Early retirement planning guide for a prosperous future. Are you thinking about retiring early but feeling a bit unsure about what comes next in your journey? It’s more than just stepping away from work early. It’s about securing a future of financial freedom and lasting security. This guide is here to walk you through essential strategies in Australia, to help you retire early and live the life you want. Not just what you think you can afford!

Define Your Early Retirement Planning Goals:

Before you think about your financial needs, let’s start with your dreams. What does early retirement mean to you? Are you imagining a future where you travel and explore? Maybe spending time with grandkids? Or simply looking forward to free time and choice, to do what makes you happy?

By thinking through how you would like your retirement to look, you’re not just setting financial goals. You’re crafting the foundation for a life that’s all about purpose, joy, and the things that truly matter to you.

Assess Your Financial Position:

Take a close look at your current income and expenditure. This will give you a clear understanding of your financial position. Next, project how these factors may evolve, considerate of your retirement goals, and calculate the amount you’ll likely require once you transition into retirement.

As you outline your living cost, account for unavoidable expenses like housing, food, clothing, utilities, transportation, insurance, and healthcare. Then think about the things that you want, like holiday’s, car upgrades and entertainment.

By deeply understanding your current financials and carefully budgeting for your future needs, it will guide you towards an early retirement that matches your personal and financial objectives.

Contribute to Your Super & Know When You Can Access It:

Superannuation is purpose built for retirement and is very tax effective, so should be considered as part of your early retirement plan. There are various types of super contributions, from pre-tax ‘concessional’ contributions, to after tax ‘non-concessional’. Super contributions are explained in detail here.

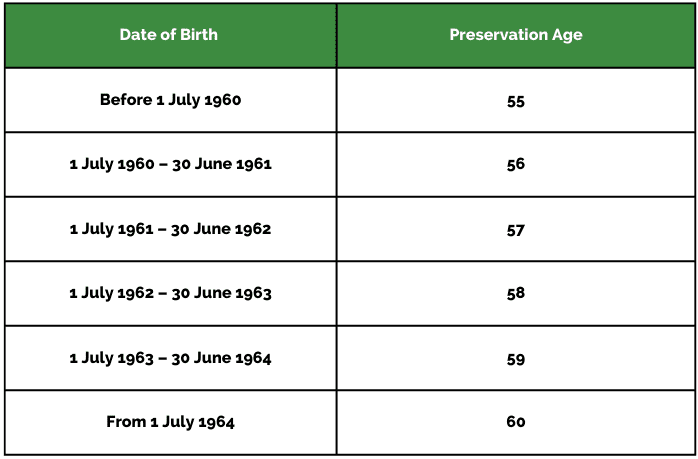

Knowing when you can access or withdraw your super is important, because it will likely be your main source of income. Access is allowed when you turn 65 (irrespective of whether you’ve retired) or when you reach your preservation age and are retired. There is a sliding scale to 60, depending on when you were born. What this table shows you, is that if you are younger than 59 in the 2024 financial year, then your preservation age will be 60 years of age.

It should also be noted that you could potentially access your super early upon meeting other specific criteria.

With Yield Financial Planning, you won’t be left uncertain. We are experts in superannuation and will help ensure you make well-informed decisions, while planning for early retirement.

Leverage Opportunities to Grow Your Income For Early Retirement:

In retirement, funding your income needs is what matters most. You should therefore put wealth creation strategies in place now, that pave your way to early retirement. Here we share three retirement tips for generating secure income:

- How you structure your assets is the first most fundamental decision to planning for early retirement. Consider flexible investment structures such as Superannuation, SMSF, Companies, Trusts, Individual, Joint, and other business structures.

- How you invest is the next most important consideration when planning for early retirement. Explore diverse investment options like Managed Accounts, Shares, Property, Ethical Investments, Managed Funds, and ETFs.

- Property forms a big part of most Australian’s wealth position and so is a retirement planning consideration. Whether you’re an Upgrader, Downsizer, Investor, Renovator or Developer, there are property planning strategies to align with your specific goals.

Take Steps to Pay Off Your Debts:

Debt reduction is an important part of early retirement planning. But it should be considered as part of a broader financial strategy.

While it is intuitive to simply focus all your resources on reducing debt for retirement, this is a very slow way to accumulate wealth. You should therefore focus on reducing debt, in conjunction with other strategies.

As financial advisors, we consider investment strategies that can be used for debt reduction. We help clients weigh up the timing of when it is tax effective to realise capital gains for this. Importantly also, any strategic investments made for debt reduction, must be balanced by liquidity considerations.

Getting your debt structuring right, is one of the simplest and most powerful ways to reduce debt faster. An experienced mortgage broker can help you with this, including refinancing options or debt consolidation.

Finally, if you do not already have a structured repayment plan that aligns with your budget, start to do this. It is usually preferable to reduce or eliminate your high interest debts first, but be aware of whether the higher interest rate loan is tax deductible, as this may make it a lower net cost to you after tax.

Explore Health and Life Insurance Options to Protect Your Downside:

Planning for early retirement relies on you managing risk. For one thing, you have worked hard to get to this point, and so you can’t afford to lose what you have gained.

But in addition to this, until you have a lump sum big enough to retire on, you are relying on your ability to work and earn an income also. This is where insurance comes in.

Insurance options include Income Protection (IP), Trauma, and Total and Permanent Disability (TPD), Life insurance and health insurance coverage. Regular review and identifying the best health and life coverage is a proactive step towards ensuring your insurance policies align with your evolving needs, providing optimal protection for your early retirement and beyond.

Professional Advice and Regular Review:

Financial advisors that are qualified retirement planners can help you plan for early retirement. They will help you layout a financial plan that makes sense for you and then help ensure it remains aligned with your evolving goals and the ever-changing economic landscape.

Ongoing support from professional advisors not only instils confidence, but also adds a layer of resilience, so you are ready to respond to change. Read some client case studies that highlight the value of financial planning advice to help achieve early retirement.

How Yield Financial Planners Guide to Early Retirement?

At Yield, our financial advisors specialise in providing early retirement planning. Retirement is the biggest financial goal that we share, and the sooner you get on to considering how much you will need for retirement, and crafting a plan towards achieving it, the better off you will be.

We offer personalised strategies, tailored to your unique goals and dreams. We are always looking forward to what is happening in the world economically, and team up with experts that help you navigate the complexities of wealth management, investment optimisation, and retirement planning.

Get in touch with us today, let’s have a one-one discussion designed specifically to you. Your early retirement goal is within reach, and we’re here to make it a reality.

For more related content read:

Our comprehensive guide on how much you need to retire