Financial stress in Australia has become quite prominent, especially more recently due to the rise in cost of living we’re experiencing. Financial concerns can be the result of losing your job or being retrenched, being unemployed and unable to find work, having debt that you can’t pay off or even just worrying about expected financial pressures.

Between inflation and the incremental interest rate hikes we’ve been facing, eliminating financial stress has become increasingly challenging. In June of 2023, it was reported that 43 per cent of Australians found themselves to be under some degree of financial stress. This was a climb from the previous 29 per cent of people that reported levels of financial stress in early 2022.

Among a multitude of others, some causes of financial stress include:

- Reduced hours at work, unemployment or redundancy

- Supporting others financially, including children or relatives

- Global factors: Recession, high unemployment rate

- Health issues or illness

- Financially abusive relationships: Whether you’re in one or have recently left

- Investments that may not have performed as well as expected

- Divorce or broken relationships

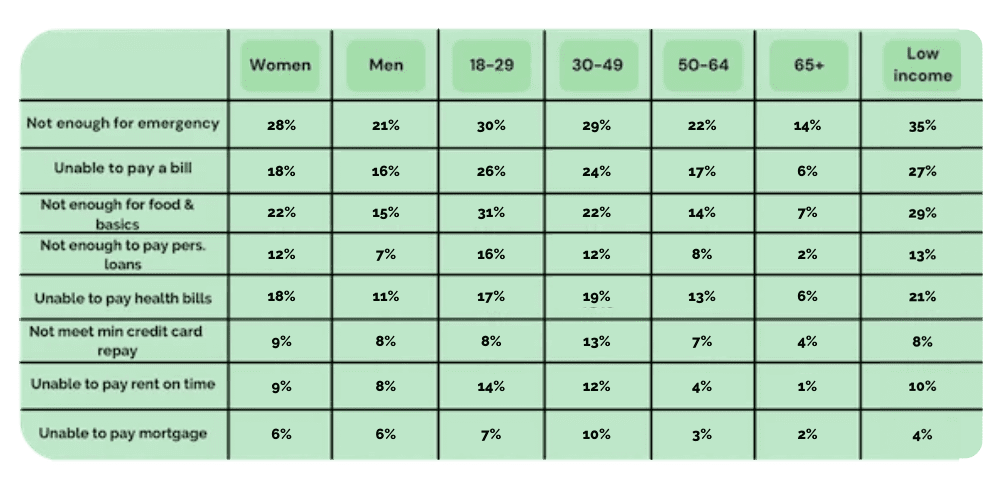

Below is a table that depicts the various types of financial hardships experienced by Australians throughout quarter 2 (2023) of the last financial year.

How to Deal with Financial Stressors

Over the duration of the last couple of years, many Australians have found themselves out of work, often involuntarily. Whether loss of employment is a result of your performance, or can be attributed to the aftermath effects of the pandemic, it is no doubt a daunting issue to be faced with. Below are some tips that can help you navigate the ever-troubling issue of financial stress in Australia.

Look into Your Entitlements

There is a large array of payments offered by the government for various types of situations, which all depend on your current circumstances and whether you meet the criteria. With some benefits boasting long waiting periods, it is always recommended that you get in touch with Services Australia as soon as possible.

Assess Your Personal Financial Situation

Evaluate the amount of money that you’re in possession of so that you’re aware of how long that amount will last. Making conscious changes to your spending habits is also a good habit to acquire until you’re able to get back on your feet. This could be actioned by limiting the use of credit cards. In doing so, it could reduce future financial stress that may hinder you as a result the high interest rates and repayments that accompany the use of credit cards, as well as make it easier to keep tabs on what you can afford. Another great budgeting technique is to identify what you need (IE: what you can’t do without like rent and electricity) and then what you want. What you want can then be prioritised as affordable or not.

Check your insurance policy

If you have life insurance, it may be worth checking your policy for redundancy insurance. Some policies are known to provide an option for income protection, which may provide short-term financial assistance if you’re faced with unemployment. Another tip is that insurance can be seen as an easy cost to cut when you are in financial hardship. Before you do this, understand what cover you have and consider how it may meet your longer-term need. There can be a variety of reasons your existing cover is in your interests to keep and there can be various ways to structure your cover to help you continue paying for it. If in doubt, you may consider getting advice to assist you here.

Begin to Eliminate Your Debt

Identifying the cause of your debt is a great place to start, as this step aids in the process of elimination and prevention. A good example of this being, if you are in debt to your bank or financial institution, you may want to work on eliminating this debt by getting on the front foot and contacting them to discuss organising an alternative repayment method.

Check Your Superannuation Fund

If you have been made redundant, you may be eligible for early access to your superannuation and benefit entitlements.

See a Financial Advisor

Don’t be afraid to seek help from a professional. A financial advisor can help you with your money troubles, whether they’re big or small. An advisor can also assist you in planning and implementing a strategy to slowly get you back on your feet.

Habits to Adapt For Future Avoidance of Financial Stress

Experiencing financial stress is a less than ideal situation to be in, however, it has consistently proven to be one of the leading causes of stress for Australians. As increasingly common as it is, it is important to realise that there are plenty of preventative measures that can be taken to help avoid the situation of financial hardship.

- Budget and track your spending: Planning what you are going to spend can be stressful, but it will assist you in getting on top of things in the long-term. Limiting your spending to allow for money to be put aside for bills and essentials can help ease the stress.

- Avoid impulse buys: By keeping track of your spending, it may help you avoid things you don’t necessary need. A helpful trick to utilise is to cull the amount of money you spend on ‘wants’, leaving those funds to be redirected into ‘needs’.

- Contributing to an emergency savings fund: Putting money aside into an emergency fund, covers all bases by protecting you from unforeseen circumstances that could otherwise meet you with disruption

- Set realistic goals: You won’t solve your money problems overnight, but there is a lot of support available, and your financial advisor can help you plan out small steps to slowly get back on your feet

Yield Financial Planning is Here To Help

Financial stress is not only a daunting issue to be faced with, but it can also be an extremely difficult situation to navigate on your own. Whether you are experiencing financial hardships yourself, or looking to prevent such a situation from occurring, seeking advice from a professional is a great place to begin. If you have any questions or queries about the topics explored above, please reach out to our team of industry experts here at Yield.