What is the Catch-up Rule?

The “Concessional Catch-up Rule (Catch-up Rule)” is one of the latest superannuation reforms introduced by the government which provides individuals with Superannuation balances less than $500,000 greater flexibility when making concessional contributions. From the 1st July 2018, they can begin accumulating unused concessional caps and utilise the difference in future financial years.

Concessional contributions are a valuable retirement planning tool that can enable Australian’s to build a retirement nest egg whilst also receiving valuable tax concessions in the process.

The introduction of this rule is great news for those with low superannuation balances with plans to boost their savings in preparation for retirement, however, there is also room for creativity in its use, where strategies can be devised to assist in the minimisation of large tax bills in future years.

Eligibility Criteria

In order to be eligible to utilise the Concessional Catch-up rule, you must satisfy the following criteria:

- Be eligible to make concessional contributions – Unfortunately, the catch-up rule does not circumvent the rules around who can contribute concessionally to Super. Therefore, it’s a requirement that you be eligible to contribute to super in order to utilize this rule.

- Have a Total Super Balance (TSB) of less than $500,000 at the end of the preceding financial year – In order to be eligible, you must have a TSB less than $500,000 as of the 30th June of the previous financial year. Your TSB is the total sum of all funds held within the Superannuation environment and includes those held in accumulation, pension, defined benefit, and those funds in transit due to a rollover between funds. If your TSB is above $500,000, you can still accumulate unused concessional caps up to five years which can then be used at a later date when your TSB falls below $500,000.

- Have unused concessional caps from the past 5 financial years – It is unlikely for those to meet this criterion at this moment, as due to the recent nature of this legislation you can only begin accumulating unused caps from the 1st of July 2018 onwards, meaning that at the time of this piece, only 1 financial year is readily available to be brought forward.

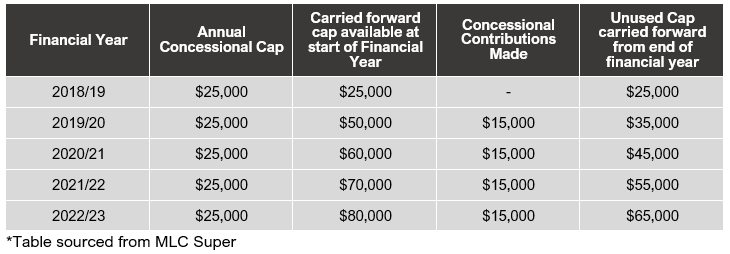

The following table illustrates, how the accumulation of unused caps can play out going into the future:

Why Make Concessional Contributions?

Concessional contributions are a great way to reduce tax, as these contributions are those which are either sourced from pre-tax monies, i.e. before tax is paid at your Marginal Tax Rate (MTR), or voluntary contributions made that you intend to make a tax deduction for. In both situations, the end result is that rather being taxed at your MTR which could be up to 47% including Medicare levy, you are instead taxed at either 15% or 30% for high-income earners.

This means that so long as your MTR is lower than the applicable tax rate, there is a tax benefit to be had.

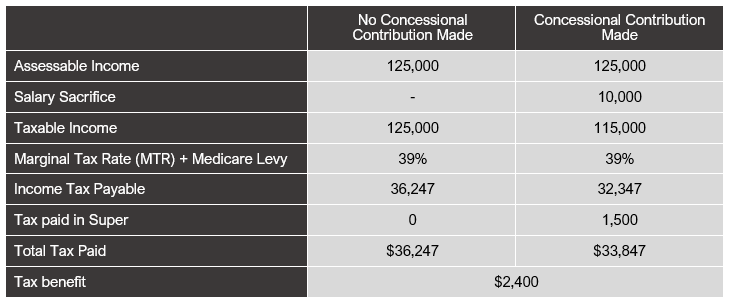

The following table illustrates the tax benefit of a self-employed individual with assessable income of $125,000 making a $10,000 voluntary concessional contribution to super:

The above table does not consider any applicable tax offsets and should simply be used for illustrative purposes.

Given the inherent tax benefit applicable, many individuals aim to maximise their concessional contributions when approaching retirement and the introduction of the Catch-up rule is simply a tool that offers greater flexibility.

Tax Planning Strategies Utilising the Catch-up Rule

As stated before, the introduction of the carry forward rules has opened doors to some creative tax planning strategies, as now eligible individuals can take advantage of unused concessional caps to reduce tax payable.

We can see this being exceptionally valuable going into the future for those with an investment property, business asset sale, or share portfolio with a large unrealised Capital Gain tax liability. Essentially, if an investor knows that they will generate a large capital gain and consequently incur a large tax bill.

If you would like to discuss how this could be applicable to you or if you are interested to discuss your financial plan, contact us for a no-obligation discussion.