Mastering tax structuring is fundamental to a great financial plan. With it, you enable yourself to optimise wealth creation and protection, while minimising tax liabilities. In Australia, there are a variety of tax structures available to choose from and by optimising your tax structuring, you are improving your ability to secure your after-tax returns and achieve your long-term financial goals and lifestyle.

This blog focuses on tax structuring from a financial planning perspective, highlighting its significance and benefits in the Australian context including:

- Understanding Tax Structuring in Australia

- The Importance of Tax Structuring in Investing

- The Role of Professional Financial Planning

- Simplifying Your Tax Planning with Yield Financial Planning

The key takeaway from this blog is that when you get your tax structuring strategies correct and compliant with Australian laws, you will reduce tax liabilities and retain a greater portion of your earnings. Usually with no more, or less risk. Additionally, professional financial planning services, such as those offered here at Yield Financial Planning, can provide invaluable guidance in navigating the complexities of tax structuring and how they relate to your financial plan.

Understanding Tax Structuring in Australia:

Tax structuring involves strategically organising your financial affairs to minimise taxes, while adhering to legal obligations. In Australia, leveraging the country’s unique and ever-changing tax system can make a significant difference to your after-tax income and investment returns and should be a cornerstone of your financial plan.

Australia operates under a self-assessment system, requiring taxpayers to report their income and ensure compliance with tax laws. This means that there must be an understanding of things like income types, deductions, exemptions, and tax offsets. For most people, they will leverage the support of external advisors, like their Accountant and Financial Planner, and this makes sense, to ensure you meet your obligations, but also maximise the opportunity to legally reduce your tax bill.

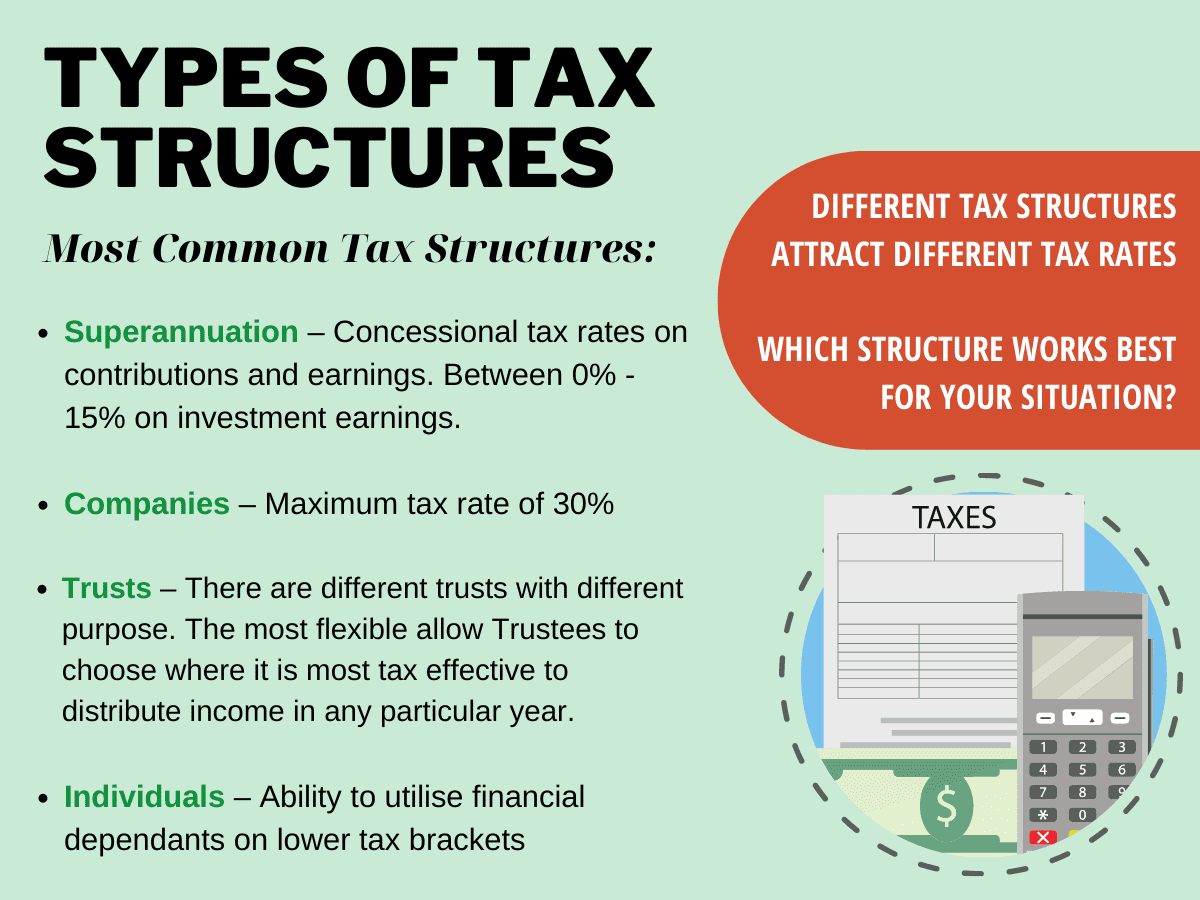

Some of the main tax structures available in Australia are illustrated in this infographic. Each structure has its own tax rules, and each has its own pros and cons, so it is always ideal that you determine the opportunity each present for your specific need and circumstances upfront.

For most people in Australia, they will invest individually and through superannuation. This is normally all that is required, and there is quite a lot of scope to navigate within these two structures, so we will start by elaborating a little more on each of these and then expand on where trusts and companies can make sense.

Investing as an Individual:

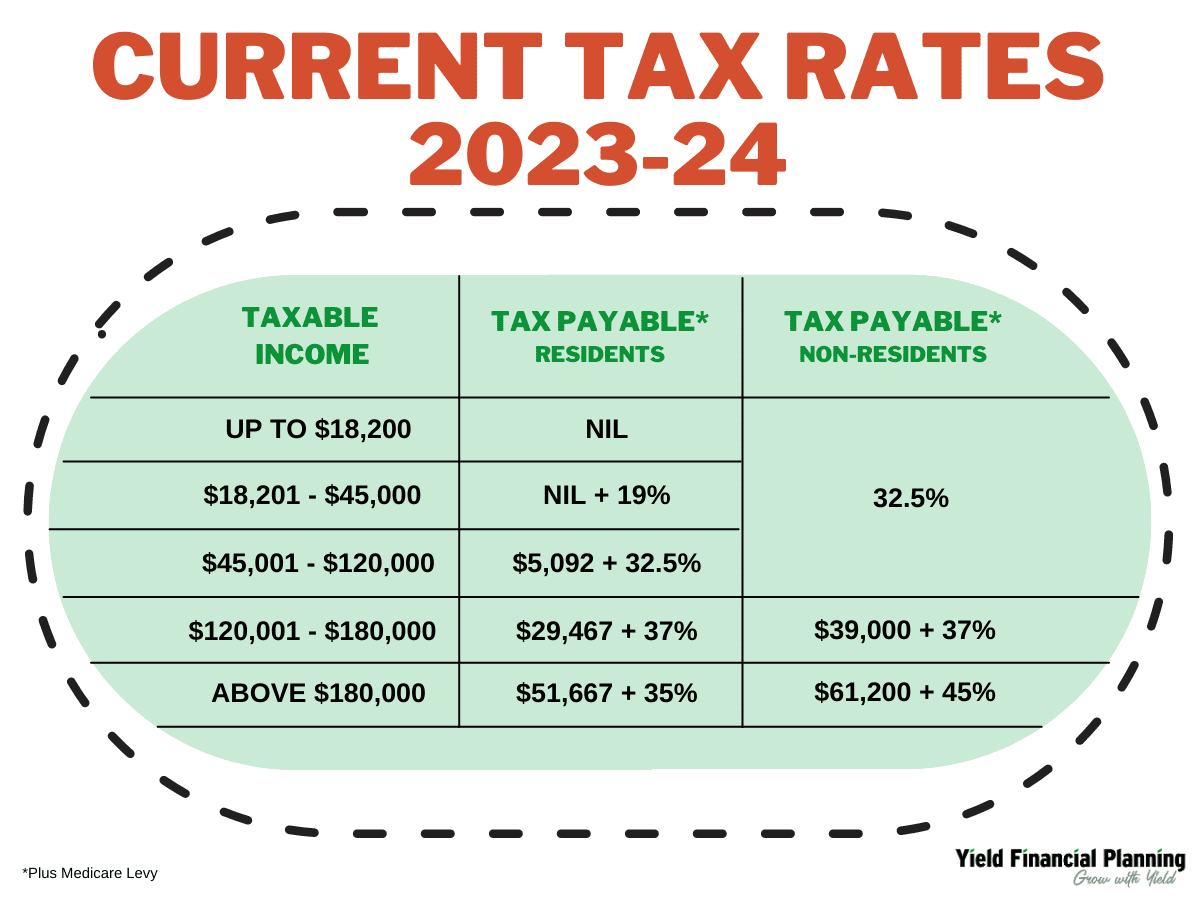

As individuals in Australia, we each have a tax-free threshold we are allowed to claim as income and there is an income tax scale that applies that determines what personal tax is payable in a given financial year. Income that will be assessed includes employment and investment income, along with assessable capital gains. Below is the tax scale in Australia in the 2024 Financial Year.

Depending on your income level and the strategy being employed, it can make sense to invest in a low income earning individual’s name, to minimise tax on income and capital gains; in a higher income earning spouses name, to maximise negative gearing benefits; or for business owners there can be capital protection benefits, investing in a spouse name, that is not a legally liable owner of an entity.

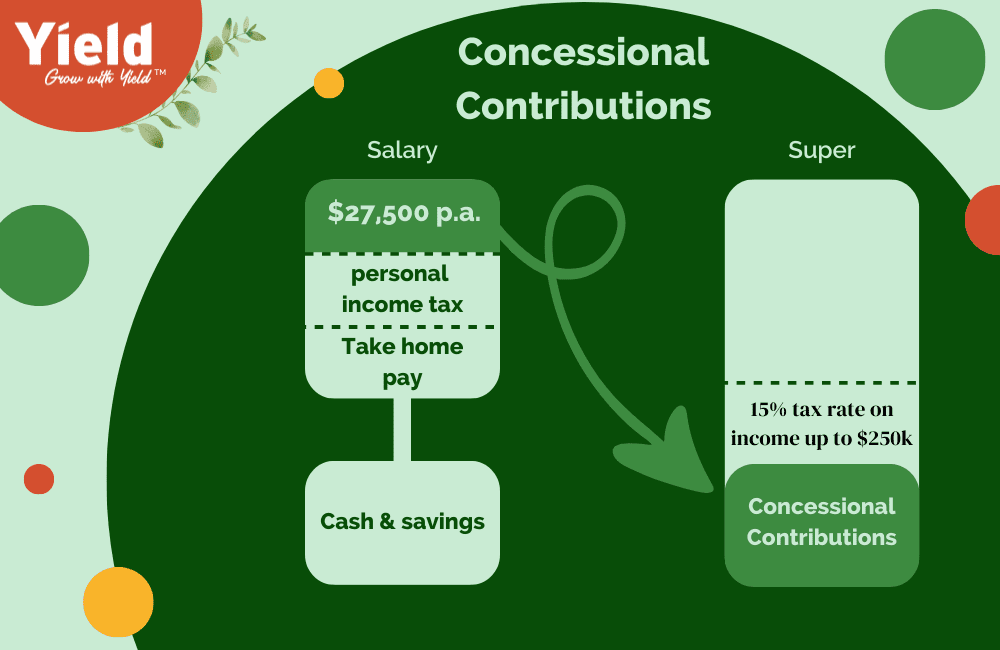

Investing in Superannuation:

Superannuation is a highly tax effective, purpose-built tax structure for retirement, and should always be considered as part of a broader tax structuring component of your financial plan. Whether your money is invested in an industry fund, retail fund or self-managed super fund, there are concessional and highly favourable tax rates, compared to other tax structures in Australia. Below is an illustration of the tax rate applied to concessional contributions.

Investing in Trusts:

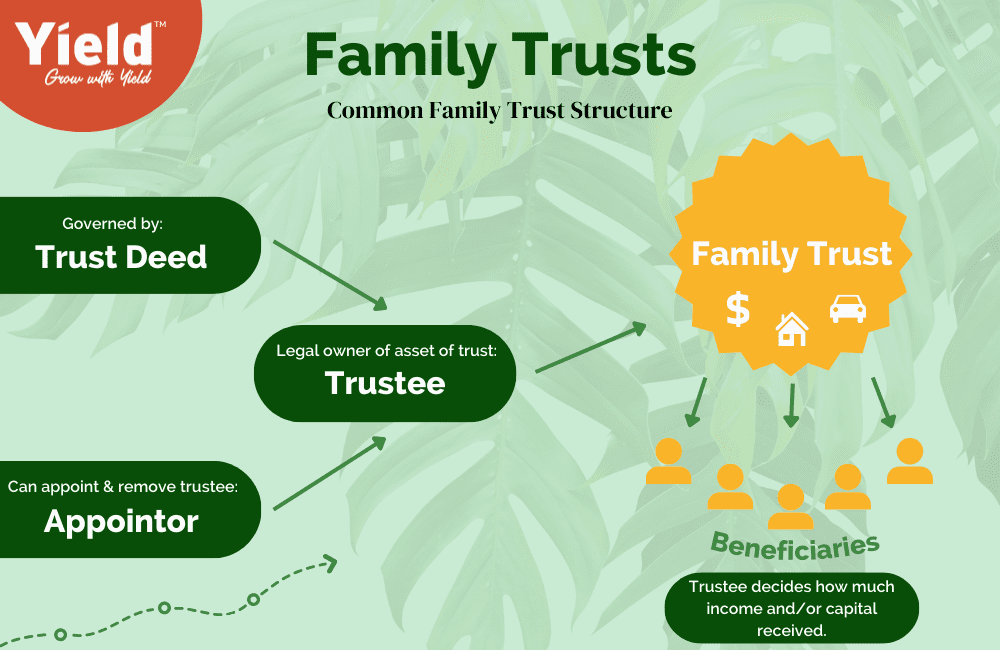

There are several types of trusts in Australia, and each serve their own unique purpose. Trusts include bare trusts, charitable trusts, child maintenance trusts and even superannuation is a trust. Apart from superannuation, the most common trusts for personal investment purposes are Family trusts (or Discretionary trusts), Testamentary trusts and Unit trusts. Trusts are commonly chosen for tax structuring benefits and asset protection considerations.

Discretionary trusts are often favoured by business owners, and it is therefore not unusual to see business owners with these structures as part of their existing tax structures. This is because they offer more flexibility and control to move money around to places that work favourably for their business.

Discretionary trusts are also often favoured by high-net-worth individuals, seeking flexibility for how they distribute income and capital gains from their investments. Often this includes Doctors, Surgeons and related medical professionals, that earn a high income, and may have increased risk of being sued or are looking for opportunity to distribute income to lower income earning members of the household.

As Financial planners, specialising in the needs of HNW professionals and business owners, we regularly consider the opportunities trusts present for our clients and related tax structures. We help clients think forward about the long-term intent of their financial decisions considerate of their financial objectives.

Investing in Companies:

Investing in companies offers individuals and businesses the opportunity to maximise profits while strategically managing assets in a tax-effective manner. In the context of tax structuring, a bucket company often serves as a subsidiary to the main business entity, serving to ‘catch’ and hold profits that the business owner or shareholders deem unnecessary for immediate use. By keeping these profits within the bucket company, businesses can effectively reduce their taxable income, leading to lower tax obligations for both the business and its owners.

Click on the above image to learn about bucket companies!

- Dividend Imputation for Enhanced Returns:

Dividend imputation credits are otherwise known as franking credits. We will refer to them as imputation credits here.

The maximum tax rate of company earnings is 30%. This means that earnings that are retained in the company may be lower than your personal marginal tax rate and may therefore be beneficial to retain for later draw down. Besides the lower tax rate potential while in the company, Australia operates under a dividend imputation system, which prevents double taxation of dividends. This means that when a dividend is declared by the company directors, shareholders receive imputation credits that reflect the tax the company has already paid. Shareholders can use these imputation credits to offset their tax liabilities or receive a refund if the credits exceed their tax obligations. By carefully considering the imputation credit implications, individuals can maximise their after-tax returns. As part of a well-considered financial plan, Yield advisors will think through the benefits of bucket companies for suitable clients and we regularly use it for appropriate clients, as part of their retirement plan.

- Potential capital protection benefits:

The benefits of a bucket company can extend beyond tax optimisation. For business owners and shareholders, a bucket company could provide additional security and protection to manage and distribute dividends. This protective measure helps to keep the wealth accumulated through hard work and successful business ventures more shielded from potential risks or legal challenges. If capital protection is a motivation for starting a company structure, you should seek personal advice.

The Importance of Tax Structuring in Investing:

Considering everything we have covered so far it is easy to see that tax structuring is important for minimising tax. But once funds are in the relevant tax structure, it is equally important to have a cohesive investment plan for the funds within them, because it can significantly impact investment outcomes. Depending on the tax structure you are using, it can often make sense to vary your investment approach, considerate of the unique tax advantages of each. Let’s explore how tax structuring can be leveraged effectively a bit further, for capital gains tax planning:

Capital Gains Tax (CGT) Optimisation:

Capital gains tax is a significant consideration for investing. It is levied on the profit realised from selling investments that have appreciated in value. Australia offers various discounts and exemptions on capital gains, based on factors such as the holding period, investment type and the tax structure you are invested in. Carefully planning the timing of your investment sales, considerate of financial years and potential CGT discounts can help minimise CGT liabilities and optimise investment outcomes.

By understanding the requirements for capital gains tax discounts, such as the 50% discount for shares and property held for at least 12 months, individuals can strategically structure their investment portfolio. This approach allows you to minimise the taxable portion of capital gains, resulting in lower overall tax liabilities. Tax structures that can be most suitable for growth assets like shares and property, include investing individually, superannuation and certain trust structures. However, may not be as suitable to investing within a company structure, depending on your unique situation.

The Role of Professional Financial Planning:

While tax structuring is so, so important, it is just one component of a comprehensive financial planning strategy. Professional financial planning services will help you ensure you achieve effective tax structuring and overall financial success. Here’s why professional financial planning services, such as those offered by Yield Financial Planning, are essential:

- Expertise in Tax Planning:

The best financial planners will possess a wealth of in-depth knowledge on the Australian tax system and keep up to date with changing policies. A financial planner will go deep with you on what you want from your money and develop a cohesive plan that helps you properly navigate complexities associated with tax planning and wealth building. They will help you marry your wealth plan, with the life you want to live, considerate of what you value in life, your financial goals and risk tolerance. By taking a holistic approach to financial planning, professionals ensure that tax structuring strategies integrate seamlessly with other financial considerations, such as investment planning, retirement planning, and risk management.

- Comprehensive Financial Planning:

Professional financial planners offer comprehensive financial planning services that go beyond tax structuring. They consider the broader financial picture and will help you set clear financial goals, develop investment strategies, and ensure long-term wealth creation. By taking into account various aspects of financial planning, professional advisors will provide holistic solutions that align with your needs and aspirations.

The financial planner that is right for you, will help you build on what you have created yourself so far, so you have a diversified investment portfolio that balances risk and reward. They should be monitoring investment performance, make necessary adjustments, and provide ongoing guidance to ensure that your investment strategy remain aligned with your goals and market conditions.

- Proactive Approach to Tax Changes:

Professional financial planners stay informed on tax laws and regulations which are subject to change. This process can be challenging for individuals to navigate alone, which can lead to inadequate tax strategies. By staying ahead of the curve, the best financial planners will help you proactively work through changes to laws that may impact your financial situation. As a result, helping you adapt your tax structuring strategy, as well as identifying new tax-saving opportunities that comply with the law.

Grow with Yield Financial Planning:

Yield financial planners specialise in advising business owners and professionals. The first step we will take with you is to understand what is important to you, and the life you want to live. We will then review your tax structuring and identify opportunities to create improved tax outcomes. From there we will work through the investment and risk strategies that exist to enhance your position and that will help set you up for a comfortable retirement.

Tax structuring is a complex domain, and Yield financial planners are well equipped to provide the necessary expertise and support. Get in contact with an advisor today to learn about how you could unlock the full potential of tax structuring, maximise tax returns, and pave the way for long-term financial success. Contact us today to create the security, you need.