Retirement planning is not something to be left to the last minute ideally. There are numerous lifestyle and financial variables to consider prior to retiring and it is preferable to begin to organise yourself 15-20 years prior to your retirement, so you can prepare yourself for any unforeseen circumstances that may impact your nest egg. With this said, however close to retirement you are, this retirement checklist will help you retire on your terms and securely.

We’ve created this retirement checklist for different stages of your life to help you think about the steps you can address in advance. This retirement checklist will help ensure you can achieve the lifestyle you want when you finish working.

15-20 Years Prior to Retirement

You may think that 15-20 years prior to retirement is too early to begin retirement planning. However, starting earlier rather than later has proven to add to our client’s confidence while transitioning to retirement. It also allows you to plan for the things that are important to you between now and when you retire.

At this point in your life, begin by thinking about:

- When you want to retire

- What you want to achieve/do in retirement

- What lifestyle you want to live

- How much money you will need annually

It’s important to note that retirement could be more than a third of your life. Having a plan will help to determine your financial requirements. If you want to enjoy a life free from financial concern and to enjoy a bit of luxury, like traveling and dinners out, then obviously more income will be needed. Retirement planning now and ongoing makes achieving it more likely.

The Association of Superannuation Funds of Australia (ASFA) released a report that shows individuals and couples around age 65 who are looking to retire today need an annual budget of $46,494 and $65,445 respectively to fund a comfortable lifestyle.

Running out of money is a large concern for a lot of people in retirement, so to ensure you’re not in the same position, speak to your financial planner about conducting a retirement plan.

Be clear on your cash flow and manage your budget

Another strategy to implement at this stage is a budget. Budgeting is crucial at any age and stage of life. However, it’s particularly essential once you retire, especially as you don’t have any employment income throughout retirement.

Preparing a budget ensures that you’ll be able to understand where your money is going and the opportunities that exist to improve things. Then you’re able to quantify how much money you can spend while still being able to meet your ideal retirement lifestyle.

When budgeting, don’t solely consider your regular costs. You should also consider any unplanned expenses you may have in the future, and large expenditure items; ie. a holiday or new car.

We also recommend you break your expenses down into ‘what you need’ and ‘what you want’. You need to be able to ensure that you can always afford the expenses that you need, like your groceries and power bills for example and by separating your costs out this way it is easier to prioritise what you want, in the context of what is affordable.

Retirement is when we typically want to be able to settle down and enjoy the things we love. However, it’s difficult to do this without the fear of overspending. Effective budgeting means you’re able to make measured decisions, rather than impulsive ones where you pay the price later.

5-10 Years Prior to Retirement

At this point, it’s important to review what you have already prepared for your retirement, to ensure your goals and strategies are still performing the way you intended.

There is also the opportunity to implement more strategies and plans to ensure you’re in the best position possible. One of the main things we discuss with our clients when executing a retirement plan is making contributions to superannuation.

The more money you can put into superannuation prior to retiring, the more you’re likely to have when you retire, due to the favourable tax treatment of super money. As other family commitments and debts reduce, you might be in a better position to contribute money to your super.

There are a few different ways you can contribute money into super, such as concessional contributions, non-concessional contributions, or salary sacrifice.

If you choose to invest into super through salary sacrifice, these amounts will be taxed at 15%, which is lower than the tax rate that most Australian’s pay on their employment income.

This is also a good time to begin estate planning. It’s common for our clients who are transitioning to retirement to want to leave their financial estate to their children. In this circumstance, estate planning is crucial to make sure that your assets and belongings are passed on to your beneficiaries as per your wishes.

An effective estate plan will include things such as:

- Naming your beneficiaries

- Tax minimisation

- A Will

- Power of Attorney

- A Healthcare proxy

- A Testamentary Trust

Without effective estate planning, you risk your wishes not being carried out and your intended beneficiaries may receive less than you wanted.

1-5 Years Prior to Retirement

If you’ve completed all the above points, by this stage you should be in a decent position for retirement. Yet there is always more you can do to secure your confidence about retiring, such as debt reduction.

More and more people are entering retirement with some form of debt. The majority of people aged over 55 in Australia have outstanding mortgage debt.

Carrying debt into retirement can be stressful, financially and emotionally. It also may hinder you from completing some of the things you would like to do while retired. So, where possible, begin reducing debts prior to the age you’d like to retire.

It’s important to note that if you choose to pay off your debts by selling your home or investment property, your entitlements to Government assistance may be affected however it is normally ideal to look at shuffling the decks as it were and reconsider how your money is structured and allocated to create the liquidity you need and to reconsider and adjust your risk profile for retirement.

3-6 Months Prior to Retirement

Now that retirement is around the corner, a thorough review of your financial plan, budget, and estate plan is needed. This leaves a window to make any last-minute changes or contributions to super.

This is also a good time to check your eligibility for any payments and services from the Australian Government. If you are eligible, you can have another stream of income throughout retirement besides your savings and superannuation.

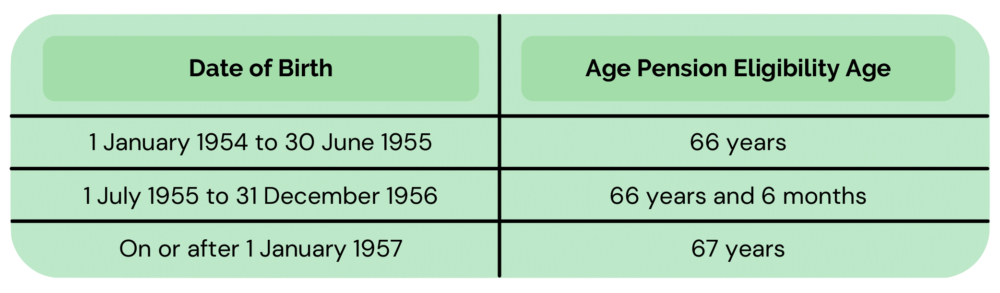

The eligibility requirements differ depending on the type of Government assistance. It’s worth checking with Centrelink or your financial advisor about your eligibility for benefits such as Age Pension or Service Pension. You can claim to receive Age Pension in the 13 weeks prior to reaching Age Pension age.

We have outlined the Age Pension ages for your convenience below:

Yield is Here to Help

We hope our retirement checklist helps you tick a few things off your list while preparing for your transition to retirement. If you require assistance regarding any of the above points, feel free to get in touch with the experts at Yield.