A Yield Case Study

Retirement

Reduced her retirement age by up to 1 year.

Insurance

Covered for the event of her permanent disablement.

Superannuation

Salary Sacrifice saved Est. $5,208 p.a. in tax.

Downsizing

Options available improved her ability to retire.

Retirement

Reduced her retirement age by up to 1 year.

Insurance

Covered for the event of her permanent disablement.

Superannuation

Salary Sacrifice saved Est. $5,208 p.a. in tax.

Downsizing

Options available improved her ability to retire.

Our client Jenny is a woman in her 50’s that is in a midst of separating from her long-term partner and wanted us to help with defining a new financial plan.

Her and her husband had created a healthy portfolio together that contained property and shares which included their primary residence that she loved and wished to retain as a part of the divorce settlement.

Introduction – Defining a New Financial Plan

Jenny wanted clarity on her financial situation and what position she would be in post-separation.

Defining a new financial plan for our client would include how she could work towards her retirement goals of transitioning to part-time work at 60 and then retire on an income greater than what she currently spends and give her additional funds to enjoy retirement.

A clearly defined goal was that she wanted to maintain her primary residence, which had already been agreed on with her ex-partner with him retaining one of the other properties and a greater share of their liquid assets, along with his business.

Overview

Our client discussed the possibilities she would be open to in defining her new financial plan which included downsizing her current residence to a smaller bayside town a few hours from Melbourne and renting an apartment in Melbourne, which is how she envisioned retirement. She also wanted to understand the possibilities of purchasing a lower valued property and then renovating. Jenny also believed that she would be able to find a higher paying job but wanted to understand the impact of not taking up this position and how it would impact on her financial plan.

We needed to understand the level of debt that could be taken on by Jenny with the equity she held in her home, so we discussed her situation with a mortgage broker to assess the level of debt she could take on with both her current salary and her possible higher salary in the future. We then used these amounts in our analysis on the separation and showed that if she did not choose to take on the higher paying job, she would likely need to part with a portion of her Super to ensure the separation was fair.

However, if Jenny was able to get a higher-paying job, she would be able to borrow more and then not have to make any Superannuation compromises.

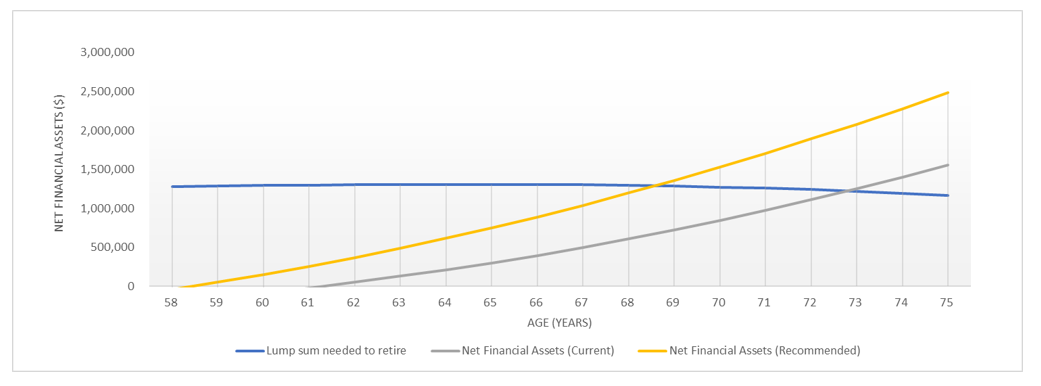

With this analysis, we then prepared varying scenarios on how her financial position could look in the future, and in doing so it became evident that meeting her goals based on her position was going to be difficult, such that, if she chose not to get a higher paying job, she might be needing to work full time until age 73.

Alternatively, finding a higher-paying job could see her being able to retire by age 69.

With the expert understanding of this client’s financial position, we were able to recommend insurance cover that would fill the gap in the event where she could not work due to injury or illness.

Outcome – New Financial Plan Defined

Our analysis showed that the biggest impact on Jenny’s situation was that her primary residence made up a large portion of her assets.

Our client’s goals were that this would not be sold to fund her lifestyle, meaning she would need to compromise on her goals and either work for longer or accept a reduced level of expenditure throughout retirement. As such, the intentions of our projections were to create a comparison between different scenarios which would allow us to evaluate the impact of our potential financial planning strategies on the client’s situation and compare their ongoing position to how our advice expected they would be.

With this, Jenny now had greater insight into how she was tracking towards her desired retirement lifestyle and be empowered with informed steps to achieve her goals. We also projected the downsizing option available to her and helped her decide on a path that she was extremely happy with that also improved her ability to retire.

Implementing our recommended salary sacrifice arrangement would also work towards her successful transition to retirement and would also roughly save her $5,208 per annum in tax. This would in turn be directed towards her retirement nest egg and allow her to retire 6 months earlier than if she did not implement this.

This all also included her new insurance policy that gave her peace of mind knowing that in the event of her total permanent disablement her plans would not be put in jeopardy.

The following graph is a comparison between the client’s current plan, which is prior to implementing any of our recommended strategies against a situation where she implements all of our recommendations. To contrast these two projections, we’ve also included the lump sum needed for the client to live her desired retirement lifestyle.

Our analysis was based on a set of assumptions, such as rates of return on investments, interest rates, inflation, and current tax and superannuation legislation. We always take a cautious approach when forecasting figures to ensure that they are realistic and achievable. This means that if our client were to outperform our assumption, she may be able to bridge the gap between what she wants and what we’ve assessed as achievable.

Alternatively, should she underperform our assumptions, it could see her needing to work even longer.