Drawdown periods in investing can sometimes be quite stressful. However, it’s important to know that periods of drawdown are totally normal.

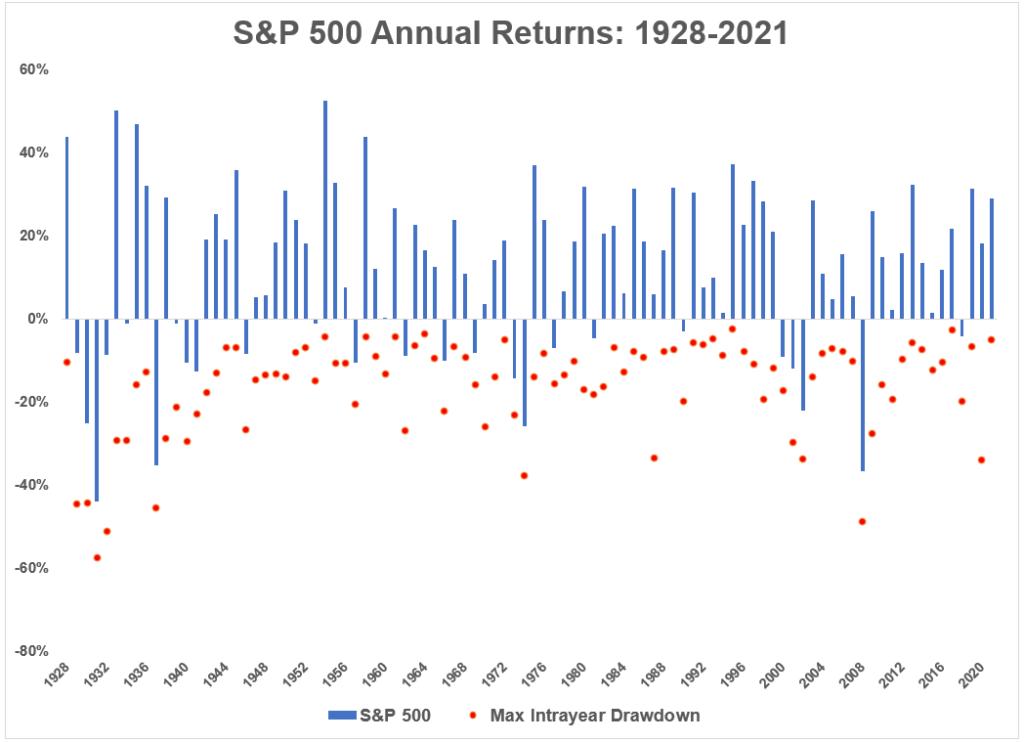

The above graph provides a visual account of the S&P 500 index (America’s top 500 companies by market capitalisation) over the past 94 years.

The blue lines are the total returns for the year and the red dots are the maximum drawdown throughout the year.

There is a lot of information that can be taken away from this graph, but one salient point to remember is that markets don’t go up in a straight line. Indeed, there are always some pullbacks in a year.

Because the share market right now is in a correction, it is timely to consider that:

- On average share markets have risen 3 in every 4 years. This means that despite the fact that the market has drawn down every year, in 3 out of 4 of those years the share market has still ended up in positive territory.

- The average return overall of the S&P 500 since 1928 is 10.13% p.a.

- The total return exceeded inflation by 6.91%, therefore creating true wealth for investors over time.

While it is normal to feel uncomfortable when share markets are dropping, it is also normal that share markets correct.

The trigger for the correction we are current experiencing is primarily inflation and pending rising interest rates. The impact of rising interest rates is taking the steam out of some parts of the market more than others and is likely a healthy readjustment, as valuations in some sectors have become very high. For our clients, we reduced holdings in some of the worst affected sectors last year.

To be a successful investor, you need your investment strategy to align with your financial plan. This is to ensure that you always have money when you need it, without the need to drawdown on your growth assets (like shares and property) at the wrong time.

Once your investment strategy aligns with your financial plan, you can find true financial freedom.

Read here about our wealth creation advice and how we can help you align your investment strategy with your financial plan.