A Yield Client Case Study

Super contribution advice saves $32,170 tax over 10 years

Converting to account-based pension results in 100% tax-free earnings

Property Planning advice to reduce debt and improve cash-flow

Project Improved Longevity of capital by 1 year

Super contribution advice saves $32,170 tax over 10 years

Converting to account-based pension results in 100% tax-free earnings

Property Planning advice to reduce debt and improve cash-flow

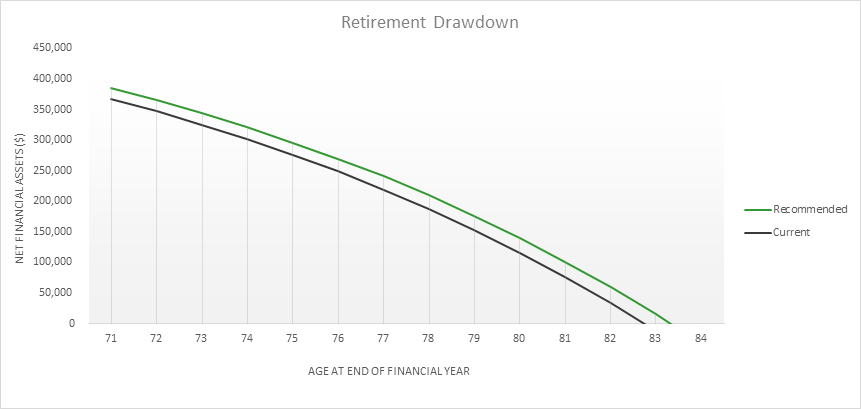

Project Improved Longevity of capital by 1 year

Yield’s strategies for retirement planning aren’t a one size fits all solution. We take a strategic planning approach that encapsulates your situation and focuses on what you want out of life and retirement. This will help put you in the most secure and confident position possible.

Introduction

Our client is a GP in her late 50s and was concerned with her ability to retire comfortably. Having recently divorced she wanted us to review her current position and develop a retirement plan to secure her post-work life.

Specifically for this client, improving cash flow, managing debt costs, investment property advice, and super performance were their key concerns in planning for retirement.

Overview – Developing a Personalised Retirement Planning

When our client came to see us, we were concerned that she was spending more than she earned, making it imperative that she implement retirement planning strategies focused on debt reduction, and that helped her free up cashflow, so she could retire debt-free.

With this said, given her profession as a Doctor her income was higher than average and there were opportunities to help her use some of her cash flow for greater tax benefit.

She is in the fortunate position that her principal place of residence is valued well above the Melbourne median, so the option to downsize exists, to realise some funds for income needs down the track, however, she did not wish to consider this now.

Of important note also, she had not finalised separation of assets from her ex-husband, and through an informal arrangement, she was carrying the debt burden for an investment property they held, with the agreement that she would retain the proceeds from any sale. The property had not performed well and was untenanted.

We advised that:

- Maximising concessional contributions would improve the longevity of retirement funds

- Improving cashflow with a budget and sticking to it would further opportunities to invest earlier and improve her retirement fund

- Seeking legal advice on ownership of properties and debt to secure her position in retirement

- Sell her investment property, as it had been vacant for a significant amount of time and could free up cashflow with a reduced mortgage.

When developing a retirement plan, it must always be personalised and our property planning analysis for our client demonstrates the benefit of assessing your investments in conjunction with your broader financial plan, not just through the singular lens of investment.

Importantly, Yield do not buy or sell property for clients. We provide strategic advice that considers the cashflow and capital impacts and how the asset class fits within your overall strategy.

Maximising super contributions would also improve the position of her retirement fund and save on tax now, resulting in $3,217 saved each year.

Our client was previously using the services of a Financial Planner to manage their super but was not happy with how it had worked for her. She wanted a more proactive approach to her investments. We recommended a Managed Discretionary Account, which provides a highly proactive approach that is also simple.

Outcomes – Secure & Strategic Retirement Plan

The strategies for retirement planning that we specified could also be enhanced by shifting the majority of her super into an account-based pension at the age of 65 so all earnings could be withdrawn 100% tax-free, which will require drawing minimum pension, which will improve cash flow.

This combined with their concessional super contributions were projected to provide a surplus cash flow by age 65.

Other social service strategies for retirement planning included applying to a senior’s card at aged 60 and aged pension benefits once retired.

Our client retains the option to increase her retirement fund post-retirement age through the downsizer contribution from a sale of her principal place of residence that will be owned by retirement in full and is above the Melbourne median house price.

There are many strategies for maximising your retirement plan that we can overlay to secure and excel your retirement income for years to come, all with suitable and holistic advice from a financial planner.

Important Note

The content of this case study has been based on a real-life client. Any information provided here is general advice only and does not consider your objectives, financial situation or needs. This information should not be taken as comprehensive and does not constitute legal or financial advice. You should seek legal, financial or other professional advice before relying on any content. Yield Financial Planning is not responsible to you or anyone else for any loss suffered in connection with the use of this information. Information is only current at the date initially published.