We were recently asked by Adviser Ratings to answer a question they were asked on the Australian share market and its current performance. Graham asked:

“My searches indicate that the Australian share market is overvalued. Is the Australian share market overvalued and does this mean we can expect a major correction shortly ???”

Thanks for your question, Graham. Considering global markets have been choppy recently, it is well-timed to ask if the Australian share market is overvalued.

With this said, our investment committee’s view is that this is not the start of a major correction and in fact, signs are promising that with the vaccine roll out and with continued economic recovery, we should be coming into a growth period.

Is the Australian Share Market Overvalued?

There are several reasons why we think this is not the case which includes:

- Unprecedented levels of government spending are expected to continue in many parts of the world

- Historically low-interest rates, with Central Banks broadly citing a preference to keep them lower for longer

- Vaccine rollout and economic recovery, coupled with the economy not performing as badly as was feared

- Cash rates are so low that most cash at banks in Australia is lower than inflation, meaning the real value of money is going backwards on risk-free deposits. This is expected to result in some higher risk-taking

- Bonds, which have traditionally been considered safe haven, now have high-risk of negative return, due to low yields and risks skewed to increasing rates over time, causing some investors to look elsewhere for returns. Some of this money is likely to find its way to the share market.

In terms of the Australian share market valuation, it depends on the individual stock you are looking at or in some cases, the sectors that you are looking at.

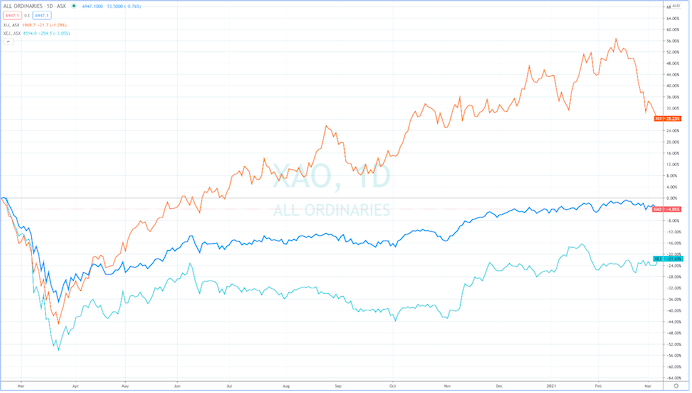

When you consider that Global and Australian share markets have largely made back the losses in 2021, that they suffered at the start of Covid (Australia’s All Ordinary index in blue), it would be easy to assume that they have overshot and thus could be determined as overvalued.

But on closer analysis, it starts to reveal that some sectors have done the heavy lifting in the recovery to date, like technology (Orange line). But other sectors like energy (Light blue line) for example are still languishing on a relative basis and have room to rerate positively.

For Australia, we stand to benefit from the stronger economic outlook globally. Commodities are in high demand which in turn influences commodity prices and this will have a positive impact on our mining sector.

Energy, which has been pummelled due to lower demand as you can see will benefit from stronger economic output around the world and has recovery headroom. As will other Covid impacted industries like Travel and Infrastructure for example.

Of course, all of this depends on the vaccine rollout proving successful and no specific investment should be made without careful consideration of the investment’s fundamentals and outlook.

Reading the Financial Review on the weekend, an article by Matthew Cranston provides a good summary of the growth forces we are experiencing at the moment in Australia that are likely to continue to support a growing share market and not resulting in being overvalued for investors.

The thrust of his article though too, is to question if our Politicians will have the fortitude to introduce the relevant reforms to our system, that will position Australia for growth well into the future or if in reality waste the long-term opportunity we have right now. In short, the decisions that are made now will certainly impact the long-term growth potential for the Australian market.

Of course, risks remain as they always do that could lead to the Australian share market being overvalued and it is therefore important to be vigilant. Inflation is becoming a topic of concern for the first time in decades. This has caused bond yields to rise recently, which has created some volatility, though central bankers at this point are not showing concern.

China presents risks to Australia and then the biggest risk is if the vaccine rollout does not prove to be successful, though, with so many vaccines available, this would appear a relatively low risk for now too.

Asking the question ‘is the Australian share market overvalued?’ is a great mindset to have when thinking about investing in 2022. With all of the above in mind, we are investing as we always do. With caution! But we are currently positioned for economic and share market growth.