Do you sometimes get confused by how many super options are available and which ones are suitable for you?

If so, I’m not surprised. In over a decade of financial planning and countless reviews of different people’s individual super, I can tell you that there are 100’s of funds available and there can be big differences in fees, flexibility and transparency between them all. This article will outline what are the best super funds available for you.

Looking into the past for a moment, the first superannuation fund emerged in 1842 by Bank of Australasia (now known as ANZ bank) for its staff and the system evolved to be available to specific white collar workers & Government staff in the 1950’s. It was then made available to specific segments of blue collar workers around the 1980s, before becoming available to the broader population after 1990, when compulsory superannuation came into effect.

Since then the Australian superannuation system has evolved to become the world’s largest retirement savings pool with a total of $2.2 Trillion and from the federal government 2018 treasury’s forecast, it is expected to increase to $8.6 Trillion by 2040 IE $ 8,600,000,000.

It’s a staggering amount of money and highlights the significance of this investment for every working Australian.

Throughout this blog, we will help you to understand what the different super options are, along with some key advantages and disadvantages of both, so that you can be better informed as to which option might be the right one for you.

We will also help you to understand some key trends on where Super is moving and provide the top super option that we think you should be looking at in the last 10 years prior to your retirement.

Overview of the Important Superannuation Options

The Australian Superannuation market is made up of a mix of retail, Industry, public sector, corporate funds and in recent times the market has a growing number of individually managed funds commonly known as Self-Managed Superfunds (SMSF).

Below we have outlined each of these for you.

Retail Funds

Superannuation known as ‘Retail funds’ are run by large commercial financial services institutions such as banks, investment companies etc. These funds include the funds of employees of a particular company or company group operated by retail providers. These funds are often open to the public and anyone can open an account with them, by contacting the fund directly or by speaking to their financial adviser to do so on their behalf. Some examples of these types for funds include AMP, Colonial First state, MLC super etc.

Advantages:

- Anyone can join

- Often have a wide range of investment options

- Passive investment options

- Access to active and specialised investment managers

- Access to limited Term Deposit and Direct Shares options

- Some tax planning flexibility

- Some control over how money is drawn down in retirement

Disadvantages:

- % based fees charged by investment managers (range 0.5%–3%)

- Limited Transparency as a specialised investment manager will generally not disclose 100% of their position due to intellectual property

Industry Funds

Traditionally, an industry fund drew members from a single industry to benefit employees working in specific sectors. Over the past decade many industry funds have opened their membership to the general public. As we have all heard from the advertising, an industry fund’s key point of differentiation is their low cost to benefit its members.

Advantages:

- Low cost platform

Disadvantages:

- Limited investment options

- Limited Flexibility

- Limited Transparency

- Passive investment options where Investment managers are restricted by trust deed to mirror the benchmark index

- Takes a one size fits all approach

- Limited or no tax planning flexibility

- Limited or no direct control over how money is drawn down in retirement

Public Sector Funds

These funds are sponsored by a government agency or have a government owned corporation as their contributor to the employee. These funds are rarely open to the general public, meaning unless one works for those respective agency you would not be able to open an account. In some cases, an individual would not be able to contribute into the fund if they leave the agency.

Advantages:

- Low cost platform

- Possibility of having a Defined Benefit scheme with a promise of either good rate of return or in some cases guaranteed income for Life

Disadvantages:

- Only available to employees working in respective agencies

- Formula can mean a low rate of return in certain circumstances

Corporate Funds

These funds are sponsored by an employer and generally dedicated to their employees. Most Corporate funds are closed to the general public, as these funds generally offer a limited option yet price competitive insurance or investment options.

Advantages:

- Often a low cost platform

- Can offer low cost insurance

Disadvantages:

- Limited investment options

- Limited Flexibility

- Limited Transparency

- Passive investment options where Investment managers are restricted by trust deed to mirror the benchmark index

- Takes a one size fits all approach

Self-Managed Super Funds (SMSF)

Unlike all the types of funds mentioned above, an SMSF is significantly different as it is designed by the member, to benefit the member and is run by the member. It offers an exceptionally wide range of investment options to choose from, ranging from Property, shares, Term deposit and all the way up to collectable artwork and it is the fastest growing segment of Australia’s superannuation market.

Advantages:

- Flexibility to tailor to your own circumstances

- Can be the most cost effective solution available

- Best tax planning structure available

- Greater Range of Investment Choice (Shares, Exchange Traded Funds, Managed Funds, etc)

- Transparency

- Greater ability to control Estate Planning

Disadvantages:

- Ongoing individual management & responsibility

- Cost effectiveness is determined by the size of the fund

Stats and Trends on What’s Happening in the Superannuation Market

A good guide for how you should plan to invest your money, is to look at where the market is moving as a whole. Below we will show you some key trends that you should be aware of.

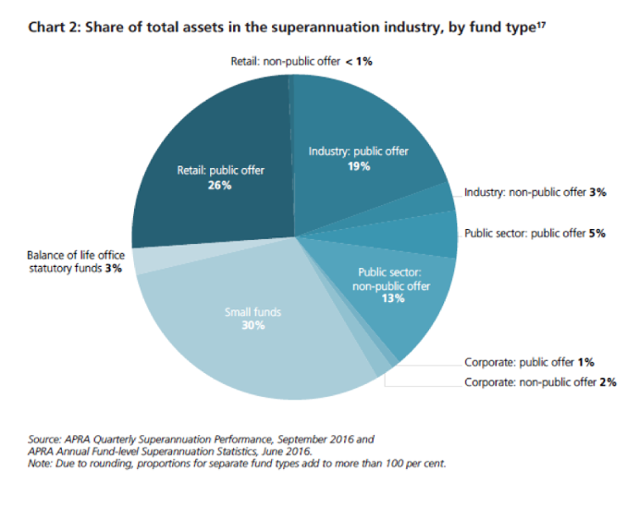

As a start, take a look at the chart below, which indicates the total assets in the superannuation system and how they are divided between these options.

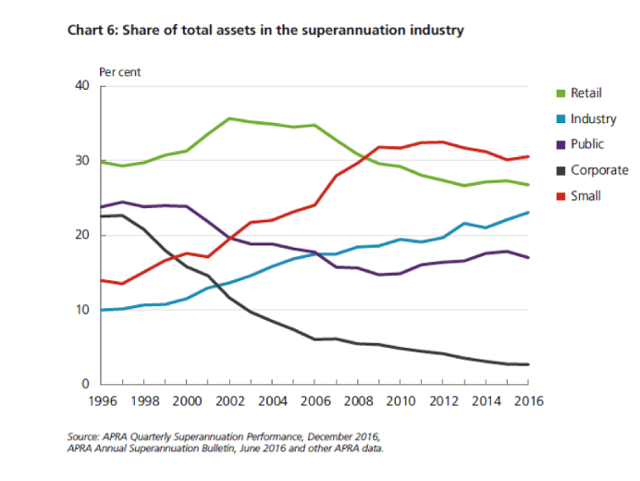

These next graphs show how things have changed over time, since super became compulsory in the early 1990’s.

What is interesting to note from this graph is that apart from SMSF’s and industry funds, the other super option’s share of the superannuation asset pool have been in an overall rate of decline.

The following table takes this information a step further and shows how many members there are in each super fund option.

Breaking this data down, it shows another interesting point. While industry funds and SMSF have been generally growing in popularity over time, the average account size of each is very different. The average balance size of an industry fund is $45,062, whereas a SMSF is $601,103. It’s a massive variance and shows where the big money is heading. It also indicates where SMSF are usually most appropriate, being larger account sizes.

To wrap up the stats and trends, the graphs below, show some additional evidence of how the super fund market is changing. Off the back of significant consolidation, industry funds, retail funds, public funds and corporate funds have all reduced in number. The outcome of this is that it has actually simplified the super fund market for consumers somewhat and for this reason I think it is probably a good thing. There is still healthy competition in the space, but it is a bit easier to navigate your options.

You can then also see the steady increase in SMSF over the years, increasing in number from 100,000 to 587,000, over the period.

Our Top Super Option for the Last 10 Years of Employment

What We Like About it and Some Pros and Cons

With all these options available to you as a consumer, the important question is “which is the best option for me?” especially if you are serious about retirement in 10 years or so.

If you reflect for a moment, what do you think is important to managing your money for retirement?

For me, I want flexibility to invest in a way that is tailored to my lifestyle needs. I want to maximise my return wherever possible and want as much flexibility as possible for what I choose to invest into to achieve this. I want to maximise the control I have of my tax position and I want it to be cost effective or if for any reason I chose to pay more than an alternative, I’d want this option too, if I had a very good reason to do so.

To achieve flexibility and control, the two best super fund options are either SMSF’s or certain types of retail super funds, like Wrap’s and Master trusts.

We assist many of our clients to create personalised portfolio’s using ‘Wraps’ and ‘Master trusts’ and these structures can provide a lot of additional flexibility and investment options, including direct shares. They also give extra control to manage tax outcomes, compared to more mainstream solutions. For many people, this is all that is needed.

With this said, SMSF’s offer the most flexibility and control of any other super fund and when they are suitable, can be the stand out best solution. They generally favour people with larger balances, which the ‘trend data’ we’ve shared shows, as this is where cost benefits are more easily achieved. This is why it is generally more appropriate to seriously consider an SMSF when you have accumulated a fund balance that warrants one and/or are actively looking at ways to grow your balance for your retirement with a more personalised and concerted strategy and plan.

Thinking about low cost, the other option that jumps to mind is the Industry Funds and it may well have jumped to your mind too. They have been incredibly successful at bringing fees to the front of mind of Australian consumers and as a result of their success they have forced unprecedented competitive pressure across the market, which is great for consumers. To keep their costs low though they have maintained a minimalist investment menu which favours a low cost ‘passive’ investment approach in the investment indexes. Retail super funds have followed suit, in order to compete and also offer similar types of investment options and depending on your balance, can actually be less expensive these days than some of the major industry funds, however it is important to recognise that this style of investing is a one size fits all approach and the ‘trends’ we’ve examined above, suggest that they are most popular with smaller account sizes.

Given all of this, with around 10 years left until retirement, it is worthwhile reconsidering your options and to try and hone in on the super fund that is best suited to meeting your unique needs. As part of this research you should consider an SMSF.

They are definitely not for everyone, so make sure you do your homework, but when you are 10 years out from retirement and flexibility and control are important to you, they are worth a look.

Conclusion

When thinking about your super, it is helpful to first look at it from this macro level. Once you understand what the different options are, you can then delve within your preferred option, to find what specific fund is right for you.

Like I said at the start, I’ve been doing this for a long time and I’ve seen more super funds than I care to count and what I can tell you from this experience is that there are huge variances in what is available, so definitely take the time to review what you have before deciding anything.

If you have more than one super fund currently, there is an opportunity to consolidate your funds together into a solution that suits you. Be considerate of possible exit fees and entry fees, which may be a default setting on existing funds you have and seek advice if you have any doubts. By consolidating, you’ll generally save on fees and of course, future administration.

As a last point, just remember that super is there for your retirement. It will likely end up being one of the biggest retirement assets you have and there are various ways that you can positively manage your super to get an excellent outcome, to meet your lifestyle needs.