According to National Australia Bank research, fewer than 10% of Australian’s are receiving financial advice, which leaves 90% asking – why is financial planning important?

I am a Certified Financial Planner, with over 20 years’ experience, and I have watched the industry evolve into a profession.

In this blog, we will demonstrate why financial planning is so important in a range of ways, but what I think is most powerful to start with is that it gives you a window into your future to see how you are tracking financially and provides tangible strategies to help you make your money work harder for you.

In the end, money is simply a commodity to help you live a good life, and the best possible outcome you can hope for, is that you use your money optimally, so there is as little need as possible for you to work to earn it. This includes how you spend and save, how you manage your tax and debt affairs and how well you invest your money.

Financial Planning Is So Important Because It Provides Financial Stability

Financial planning is more than merely numbers; it is the bedrock of long-term financial stability. It provides a holistic view of your financial health, offering insights into where you currently stand and the opportunities that exist. It empowers you to adapt your plan, when changes inevitably occur, like change in investment markets, legislation, and in your own personal circumstances.

This means more than just knowing your assets, debts and income – it’s about understanding your financial aspirations, your risk tolerance, and your life goals and adapting your strategy to account for these.

By creating a well-structured financial roadmap, you not only gain a sense of security but also an enhanced control over your finances. This empowerment is invaluable, especially in the face of unforeseen economic challenges, as it enables you to make informed decisions and navigate through change to your advantage.

Managing Income and Expenses

After years of controlled inflation in Australia, we are now facing heightened cost of living pressure, that makes adept management of income and expenditures increasingly important.

Financial planning involves a thorough evaluation of your current financial status. This includes scrutiny of your spending patterns and assistance with the formulation of a budget where it’s valuable, to optimise how you use your earnings.

By being proactive about how you manage your income and expenses, you can safeguard against fluctuations in the economy, that may otherwise negatively impact your lifestyle or future financial plan.

Minimising Tax Liabilities

Australia’s tax system is like a complex puzzle with numerous pieces, but it also holds various opportunities for legally minimising tax liabilities. Like investing in superannuation, a family trust, or a company for example.

How you structure your financial affairs can be the biggest opportunity you have in improving your financial position and is one way that financial planning is so important.

Leveraging the knowledge of a Tax Expert Financial Planner, will ensure you harness tax strategies and incentives, while maximising deductions where appropriate.

By reducing your overall tax burden, you ensure more of your hard-earned money remains in your pocket to invest back into your financial goals. Read more about opportunities to minimise your tax liabilities.

Building Wealth and Investments

Australia has a diverse investment landscape and offers numerous opportunities for wealth creation. However, the sheer diversity and complexity of these options can be daunting without expert guidance.

A proficient financial planner will help you sift through your investment options and tailor them to your unique risk tolerance, financial objectives, and time horizons. This level of personalised attention ensures that the investments you make are specifically designed to maximise your wealth-building potential, whether you’re looking at shares, property, or other asset classes.

A financial planner will also help you avoid typical investment biases. These biases are common among individual investors that don’t have an objective advisor supporting them, because they are hard to see when you are investing for yourself – like confirmation bias; familiarity bias; and illusion of control bias.

Retirement Planning

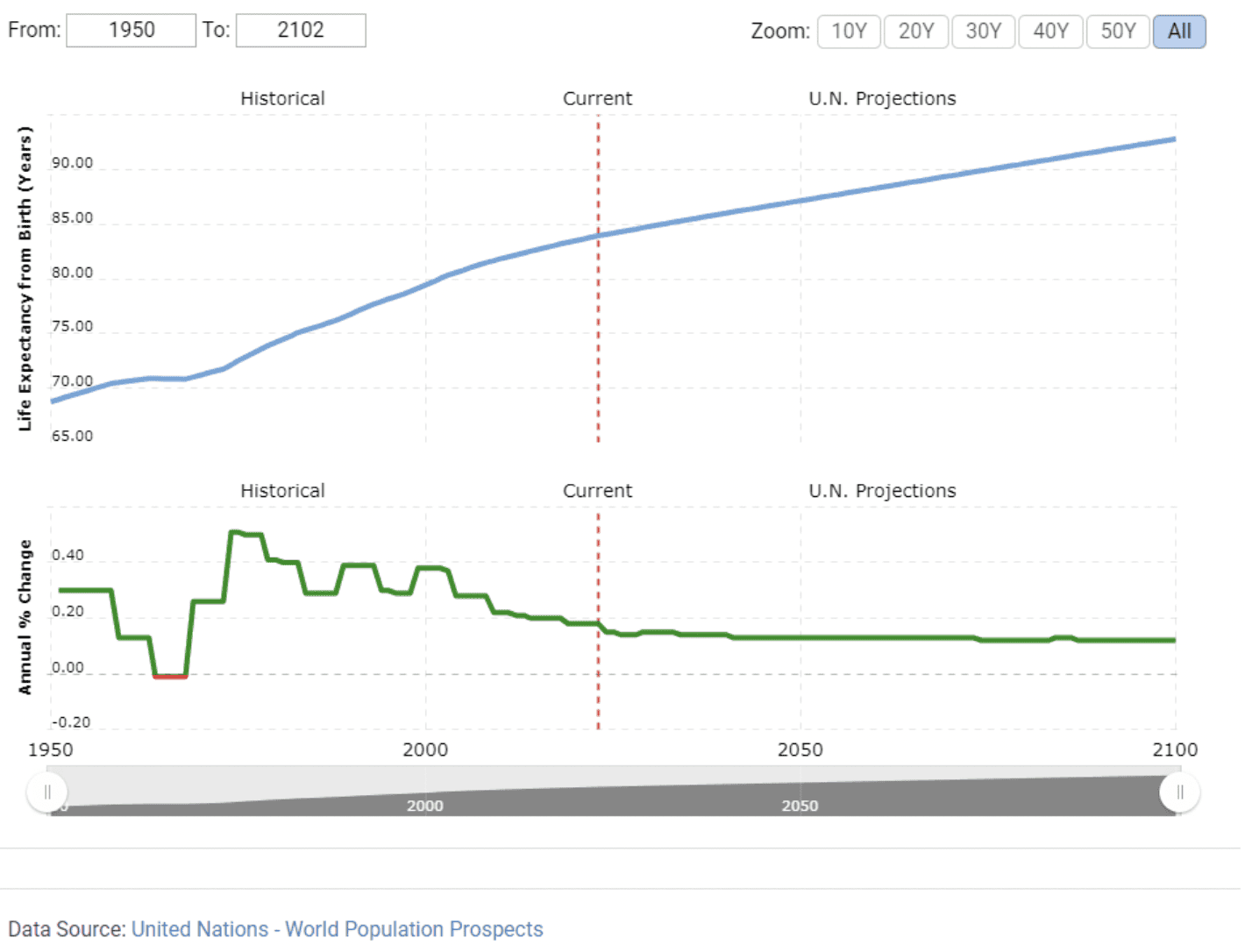

The Australian Bureau of Statistics estimates that over 157,000 Australian‘s intend on retiring in 2023 and with longer life expectancy in Australia, an extending trend, the importance of financial planning for retirement has never been higher.

Financial planning plays a pivotal role in ensuring a stable and comfortable retirement. This involves creating strategies for superannuation, age pension planning, and carefully selecting investments that will adequately support your desired lifestyle during your retirement years.

I often tell clients that retirement is the most important time to get a financial plan. This is because when you retire, your financial strategy shifts from wealth creation to regular income and to achieve the secure retirement you desire, you need a well thought through strategy, that has risk protection and liquidity built in, to suit the way you want to live your life. Financial planning provides a window into the future to give you confidence in your financial position and decision making and then can help you manage change as it inevitably occurs along the way too.

Risk Management

The way you manage risk is of critical importance to your financial future and financial planning plays an important role in how you navigate risk.

Australia’s economic landscape is not immune to risks, including market downturns, unforeseen medical expenses, and other financial setbacks. A comprehensive financial plan includes robust risk management strategies that encompass advice on insurance policies designed to protect you and your family from unexpected financial shocks. As well as structuring advice, to ensure that your investment strategies match what you want from your money and that they match your risk tolerance. This will help ensure you are not kept awake at night or forced into a position where you lock in a loss unnecessarily, that may set back your financial plan.

Having these safeguards in place offers peace of mind, knowing that you are prepared for the unpredictable.

Estate Planning

How you ultimately pass on your legacy, is an important part of the financial planning process, because in Australia, most people die with assets that exceed their debt. Indeed, the importance of financial planning while living is to ensure you enjoy the security of knowing that you have all that you need while you are alive, and this invariably means preserving some of it or keeping some aside for life’s unknowns, like a longer life expectancy.

Estate Planning therefore is an exercise to ensure the people or causes you care about, get as much of your legacy as possible, with as little risk of challenge or tax implications. In Australia, this procedure can be intricate, given the legal prerequisites and the potential tax ramifications involved.

An effectively organised financial plan will incorporate holistic strategies for estate planning, encompassing wills, trusts, and asset distribution, all the while aiming to mitigate the tax responsibilities placed upon your beneficiaries.

Financial planners will generally have estate specialists they know to refer to or will work with your chosen specialist. For many of our HNW families, our financial planning service extends to in-house reviews of their estate plan with a specialist lawyer and can extend to inclusion of family members, to bring everyone onto the same page about the family intentions and reasons for this. Inclusion of family members in your estate plan, can lead to a smoother transition of wealth.

How Yield Financial Planning Can Help

Financial planning is not merely about numbers; it’s about building a secure and prosperous financial future. It’s about understanding where you stand financially, achieving your goals, managing income and expenses, minimising tax liabilities, building wealth, planning for retirement, managing risks, and preserving your legacy.

If you’re ready to take control of your financial future, Yield Financial Planning can assist you. Our experienced team of financial advisors will help you craft a tailored financial plan that addresses your unique goals and circumstances.

Contact us today and let us guide you toward a brighter financial future.