It’s fair to say that most of us have thought about when and how we might like to retire, whether it’s 10 or 30 years into the future. The majority of us have a rough idea of the age we would like to retire, however it’s important to understand that many of us don’t get to live out our plans as we might have hoped. This article will outline retirement advice to ensure you understand how you can prepare for retirement.

Some Sobering Facts

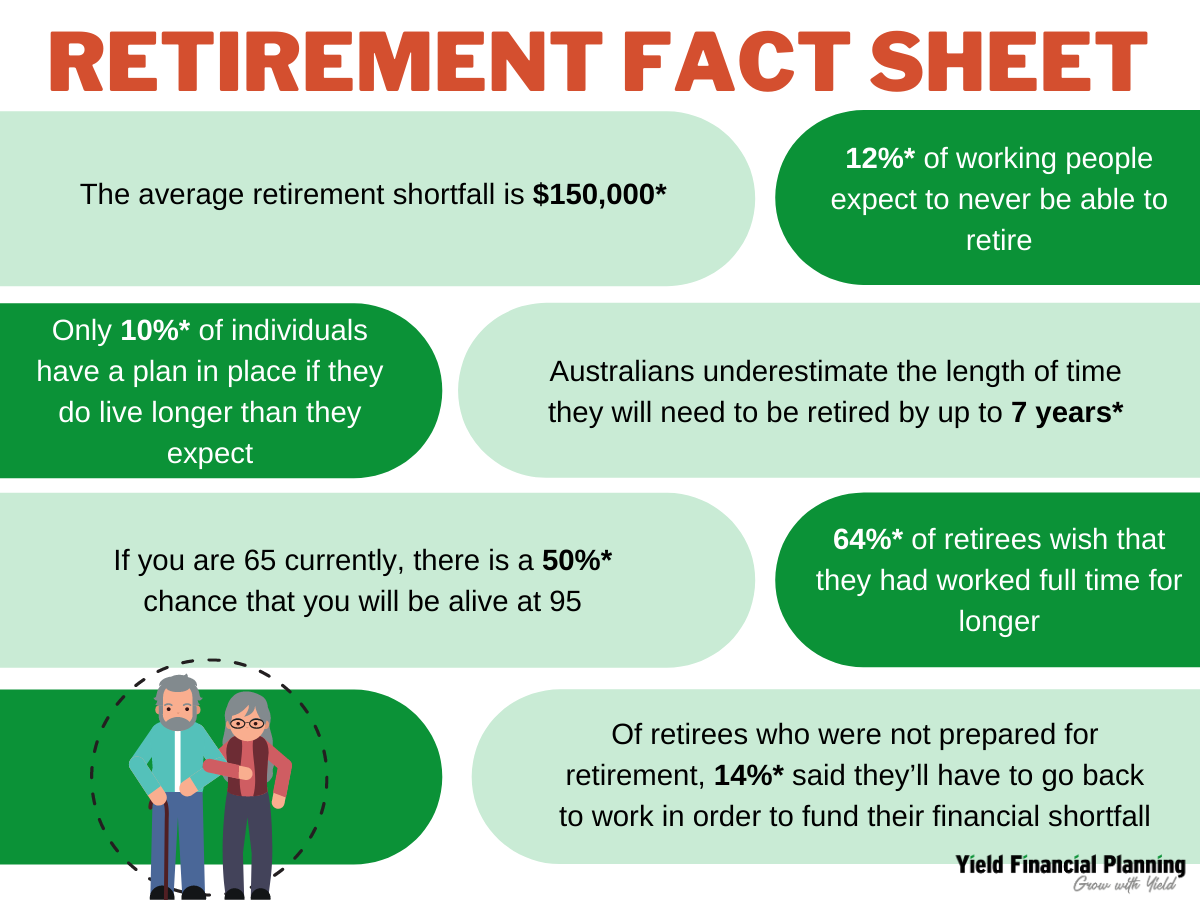

- The average retirement shortfall is $150,000*

- Australians underestimate the length of time they will need to be retired by up to 7 years*

- Only 10%* of individuals have a plan in place if they do live longer than they expect

- If you are 65 currently, there is a 50%* chance that you will be alive at 95 – that means you might need to plan for over 30 years of retired living!

- 12%* of working people expect to never be able to retire

- 64%* of retirees wish that they had worked full time for longer

- Of retirees who were not prepared for retirement, 14%* said they’ll have to go back to work in order to fund their financial shortfall

There’s No Magic Number When it Comes to Retirement

There is no magic dollar amount that is universal to retire on, despite what you might have heard. In reality it all depends on your health now and in the future, if you are in a relationship and what your lifestyle expectations are.

More often than not, injury, illness or redundancy puts a spanner in the works, and prevents us from staying in the workforce to continue to build superannuation assets.

It is also important that you don’t simply think of your retirement savings as a lump sum. It is the income that you can generate from the lump sum that is important.

This is where quality financial and retirement advice really comes to the forefront, as investment strategies can help make the difference between living how you would enjoy versus living how you can afford to.

Retirement isn’t a One Off Event Anymore

Retirement in today’s society tends to be a progressive event that occurs over an extended period of time.

Retirement is evolving for a variety of reasons:

- We need to work for longer to fund our longer lives

- We don’t want to be removed entirely from the workforce for 20+ years

- A lot of us find enjoyment in working, and want to keep active

- There are some strategies, such as Transition to Retirement, which enables you to access superannuation, whilst salary sacrificing when working, to maximise taxation benefits

In The ‘Prime’ Of Your Life and Retirement as a Distant Dream For You?

What you do in your 30’s and 40’s can have serious implications on the state of your finances when it comes to finally retiring.

Contribute over the superannuation guarantee – A simple understanding of compound interest would tell you that there are amazingly tangible benefits from contributing extra to your super.

Consider what might happen if you were out of the workforce for an extended period with a serious injury or illness. If this happens when you are in your late 40’s or 50’s it could prove difficult to make up the difference by the time you retire. You may also need to face the possibility that you might not be able to re-enter the workforce in the same capacity, if at all. This is why we provide retirement advice that focuses on ensuring your wealth is protected whilst you are building it over the most productive period of your employed life.

Food For Thought?

We hope this article has provided you some understanding when it comes to retirement advice. Yield Financial Planners welcome calls and emails if you’re looking for more clarity on how your future retirement is looking, and how we can help you get it on track.

Yield Financial Planning is Here to Help

As Financial Planners, the team at Yield are specialists in ensuring your understanding of superannuation and retirement. We conduct a thorough analysis to ensure that you’re receiving the maximum benefits from your financial plan. If you are interested in discussing with us, please contact us here.