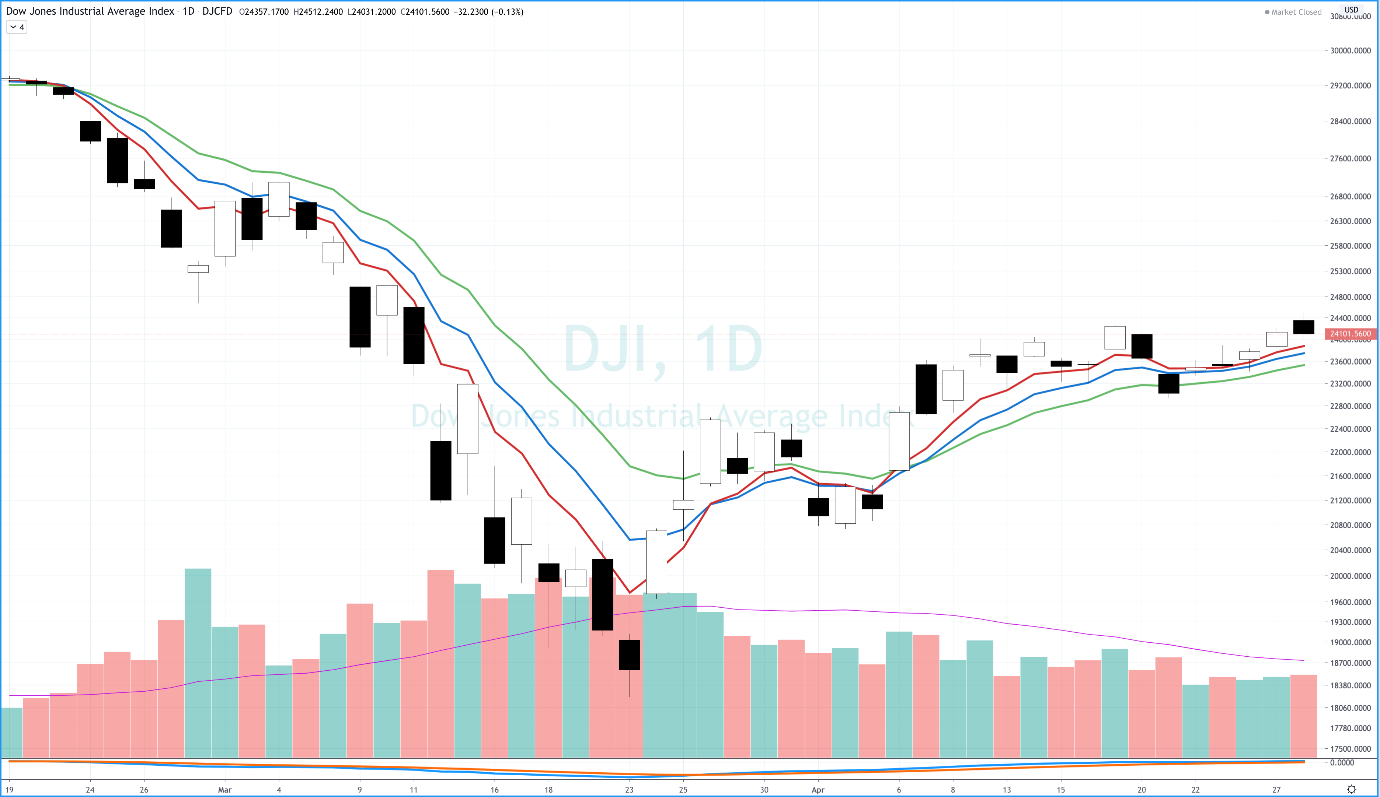

In just over a month, the Dow Jones industrial index shed 36% of its value, representing the fastest bear market retraction in history, making those in the industry consider; is this the calm before the storm for investment markets?

In just over a month since, the markets have recovered well over half of this, to only be 17% down and this is all while the majority of the planet remains in lockdown.

It has been a spectacular recovery from share market lows and actually puts us into a technical bull market once again, so the natural question on every investors mind is – what does the future hold?

Dow Jones performance from peak to present, including bar graph that reflects volume of transactions in market

At face value, it is fair to assume that share markets should be plummeting right now.

Not growing, like we are starting to see, with increasingly less volatility. The global economy remains all but shut down and this is terrible for company profitability, which drives share markets.

Calm Before The Storm For Investment Markets – What’s Next?

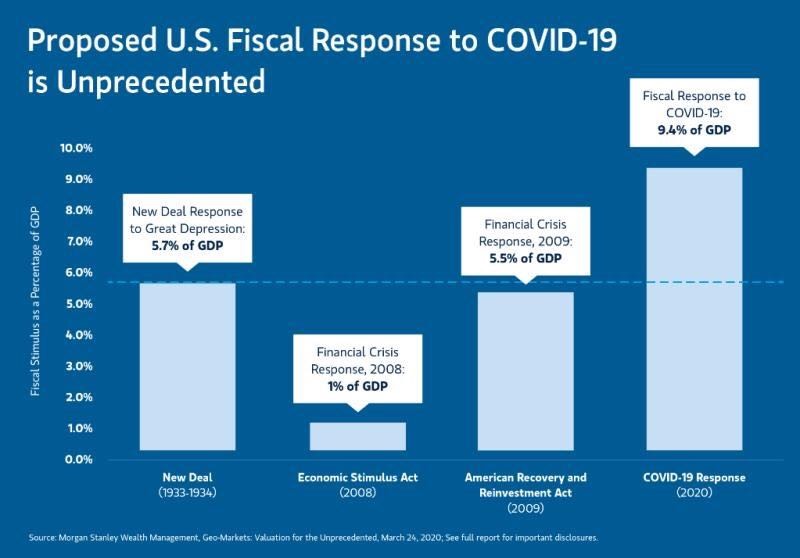

The reason for the market strength however is the unprecedented liquidity stimulus we have seen globally (over A$8 trillion to date).

Especially from major world economies of, in Australian Dollars, US $4.6 trillion; Europe $900 billion (with plans being drafted to increase to over $1.6 trillion); Japan $1.7 trillion.

Even many small economies like Australia have pumped an unprecedented amount of liquidity into the economy (A$276 Billion).

The united government and central bank response is not only more than we have ever seen before, but it has also happened quickly.

This is significant, because history has taught us that the earlier we move, the more effective the stimulus measures will be, and share markets are in turn responding favourably to it.

The alternative would be calamity or more specifically an economic depression and this would come at a greater cost overall. Not just financially, but with real human cost. Investopedia define a depression as:

“A depression is a severe and prolonged downturn in economic activity. In economics, a depression is commonly defined as an extreme recession that lasts three or more years or which leads to a decline in real gross domestic product (GDP) of at least 10%. in a given year.”

It is with this backdrop that the market is currently trying to accurately value the companies that make up the share market and with so little insight currently into what is really going on, it is doing its best to look past the ‘known unknowns’ to a future, where the economy can return to some kind of normality.

A ‘known unknown’ now is that company earnings will be affected because of COVID and it will result in an economic recession, defined as two quarters of negative growth.

How deep and how badly they are affected remains to be seen, but the markets are currently pricing in what is known as a V shaped recovery, which assumes that the stimulus measures that have come and that are expected to continue to come as required from governments and central banks, will help the global economy come through the other side of this and resume with some degree of normality as early as next year.

Assumptions are being built into pricing on things like when a vaccination may come and when lock downs will be lifted too and these will be important milestones to restoring confidence and normality.

The important thing to be aware of however is that markets don’t like ‘unknown unknowns’ and there are several that could rear their heads.

A second wave of infection and further lock down, could be an example of this.

How quickly we reintegrate into our old way of life is another and on this one China could be providing a window into the future.

Having watched them now reboot their economy, the media are reporting changes to consumer behaviour, for instance not rushing back to restaurants or the cinemas.

Fortunately for China, the main driver of their economy is manufacturing, but in western countries like Australia & the US, we are far more consumer reliant.

This means that a similar consumer response, will have meaningful economic impacts.

It’s kind of like lifting rocks at the moment to see what we find and no one really knows for sure what that will be yet. With this analogy in mind, at Yield, we think it is naturally wise to be cautious.

Another factor of note is that this is the tale of broadly two parts of the economy right now.

Companies less affected or even prospering; and companies that are suffering in varying degrees from badly to completely shut down and at risk of collapse.

With this in mind, what we are seeing is some companies trading at similar valuations to before the crisis unfolded (think Amazon in the US or in Australia CSL – both the biggest companies on their respective countries indices); and conversely other companies who are struggling and that are subsequently trading a lot lower (think Virgin or Property trusts for example).

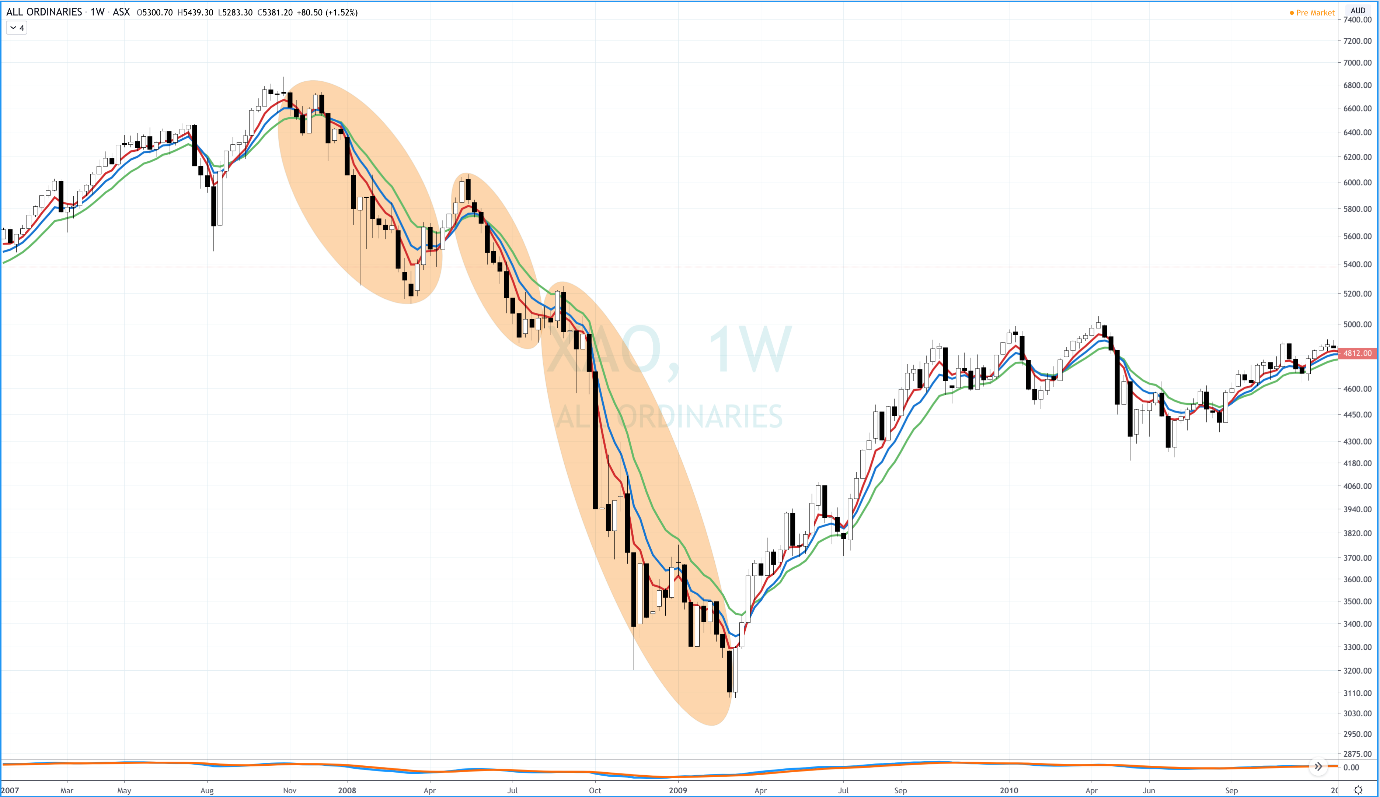

The question we should all be asking however is whether the market recovery we are experiencing is a resumption of the bull market, meaning we’ve seen the worst of falls or if in fact this is a bear market rally.

Essentially a false rally, that will make way for further falls and potentially greater falls than we experienced before.

In the GFC for example we saw broadly three legs of the fall, before it reached its bottom, which would imply this may well be a bear market rally, with further falls to come.

Australian All Ordinaries index through the GFC.

Interestingly, the bear market from the tech wreck in 01-03; the 90-91 bear in Australia (the recession we had to have) and the 81-82 bear follow a similar pattern of three or four stage falls. The exception in this time frame, was the ’87 crash… which is why it was termed a ‘crash’.

If this is a calm before a storm for investment markets and we are in a bear market rally, when the market does roll over we can expect companies that are most affected currently to fall further.

However, if the fall is deep and persistent, as bear markets can often be, then we should expect to see even great companies, that are presently holding the market up to be hit too and potentially very badly, as investors reprice what they are prepared to pay for these companies in the future.

Importantly, whether we are seeing a ‘V’ shaped recovery, as is being priced in currently; a ‘W’ shaped recovery, which would imply another down leg, before we can begin our recovery; or something more severe, like a ‘U’or even ‘L’ shape recovery, that would be expected if we cannot avoid a depression; it is wise to invest with caution.

As investors there are some important principles you should keep in mind:

- Invest within your risk profile

- Only invest into the share market and property market what you can afford to invest through the cycle 7 – 10 years + ideally

- Ensure you have adequate liquid money available to meet your short and medium term needs, so you are not forced to sell growth assets at the wrong time

These three points form the basis of every good investment strategy and how you personalise your approach from there is just that. Personal.

When I am investing, I am always trying to look through the noise and to focus on the facts. Right now one truth is that you can buy the market for a 17% discount to what you could only two months ago and investing is sometimes doing what feels counterintuitive and having the courage to go against the herd.

However, when you are investing in highly volatile times like these, it is especially important to have a clear strategy and plan and that is where we at Yield come in. This is our reason for being, so if it is of interest to you to discuss yours, please feel free to reach out. Contact us