As a SMSF specialist, we get asked all the time about whether buying an investment property using super and borrowing for leverage is smart and while it is not for everyone, this article explores five reasons for why it absolutely can be.

1. Borrowing Super to Buy Property, Leverage’s Your Investment

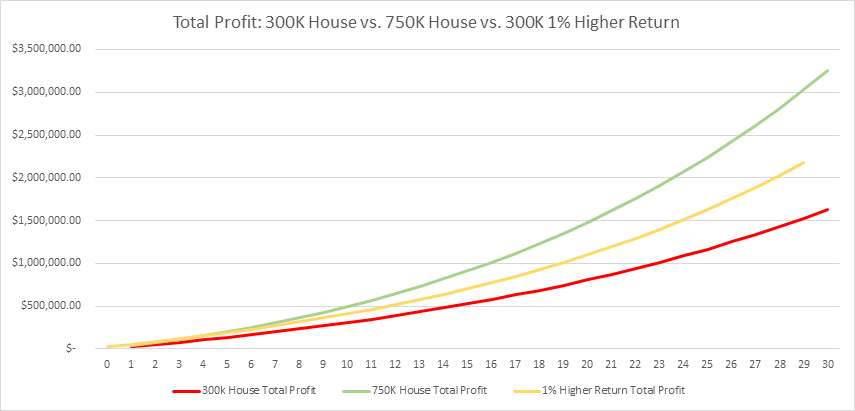

Whether you are investing inside or outside of superannuation, leverage through borrowing to a smart property investment, compounds your return and when the compound growth exceeds the borrowing cost, purchase costs and holding costs over time, you have a successful investment property using super, that can catapult your investment forward at a potentially far faster rate than it could have otherwise. To illustrate this, we’ve prepared an example.

Let’s assume you have $350,000 in your super. On this basis you can comfortably afford to buy a house worth $300,000 plus costs and it leaves some money in the bank. Now for comparison and to demonstrate leverage, we will look at the impact of borrowing $450,000 for the purpose of buying an investment property with super worth $750,000, approximately in line with the Melbourne property market median at the time of writing,

| $300,000 Property | $750,000 Property | $300,000 Property +1% Higher Return | |

|---|---|---|---|

| Total Gain | $1,624,430 | $3,251,075 | $2,177,262 |

| Total Gain % | 541% | 1,084% | 726% |

In the red and green examples, we’ve assumed the same rate of growth of 5% p.a., however in the yellow example we’ve assumed a 1% p.a. greater return, to demonstrate that even against a higher performing but lower value investment, the value gap grows exponentially over time. Further, the return of the leveraged investment has been artificially dragged down, given for simplicity we used the assumption that no capital debt repayments are made, when in reality debt repayment is a requirement of most SMSF loan providers.

2. Investment Property Using Super That is Not Leveraged, Can Mean an Investment Into a Compromised Asset

Once you’ve decided that buying an investment property with super is the investment you want, considerate of things like your age, investment time frame and diversification for example, then it may also pay to consider borrowing too.

Not all property is created equal and if a property is trading at a value below the median, then it might be providing preliminary insights into how well it may grow in the future.

Consider again the example above. The median Melbourne property price is currently around $750,000, and this implies that an investment made for $300,000 is likely to be compromised in some way. It could be any number of reasons, but a few that exist could include:

- Proximity to the city

- Maybe it is not unique or scarce in any way

- Due to design or council regulations

- It could be it has a relatively small land ownership

While it may be possible to pick a low valued property that performs or even outperforms the median, it is comparatively more likely that the reasons that have held back its value to date, will continue to hurt its future performance.

This is only a simple rule of thumb of course, as the investment selection argument is very subjective.

3. Tax Benefits

Tax benefits are one of the biggest attractions to wealth creation in super and should always be considered as part of your investment strategies for SMSF.

Tax can be as low as 0% or up to a maximum of 15%, so when you compare these rates to investing personally, the argument for growing your super is strong.

When it comes to borrowing super to buy property, you can compound your rates of growth, as outlined in point one and given the very low tax rates, your after tax ‘net investment return’ can be fueled positively as a result, when buying an investment property in super.

4. Buying an Investment Property in Super May Mean More Super at Retirement

When it comes to retirement, superannuation is the best structure we have available in Australia.

Besides the ‘super’ attractive tax rates, there is currently complete flexibility to withdraw any amount you like as a lump sum, assuming you’ve met a condition of release.

With retirement benefits this good, the challenge has become how to get money into super and the rules have been getting tighter and tighter in this regard.

In this way, when borrowing results in compound growth greater than what could have been achieved without it, the outcome has been to positively turbocharge your savings in this very tax-effective and attractive retirement savings vehicle, making buying an investment property with super a smart property investment.

Importantly to temper this, if this is your strategy, it is worth viewing your debt levels across your entire position, as if you are already highly geared outside of super it may well not be appropriate to be borrowing within super as well. Debt does ultimately equate to greater risk and if your investment does not perform well then your return is compounded on the downside by having debt.

5. Buying Your Own Business Premises As an Investment Property

Do you own a business that is stable and profitable or know somebody that does?

If yes, then buying a business premises within an SMSF may be a very smart property investment.

Buying a business premises can make a lot of sense when owned in an SMSF, but most people don’t have a balance big enough to buy it outright.

This quandary is regularly compounded, because commercial property is often more expensive than residential property, making the commercial purchase even more out of reach for most people.

This is where borrowing super to buy property can make a lot of sense, especially if you are already contributing all you can to super as concessional contributions.

Commercial property rental returns are generally higher than residential property as a percentage of the value and as a business owner, this equates to a large amount of rent being paid out of the business cashflow.

However when you own the property, rent money is not dead money. There is actually an argument to pay yourself on the high side of fair market rates, especially when you are already maximising your personal concessional contribution levels.

If you are a business owner and there is a long term need for a business premises, this strategy can make particular sense, as your needs as a landlord are aligned to your needs as a tenant.

This strategy can work, even when you already own a commercial property for business, but transferring it in is complex and you should consult an SMSF specialist, before proceeding.

It’s a Wrap

Each of these positives should be considered in light of the negatives that go with borrowing to invest, however we hope to have shown some of the reasons why you could consider buying an investment property with super.

A lot of consideration and forward planning should go into ‘why’ you would borrow to purchase property in super and we’d welcome the opportunity to have a private consultation with one of our SMSF specialists to review how this could work for you.

Written by James McFall – Financial Planner and founder of Yield Financial Planning.