A Yield Client Case Study

Wealth Creation

$2,577,374 Est. value of net financial position at 65.

Property Planning

Able to buy a holiday home three years sooner than expected.

Retirement

30% more in their superfund at age 65 than on their current trajectory.

Financial Planning

Meets all stated goals and objectives.

Wealth Creation

$2,577,374 Est. value of net financial position at 65.

Property Planning

Able to buy a holiday home three years sooner than expected.

Retirement

30% more in their superfund at age 65 than on their current trajectory.

Financial Planning

Meets all stated goals and objectives.

Overview

A professional couple in their early 50s sought property planning advice and investment strategies for retirement to improve their financial position. They wanted to either renovate their current home or purchase something of higher value in the next two or three years to eventually purchase a holiday home. They also wanted to create a regular investment strategy with their strong saving capacity.

Illustration of Outcomes

Our review analysed several options and illustrated the possibilities of their ability to purchase a property. We found that simply renovating would put them in a position to buy the holiday house in 5 years, whilst purchasing a bigger property would push this out to 8 years.

- Our in-depth review illustrated detailed financial projections on the couple’s options and the potential position they could be in now and in their retirement

- We identified a variety of financial strategies that could substantially improve their position in retirement.

- These were maximising concessional super contributions, co-contribution, spouse contributions, establishing a regular investment strategy for retirement and debt reduction advice.

Outcome

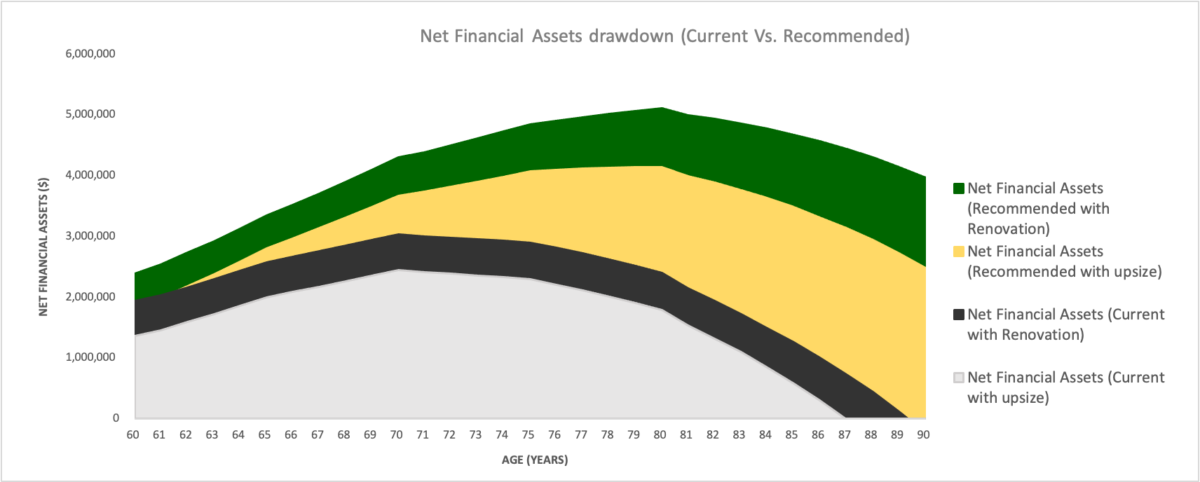

Our advice indicated that when the couple is at age 89, they would have around $3.97 million in financial assets if they chose to renovate, and $2.48 million if they upsized. This improvement compared greatly with their original plan to only upsize which would have meant their financial assets would be completely depleted then, meaning they would have to downsize or sell their holiday house. This highlights the benefit of getting their money to work for them early with investment strategies for retirement, rather than holding these funds in cash.

The following graph illustrates the estimated net financial asset drawdown from the youngest client aged 60 to 90, contrasting the long term implications of the choice to renovate vs upsize their residence.

Produced With Our Client’s Permission

Important Note

The content of this case study has been based on a real-life client. Any information provided here is general advice only and does not consider your objectives, financial situation or needs. This information should not be taken as comprehensive and does not constitute legal or financial advice. You should seek legal, financial or other professional advice before relying on any content. Yield Financial Planning is not responsible to you or anyone else for any loss suffered in connection with the use of this information. Information is only current at the date initially published.