A bucket company is a tax structure, typically used by business owners and investment trusts, to maximise profits. Why we love bucket companies at Yield, is they are a powerful tool to grow wealth for retirement.

So what is a bucket company? The term ‘bucket company’ is used, as it sits under your business or trust to ‘catch’ some of your profit. Normally this will be money you don’t need for personal cashflow.

If you or your family are running a successful business, a bucket company should always be considered. Similarly if you have a trust you use for investment, you should think about a bucket company. As a financial planner, that regularly work with business owners and HNW, regularly consider bucket companies. We will look at both your business and personal finances, to see how you can include a bucket company, and blend it with other strategies.

To see how we implemented this strategy for one of our existing clients, click here.

Explained – What is a Bucket Company?

A bucket company is usually set up to be the beneficiary of a trust. The trust is often your business, that you pay yourself and your bucket company from. It may also be a beneficiary of an investment trust, that you distribute some income and capital gains into.

One of the key benefits of this is to keep your tax bill down. So you don’t end up paying the individual tax rate on all your earnings. Instead the money paid to the bucket company is only taxed at the corporate tax rate.

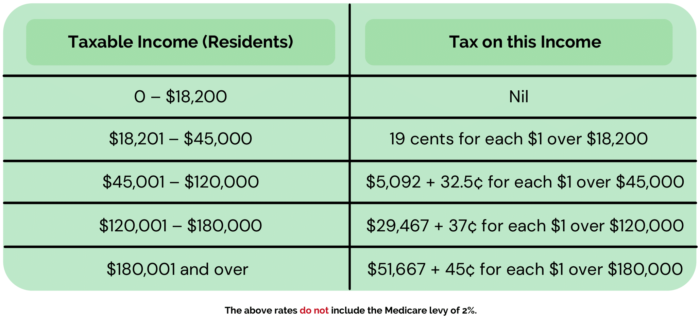

Currently, the highest individual tax marginal tax rate is 45% (not including the 2% Medicare levy). By comparison the company tax rate is 30% or 25% for small or medium businesses.

To look at an example, if your businesses profit was $270,000, and you were drawing all of this personally, you would be taxed at 47% on everything above $180K. Therefore in this case $90,000 would be taxed at 47%. This equates to tax payable on this portion of income of $42,300. If instead you directed the same $90,000 to a bucket company, it would only be taxed at the corporate tax rate of 30% or in this case $27,000.

As you can see, with a bucket company in place you could be saving a total of $15,300 per year in tax.

How a Bucket Company Strategy Can be Enhanced With a Financial Planner

Because a bucket company is a tax mechanism, it is typically recommended by Accountants. What we see however is that too few people integrate their business structure, with their personal financial plan. This is where financial planning comes in.

At Yield, we believe that your business and personal strategy should be unified. This way your goals and desires both in business and life are considered.

Financial planners, will help you view your bucket company as part of an integrated retirement strategy. The three steps we will help you work through include:

- Step 1: establish a plan to manage your personal income needs, and tax position.

- Step 2: provide advice on how to invest the money.

- Step 3: plan to draw down dividends from your bucket company in a tax effective way. This is usually tied to your retirement plan.

Whatever you decide to distribute to your bucket company, you need to physically pay into the bucket company bank account. Alternatively, if this does not happen before you lodge your tax return, there may be provision to create a Division 7A Loan.

Division 7A Loan Explained

A Division 7A loan is often a provision business owners use when their business is growing and their profits are strong. But cash has been reinvested into the growth of the business.

When this is relevant, your Accountant will apply through the ATO on your behalf. This can allow you to pay the loan between yourself as a sole trader, partner, or trust, and the bucket company over seven years. Interest is charged at a benchmark rate.

What to Do With the Money in the Bucket Company

Once the funds are in the bucket company, you should have a plan to invest them. A bucket company is flexible in what it can invest into, including shares, properties and any other private investments. Investment advice is one way a financial planner is perfectly placed to help you. Because we can help you match your investment strategy with your cashflow needs.

Once invested, investment earnings are taxed at the company tax rate of 25% or 30% and accumulate franking credits. Franking credits are the governments way of ensuring you are not taxed twice. Combined with a well thought through strategy, you can pay franked dividends from your bucket company when your income is lower. Our strategy often is to align this to retirement.

When you are ready to withdraw money from your bucket company, it will be by way of a dividend. It is important to understand that dividends must be paid in the exact percentage of the shareholder’s ownership. To keep things flexible and tax effective, a strategy can be to set up another trust to hold the shares of the company.

An added benefit for business owners, is that assets owned by a company or trust provide a level of asset protection. This is in comparison to holding assets in your own name as an individual.

As you can see, utilising a bucket company can enhance your business earnings and your broader financial outcomes. The decision to set up a bucket company however should not be approached lightly and advice is recommended.

Yield Financial Planning is Here to Help

At Yield, 1/3 of our clients are also business owners, so we are very familiar with the power of bucket companies. We also specialise in working with high net worth individuals, which regularly have investment trusts, where bucket companies can be valuable.

We will help you determine if a bucket company is suitable and work with your Accountants on your broader tax strategy as it relates to your personal financial plan.

Good fortune needs great planning, so if you have any further questions on if this tax and investment mechanism is right for you and your business, get in contact with one of our financial advisors to discuss your options.