net worth financial advice, requires deep consideration of your current position, matched with strategies that exist. In my experience most financial planners do not regularly work with HNW.

Whoever you speak to, remember that the goal should be to evolve your plan, rather than completely rebuild it. By working methodically through what you have, it will account for the strengths and weaknesses of what you already have in place.

Your financial planners first objective must be to understand what is important to you now and what you want to achieve in the future from here. This will help them identify strategies to help you that are tax efficient, debt conscious and help you achieve sustainable growth with managed risk.

The Backbone: Strategic Asset Allocation

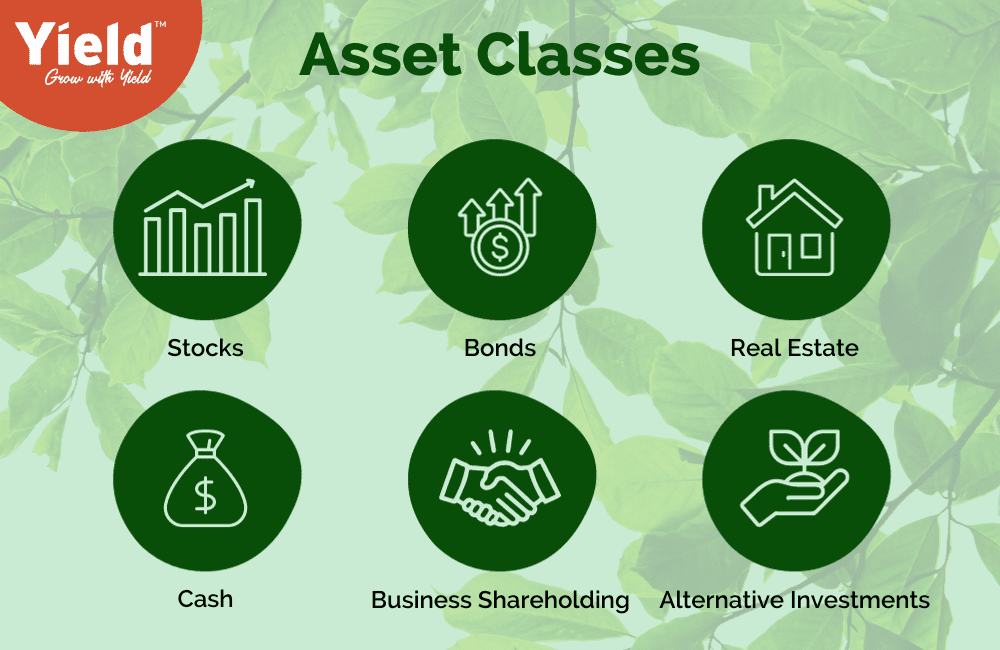

How you spread your money around between cash, bonds, property, shares and alternative investments, is known as asset allocation. It is very important, because it determines your rate or return, the volatility you experience and how much liquidity you have.

For high net worth wealth management, this is called strategic asset allocation. It involves carefully determining the ideal combination of investment asset classes, considerate of your objectives and your existing portfolio. Why this is often particularly important for HNWI’s is because their portfolio often includes large illiquid investments like business interests or property.

The ultimate aim is to achieve a delicate balance between risk and return. Then tailor it to your individual financial objectives, risk tolerance and time frame.

A vital part of strategic asset allocation also, is managing market correlation. The key objective here is to design a portfolio that can achieve a good return, but with lower volatility than the broader market. Financial planners provide regular reviews and will help you adjust your portfolio when it is suitable, to maintain the desired asset mix. With ongoing management, you can keep your portfolio aligned with your evolving financial situation and goals.

High Net Worth Wealth Management Tax Optimisation Strategies

Australia’s tax system is renowned for its complexity, and HNWI’s often find themselves grappling with intricate tax issues. To navigate this, you may benefit from advanced tax optimisation strategies. By planning your tax position well, you can reduce the impact of taxes and in turn improve your investment returns.

Strategies that yield financial advisors will consider with clients include:

- Tax-Efficient Investment Structures: This includes trusts, superannuation funds, and investment bonds. Tax structuring is one of the most vital aspects of high net worth wealth management.

- Capital Gains Planning: Strategically time the sale of assets and apply tax exemptions or concessions where applicable. This will keep your capital gains tax bill down

- Tax-Loss Harvesting: Consider selling investments that have experienced losses to offset gains in other parts of the portfolio, thereby reducing overall tax liabilities. We find this can be a good way for HNWI’s to manage some concentration risk in the portfolio, and increase diversification.

- Income Splitting: When family members are on lower tax brackets, income splitting strategies may be employed. This can result in distributing income more tax-effectively. Wherever possible, well thought through income splitting is a great strategy for high net worth wealth management.

Risk Mitigation

To be a HNW individual, you have established yourself with a sizeable amount of wealth. So it is essential that you manage your risk. Financial planners assess and mitigate risks through a multi-faceted approach. Here are three important risk management strategies that should always be considered.

- Diversification: Diversification entails spreading investments across various asset classes, industries, and geographic regions. The goal is to reduce exposure to any single risk factor. By avoiding over concentration in one area, you can shield your wealth from the adverse effects of a particular economic event or industry downturn. Diversification is also an essential strategy to maintain liquidity when you need it. This ensures you get to enjoy what you have, without fear of needing to sell a growth asset at the wrong time.

- Structuring: How you structure your assets is not only important for tax management, but also asset protection. You should carefully consider potential risks you face, such as liability risk in your occupation or business. Then structure your assets to reduce risk from creditors and other parties . This extends to estate planning considerations for your family.

- Insurance: Insurance plays a vital role in risk mitigation and high net worth individuals often require tailored insurance solutions. Insurance options for high net worth include liability coverage, life insurance, and business insurance for example. Because HNWI’s often have strong cashflow, it is also typical to have higher than average debt, making protection like income protection important. By ensuring that you have adequate insurance, you are creating a safety net, that will help protect your wealth from unexpected liabilities and events.

Comprehensive Estate Planning

Estate planning is a cornerstone of high-net-worth wealth management and it requires deep thought, to get the best outcomes. The focus is on expressing your wishes, minimising tax implications, family planning, and avoiding potential disputes among heirs.

Estate planning should be an ongoing discussion with your financial advisor and includes:

- Trust Structures: Setting up trusts, including testamentary trusts which are formed on death, can be used to manage and distribute assets according to your wishes while optimising tax outcomes.

- Gifting and Inheritance Strategies: Structuring gifts and inheritances to maximise tax efficiency and minimise the tax burden on heirs.

- Charitable Giving: Incorporating philanthropic goals into your estate plan can yield both personal fulfilment as well as various tax benefits.

Financial Planners that specialise in high net worth wealth management, will work directly with suitably qualified estate lawyers. This will create a collaborative approach for you and help ensure that our estate plan is not neglected.

Make Your Money Work, so You Don’t Have to, With Yield Financial Planning

Yield Financial Planning specialise in the needs of high net worth wealth management. There is so much value that we can add, by assisting you to build on what you have in place currently, helping you manage tax and debt implications, and grow and protect your position, ensuring you have a structure set up so you can enjoy what you have worked hard to build.

The Yield Financial Planning team support some of the inner east of Melbourne’s most affluent families, and on last count average over $5m investable assets, excluding the family home. Take the First Step Today with a complimentary discussion and review of the opportunities that exist for you.