The recent Work Test Exemption (WTE), which came into play as of the 1st July 2020 , allows people aged between 67 to 74 to make voluntary contributions to Super for an additional financial year.

Importantly they must have met the work test (IE were gainfully employed for at least 40 hours in any 30 consecutive day period) in the preceding financial year and have a total superannuation balance less than $300,000, which is great news for those with low superannuation balances playing catch-up for retirement.

A note to consider is that the rule was set for age 65 years from 2019-20 financial year and before.

The WTE expands on the current contribution rules allowing more flexibility for recent retirees by expanding that window to make voluntary contributions to Super.

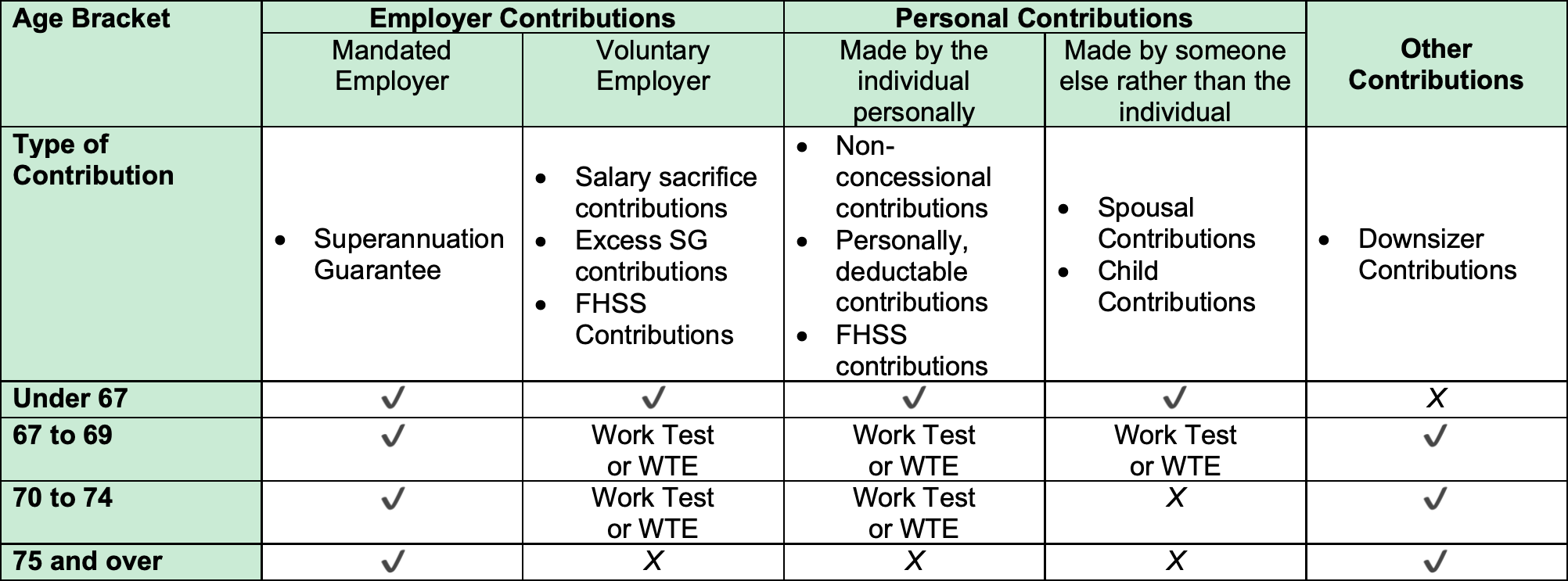

To give a further summary as to the eligibility criteria to contribute to super the following table breaks down the eligibility criteria for contributions based on age and contribution type:

How it works?

As eluded to previously, if you are aged between 67 to 74, to be eligible to take advantage of the Work Test Exemption you need to meet the following three conditions:

- You must have a total superannuation balance at the end of the previous financial year of less than $300,000;

- You must have met the work test in the previous financial year (Been gainfully employed for at least 40 hours in a 30 consecutive day period); and

- Must not have used the Work Test Exemption in a previous financial year (The WTE is a once in a lifetime exemption).

Should you meet the above criteria, congratulations! You can now take advantage of the Work Test Exemption and make a one-time voluntary contribution to Super. Further to this, you are not limited to the type of voluntary contribution which means you can make both concessional and non-concessional contributions.

How does the work test exemption apply in practice?

EXAMPLE 1 (Basic Work Test Exemption)

John was aged 65 on 30th September 2019 and had recently received an inheritance of $75,000 from his late father’s estate. John wanted to consolidate these funds with the rest of his assets in Super which he currently had a balance of $250,000 on 30th June 2019. He hasn’t been gainfully employed during the FY20; he did however retire from full-time work during FY19 where he met the conditions of the work test.

As John is between the ages of 65 to 74, met the work test in the preceding financial year and had a total super balance less than $300,000 at the end of the previous financial year, he would have met the conditions of the work test exemption and therefore be eligible to make a one-time contribution to super of $75,000 during FY20-21.

What other opportunities does the WTE create?

Extending the window for those transitioning into retirement to contribute to super allows for greater flexibility and opens a lot of doors to potential strategies aimed to maximise retirement funds. One stand out opportunity is to utilise the Bring-forward rule, which we have detailed in a separate article post and another strategy that we could see many newly retired clients take advantage of is using the concessional catch-up contributions that were introduced from the 1st July 2018. We’ve created a separate article post on this also.

To discuss how you can benefit from the work test exemption or other aspects of retirement planning, we welcome the opportunity to help you.

OR, if there is someone you think will benefit from this information, please feel free to share.