Proper financial advice should be tailored to your situation, to give you the best possible chance of success. This is especially true for doctors because of the highly unique and potentially risky aspects of your profession, such as liability considerations and the potential for high wages, requiring detailed tax planning.

Our advisors work to leverage the earnings of doctors so their financial plans put them on a path of wealth creation and protection whilst also planning for how they will fund their ideal retirement.

Whilst some of these solutions have aspects that are specific to doctors, the majority can be applied to a variety of situations with the advice of a financial planner.

Tax Planning Options

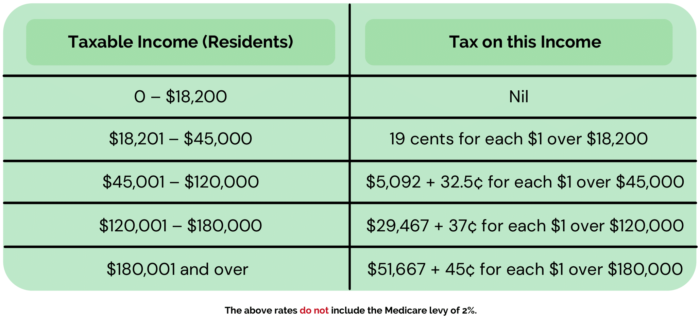

With the average salary of doctors in Australia approximately $160,875 and more experienced practitioners and specialists making $234,000 and above, the profession is usually in the top 2 tax brackets.

Doctors working in ‘not-for-profit’ hospitals are afforded a unique opportunity to salary package benefits, which can be a great way to fund essential items from pre-tax earnings instead of post.

For eligible doctors, salary packaging allows you to pay for essential items such as mortgage payments, additional meals and even entertainment benefits. There are limitations on this, which will be considered during the preparation of your financial plan, if you choose to implement one.

Doctors, including those who are self employed, are limited in how they split personal services income for tax purposes. However, structures including family trusts, self managed super funds and company structures (often called bucket companies) are commonly used for investment strategies, because they provide tax planning benefits and asset protection value.

If you are a doctor that owns your own business or has a trust used for investing, you may consider utilising a ‘bucket company’ to structure some of your assets in a tax effective way. The strategy involves using a company structure as a beneficiary to a trust. The earnings paid into the trust are taxed on the corporate tax rate, as opposed to the marginal rate and can offer some long term benefits to your retirement plan.

If you want to learn more about ‘bucket companies’, read this blog, where we elaborate on the structure in depth.

The Importance of Insurance Planning

The Medical Journal of Australia cites one of the biggest mistakes a doctor can make is under-prioritising insurance. Whilst many people in general are underinsured, doctors have a higher need for wealth protection, given they are usually the primary earner in the family and typically have higher levels of debt.

We often insure things which we value, whether it be our cars, home or contents. But nothing is more important to insure than your life and your ability to work and generate an income.

While many doctors we see do have personal insurance in place, it is not always in line with their needs. There can be a lot of different reasons for this, including the time since last review and changes in the market; incremental increases in cover accepted over a matter of years adding up; but most often it is because the advice has been received in isolation and not as part of a broader financial plan.

As a doctor, you could be liable if not properly insured and different insurance policies have specific features that may benefit doctors. For instance, needlestick benefit is a unique risk facing doctors and is one reason why all doctors should consider hiring a financial planner to assess what is the most necessary cover, and to ensure you’re not overpaying.

Investing to Grow Your Wealth

Often Doctors meet the definition of ‘wholesale investor’, which can open exclusive investment opportunities. In fact, wholesale investments are becoming increasingly more accessible, through select financial advisors that work with HNW investors, including Doctors.

While careful selection is essential, Yield’s investment committee is regularly presented with wholesale investment opportunities and they can provide excellent attributes for highly tailored investment portfolios for HNW investors. Investments including direct infrastructure assets, property, and private equity, for example, can derive strong risk-adjusted income and growth opportunities, in an otherwise yield starved world.

More broadly, a well crafted wealth creation strategy should include a balanced portfolio of investments for you and your family that leverages off your income and capital position, while managing risk.

Taking Care of Your Nest Egg

One of the best financial planning solutions available to doctors and anyone earning a medium to high income, is making concessional and non-concessional contributions to superannuation. They allow you to save on tax, and grow your retirement fund at the same time.

Due to the high average income of doctors, we see making concessional contributions to super as something that should be considered to add to your financial plan. These contributions are paid to super before tax, so will reduce the total amount that you are taxed on your income.

We also see value in contributing non-concessionally to super, which are post-tax contributions to super to save for your nest egg in a tax effective structure.

Yield Financial Planning is Here to Help

If you are a doctor that wants to be in the most strategic financial position possible, you should consider partnering with a financial planner that understands the unique risks and opportunities for your specific circumstances, and who will help you coordinate your financial structures towards your lifestyle and retirement objectives.

By utilising the help of a financial advisor, you can make your money stretch a lot further.