A Yield Client Case Study

Structure business to operate via a Family Trust with a Bucket Company. This saves approx. $16,740 a year in tax

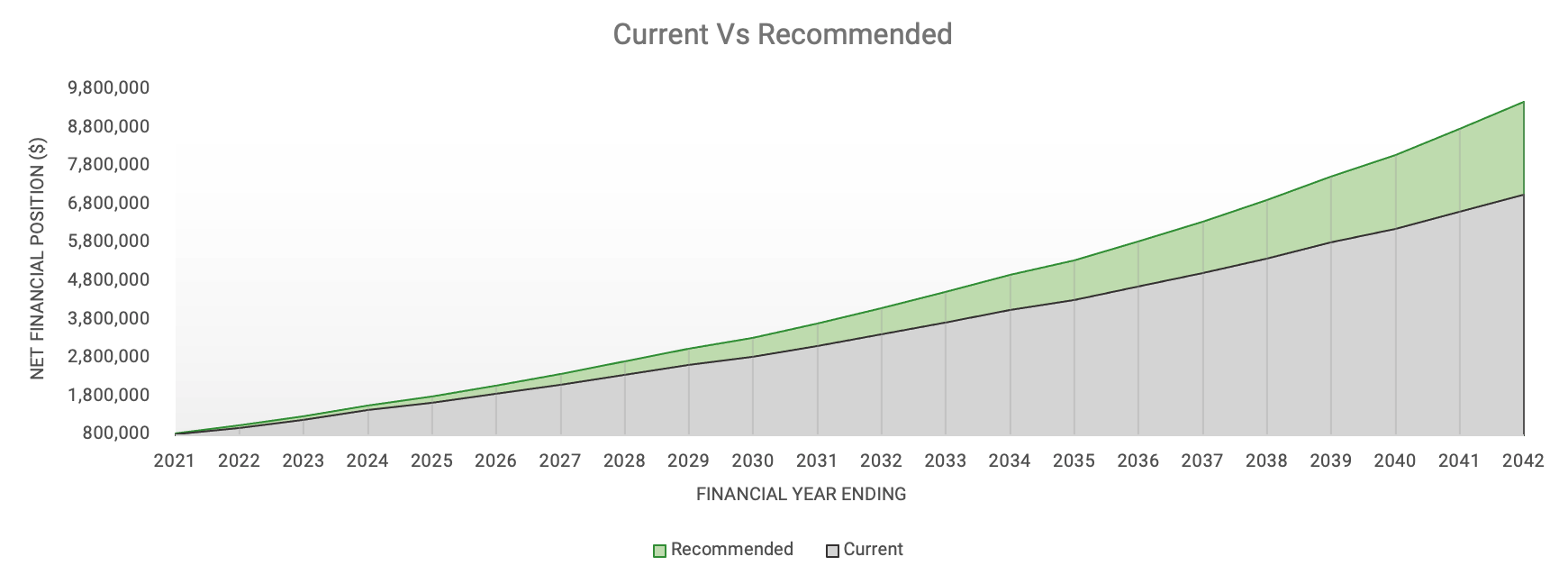

Overall asset position improved by $4,012,000 at clients desired retirement age of 60

Cashflow analysis demonstrates the couple is in a strong position to purchase two investment properties over next 3 years

Ability to retire as early as 47 years old, which is 1.5 years sooner than current trajectory

Structure business to operate via a Family Trust with a Bucket Company. This saves approx. $16,740 a year in tax

Overall asset position improved by $4,012,000 at clients desired retirement age of 60

Cashflow analysis demonstrates the couple is in a strong position to purchase two investment properties over next 3 years

Ability to retire as early as 47 years old, which is 1.5 years sooner than current trajectory

Our clients, Christina and Mitch, are a couple in their early 40s with two young kids that needed help structuring their small business that has provided them with profound success and pride, but needed our financial advice on how it could be enhanced to ensure that as much of their earnings are staying with them and that they are well protected for their future.

Christina is a sole trader who owns a small eCommerce business that resells high end designer bags that has been very successful, and this achievement has prompted the couple to look into investing in property.

Introduction

Christina’s small business and its development has led to the couple wanting to know what else they can be doing with the business to leave more money with them and their financial planning ambitions.

This included the couple’s identified goals of purchasing additional investment properties over the next few years and being able to retire by the age of 60.

Our analysis calculated that the couple would be able to retire at 60 with everything they are doing now, however, our solutions for structuring a small business in a tax-effective manner would see their other goals achieved and their retirement lifestyle enhanced.

Overview – How We Structure A Small Business

When our team of financial advisors looked over the business planning possibilities to see where we could apply our advice, we saw that the current set-up positioned them with a large amount of tax payable from the business.

This could otherwise be reduced with the right structures in place, which in this case could be the business operating through a discretionary trust, also known as a family trust.

This structure could allow for a bucket company structure to also be implemented that would have profits that are greater than the families personal cashflow needs be redistributed to the company that sits within the family trust.

This was a great financial planning solution for the couple to discuss with their Accountant as they now had significant earnings above their expenditure needs, but were being taxed at Christina’s marginal tax rate, which would now be at the corporate tax rate of 30% with the bucket company executed.

When it comes to the couple’s ability to start investing in property, we worked on the goals specified by the pair that they wanted to purchase two investment properties, one at the beginning of the next financial year (2021/22) at the value of $1 million or over, with another a year later at the beginning of the 2022/23 financial year.

Outcomes – Structuring a Small Business to Benefit Their Financial Plan

When it came to the couple’s ability to purchase their desired investment properties, their surplus cashflow put them in a comfortable position to be able to afford these whilst also being able to retire at age 60.

We found that this could be done in one of two ways

- Within the family trust for the long-term tax benefits, despite the short-term costs that could outweigh the benefits

- Having them in Mitch’s name personally, for asset protection purposes

If they were to simply focus on debt repayments and offsetting their debt, they could potentially be debt free by the 2034/35 FY.

To protect the family’s future ability to be secure despite accident or injury, we set up Life, TPD, Trauma, and Income Protection Insurance for both Christina and Mitch.

To enhance their ability to retire at 60 and being able to provide for their intended lifestyle, we recommended they both maximise concessional super contributions, which doing so this financial year would provide an estimated tax saving of $12,498.

Implementing this in the next financial year would provide an estimated tax savings of $16,740 p.a due to the increase in the concessional contributions cap and assuming that Mitch’s taxable income would increase due to the distribution of the business profits.

On the couple’s investment strategies for retirement, the bucket company can hold assets that can be drawn on during retirement in a tax effective manner as the dividends paid can be accompanied by Franking Credits.

To expand on the couple’s investment portfolio to help ensure they are well diversified, we also recommended signing up to our Managed Discretionary Account service which provides a more proactive management of investments and to shift their current super across to the Wealthguard platform.

Important Note

Produced with our client’s permission. Names within this case study have been changed to protect the client’s right to privacy. The content of this case study has been based on a real-life client. Any information provided here is general advice only and does not consider your objectives, financial situation or needs. This information should not be taken as comprehensive and does not constitute legal or financial advice. You should seek legal, financial or other professional advice before relying on any content. Yield Financial Planning is not responsible to you or anyone else for any loss suffered in connection with the use of this information. Information is only current at the date initially published.