Finding out you made excess super contributions is not ideal. There are limits on how much you can contribute to your super fund every year. These limits are called ‘contribution caps.’ If you do exceed your contribution cap, you may need to pay extra tax.

This article explores what steps you can take when you have made an excess super contribution.

Understanding Types of Contributions and Excess Super Contributions

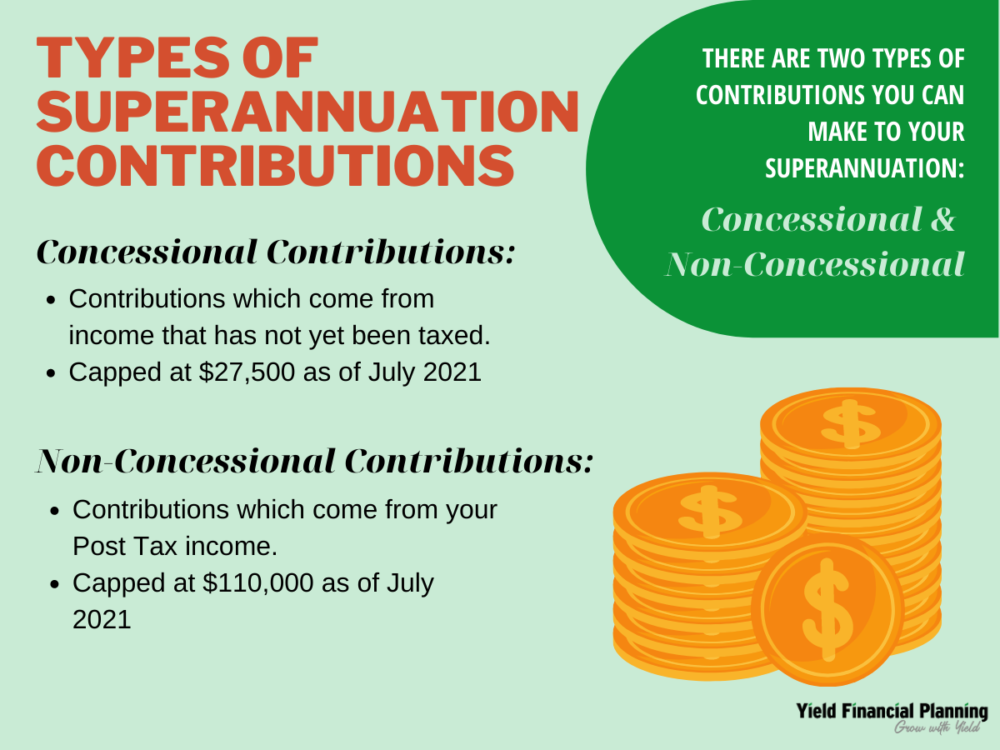

There are two types of contributions you are able to make into your super fund, concessional and non-concessional.

Concessional Contributions

Concessional contributions to superannuation come from income that has not yet been taxed. These include contributions such as Superannuation Guarantee (S.G), Salary Sacrifice contributions and any other pre-tax contributions.

The main benefit of concessional contributions is the tax saving that is generated. Concessional contributions are generally taxed in the super fund at up to 15%, instead of your marginal tax rate of up to a maximum of 47%.

Typically, an individual’s concessional contribution is capped at $27,500 any given financial year, this is known as the Concessional Cap. However, from the 1st of July 2018, you’re able utilise what is known as the carry-forward of unused concessional contributions. If eligible, this can give you the opportunity to contribute over the concessional cap during a single financial year.

The carry-forward allows you to accrue unused concessional contributions from past periods and use them in subsequent financial years. To be eligible to make catch-up concessional contributions you must have a total super balance of less than $500,000 on the previous 30th June and have made concessional contributions less than the Concessional Cap in previous financial years.

It’s important to remember that the ability to accrue unused concessional contributions only applies from the financial year ending 2019 onwards and does not apply to the financial years preceding it. Also, unused cap amounts can only be carried forward up to five years.

What If I Exceed The Concessional Cap?

Exceeding your concessional contribution cap means you have made an excess super contribution and may need to pay extra tax and fees. When it comes time to prepare your tax return the ATO will issue you with what is known as Excess Concessional Contributions (ECC) determination and a Notice of Assessment, outlining your excess contributions and the charges that come with it.

The contributions in excess of the concessional cap will be included on your assessable income for the tax year and taxed at your marginal tax rate (less a 15% tax offset). 60 days from the day of receiving the ECC determination you have the opportunity to withdraw 85% of your excess contributions from Super to assist in paying the tax owed.

As previously outlined, you will also be charged an ECC charge, which is approximately 4.54% for the July to September 2019 quarter. This charge is to consider the deferred payment of tax.

What are Non-Concessional Contributions?

Another type of contribution you can make to your superannuation is known as a non-concessional contribution. These are contributions that are made to super that come from your Post Tax income. Similar to concessional contributions, Non-concessional contributions have a financial year cap of $110,000.

You are able to contribute over the $110,000 cap by utilising the carry-forward rule. This allows individuals under 65 to make non-concessional contributions over the cap up to $330,000 by bringing forward two future periods contributions. It’s important to understand that by bringing forward contributions from future periods you will be ineligible to contribute non-concessionally for the preceding three financial years from when the contribution is made.

What If I Exceed My Non-Concessional Contribution Cap?

If you happen to exceed your non-concessional cap for a given financial year, it will result in paying more tax, unless you withdraw these funds from your superannuation account.

Exceeding your non-concessional cap will lead the ATO to issue you with an Excess Non-concessional Contribution (ENCC) determination which outlines the options available to you and asks you to make a choice.

The options available to you include:

- Withdraw the excess non-concessional contributions and 85% of the associated investment earnings on the additional contributions, within 60 days of the issue date of the determination. (The excess earnings will be included in your assessable income for the financial year; however, you will receive a 15% tax offset to reflect the tax already paid within super.)

- Leave the excess contributions and associated earnings inside of your superannuation account, however, choosing this option will result in paying the highest marginal tax rate, even if your marginal tax rate is lower with this tax being due within 21 days of electing this option. (It’s important to remember that non-concessional contributions come from post tax funds, which have already paid tax, so electing this option would result in being taxed twice).

- The final option is the default decision if you fail to respond to the ENCC determination, and it automatically elects option 1.

Yield Financial Planning is Here to Help

Good fortune needs great planning, so if you have any further questions on excess super contributions, get in contact with one of our financial advisors to discuss your options.