What is a high net worth individual in Australia?

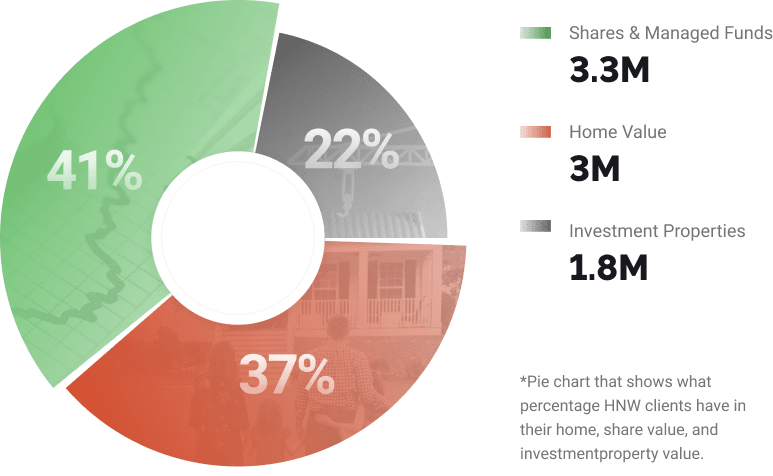

A high net worth individual (HNWI) in Australia is typically defined as someone with total assets of greater than $5,000,000 or investable assets that are greater than $2,000,000, excluding the family home.

HNW individuals typically have unique financial needs and opportunities compared to the average investor.