Finding yourself asking how to reduce tax that you pay? Well, there are several strategies that you can put in place to reduce the amount of tax you pay legally. However, the abundance of information available on the topic can make you feel like it is too much of a hassle or too difficult, stopping you from taking the next step. Seeking the advice of a good financial advisor that specialises in effective tax planning can help you navigate these intricacies and optimise your tax structure.

We have outlined the introductory steps you can take now to help put yourself in a better position in the future.

A Good Money Management System is Like Getting Your Plumbing Right

If the tap you have leaks but your normal usage hasn’t changed, you’ll use more water overall, with the excess literally going down the drain.

It’s the same for your finances and by simply avoiding the waste, you can potentially dramatically improve your overall saving capacity. All while having little or no impact on your lifestyle.

This is part two of our five-part blog series in which we will teach you to think like a business owner, by looking at the main ways money leaks from your savings, that can be fixed and then saved for your benefit. These are:

- Reduce your spending with a budget and save

- Legally reducing the tax that you pay

- Managing Debt Costs – By getting the structuring right

- Spending money that makes money

- Protecting your ability to earn income, with insurance

How to Reduce Tax – Think Like a Business Owner

Have you ever viewed the tax that you pay as an expense that you have some control over?

You can be assured that all successful business owners have, and it is with this mindset that you are most likely going to identify opportunities on how to reduce tax.

Now if at this point you are already getting bored at the mere mention of tax, we do get it!

It’s a dry and complex topic, but the thing to wrap your head around is that tax is likely to be the BIGGEST expense you have in your lifetime, and therefore the more that you pay, the more time you will need to work to meet your money goals.

So, how you ask? Let’s explore some of the biggest levers available to minimise tax legally:

- Claiming deductions and rebates you are entitled to

- Choosing between the various tax structures available

- Deferring tax bills through various means

Claiming Deductions and Rebates

If you are seeking the advice of an Accountant, they should be helping you navigate your entitlements each year. However, the important point to realise is that if you don’t claim an expense that would otherwise be deductible, you are essentially paying for this out of your net income, rather than gross.

Depending on your tax rate, this could mean you are essentially paying nearly twice what you should be!

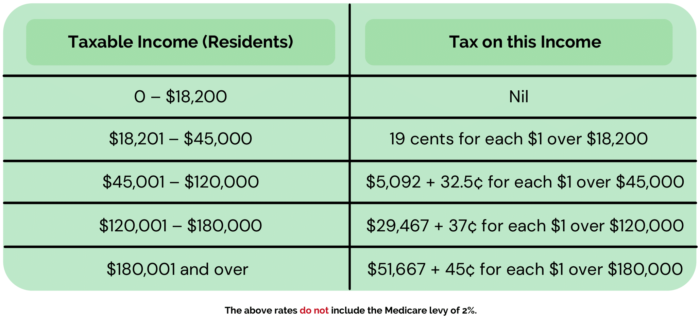

Take a look at the personal marginal tax rate table below, which will give you a guide on how much tax you are currently paying and therefore what you could be claiming back from the government, with legitimate tax deductions.

So with this in mind, it is important to ensure that you take some ownership of the discussion too.

As a basic rule of thumb, expenses incurred for income producing purposes should be tax deductible. So whether it is expenses relating to running a business; an investment like property or shares; or even home office expenses as a result of COVID-19, you should be ensuring your Accountant is aware of it and helping you to understand all of the deductions and rebates you could be entitled to.

As a Financial Planner, we help clients develop their strategy with foresight, considerate of deductions and rebates and often work collaboratively with Accountants to help develop the strategy.

Choosing an Appropriate Tax Structure

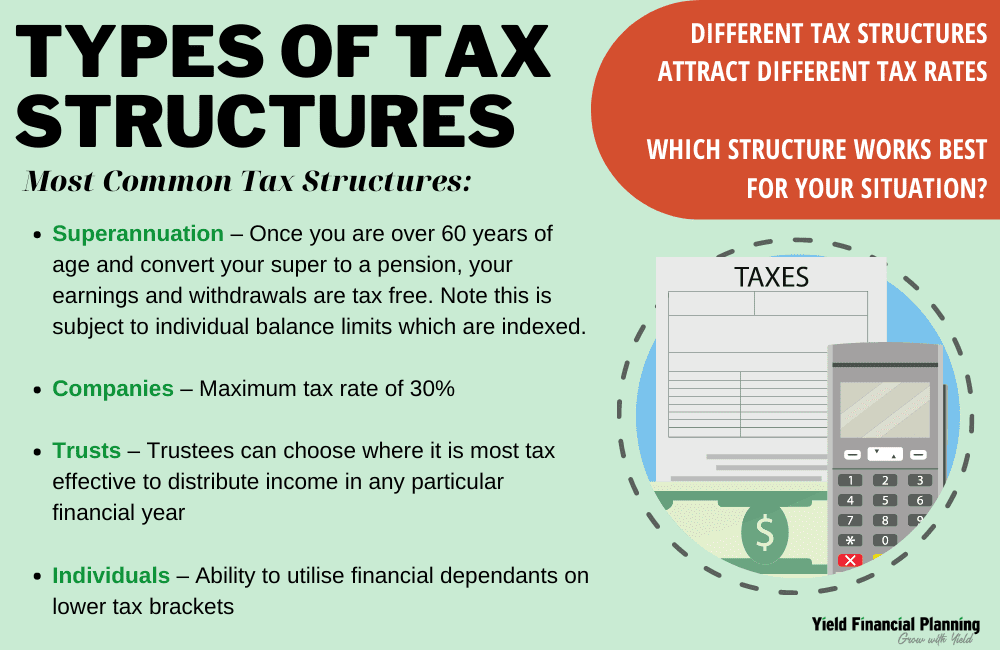

One of the most important things to understand about effective tax planning is structuring. Different structures attract different tax rates and therefore by simply channelling money through the right structure you can greatly improve your end tax cost.

Let’s first look at the simplest and most familiar – YOU! All of us as individuals are a tax structure in the eyes of the ATO and rules apply in the way we are taxed, which we outlined above. This means that all the income that you earn in your name is taxed according to rules that apply to individuals and can be up to 47%, which in anyone’s language is a lot! Understanding how to reduce taxable income means that optimising your tax structure becomes an essential component.

Now in reality it is only 5% of the population that are in the highest marginal tax bracket, however, for everyone else there are still events that can push you up, like realising a capital gain, and it is therefore relevant to almost everyone to at least consider how they can reduce their tax bill. By doing so successfully, you are keeping more money in your pocket, rather than the governments.

So, what are your options?

Some of the most common tax structures that exist include:

- Superannuation – super tax effective retirement structure

- Companies – wide usage beyond starting a business

- Trusts – one of the most flexible tax planning tools

- Individuals – financial dependants on lower tax brackets

All of which provide solutions on how to reduce taxable income. However, it’s important to understand each tax structure, in order to determine whether they are right for you.

Superannuation

When it comes to your retirement, there is simply no better place for your money than superannuation. It is a legal tax haven in Australia. Once you are over 60 years of age, everything you earn on investments you hold inside your super is tax free. Anything you withdraw, is entirely tax free.

Super has tax concessions going into super too, which for most of us means we only pay 15% contributions tax, rather than our personal marginal tax rate of up to 47%. It’s simply a must-consider structure for retirement planning. It’s important to understand your rights and limits for both concessional and non-concessional superannuation contributions, to best utilise these strategies.

Companies

When you think of a company, your mind probably immediately moves to a business. It’s true that many businesses use a company structure to operate their business from, but companies can have a lot of other uses. Particularly when it comes to tax planning.

The two main tax planning benefits that companies are good for include:

- The maximum tax rate is 30%

- Companies have franking credits, which means that when a dividend is paid out of the company, it has a tax credit

Trusts often distribute to a company and the company can then be used as an investment vehicle. We always consider companies as part of our asset structuring financial advice, particularly when viewed as part of a retirement plan.

Trusts

Trusts, like companies, have multiple uses and can make a lot of sense when asking how to reduce tax, especially for business owners. There are various types of trusts, and they are especially flexible in helping to address specific tax concerns. For this reason, it is almost certain that you should be seeking financial advice on whether a trust is suitable for your needs.

The most commonly used private trust is a family trust. As the name suggests, family trusts are broadly used as an income distribution vehicle to family members. The main benefit is that the trustees (typically the parents who are also beneficiaries) have complete discretion over where income and capital gains are distributed. This means the trustees can choose where it is most tax effective to distribute income in any particular financial year in order to reduce the tax you pay.

What’s more, beneficiaries are not limited to being individuals either. You can have a company as a beneficiary for example, meaning that trusts and companies often form part of a bigger tax structuring plan.

Trusts are not for everyone, but when they work, they can make a big difference to the amount of tax that you pay.

Individuals

We’ve already explored how we are taxed as individuals, but I circle back to remind you that the simplest tax structuring decision is to ask yourself if owning an asset in a low-income partners name for instance works. For example, an investment property owned in a non-working spouse’s name, may mean that all of the rental income is tax free year to year and could mean there is a lot fewer capital gains tax to pay when you come to sell it the asset.

Another example of when thinking about which individual’s name an investment should be in, may relate to age and what the persons employment intentions are for the future.

Effective tax planning between individuals is ultimately the simplest way to manage tax and can make a big difference to the end of financial year, tax outcome if thought through from the outset.

Deferring Tax Bills

One of the complexities of tax is that there are various ways to defer paying tax, which should always be a consideration in effective tax planning.

For a start, if you can defer paying tax, it usually gives a full year before that tax is payable, given we typically do our personal tax returns annually. What this means is that each year you can defer a tax bill, your money is working for you, rather than the government.

The simplest example of tax deferral is holding off the sale of an asset you have a capital gain on to a future financial year.

While making investment decisions based on tax alone is usually not the best idea – if it is the difference between realising the gain in May or June one year or pushing it out to July or August, it may well make sense. That money that would otherwise be paid out could be working for you, sitting against your home loan for the year instead.

Just to build on this simple example, by deferring the sale to a new financial year, you can also consider with some foresight how the individual’s personal income may differ in the following year. Is it going to be lower? Is it possible to influence this?

Tax deferral is a big topic and there are many ways that it should be considered as part of a comprehensive tax strategy, but the key takeaway for you today is that legal tax deferral is a big part of effective tax planning.

Yield Financial Planning is Here to Help

At Yield Financial Planning, we help our clients craft a financial plan for the future. A vitally important part of the planning process is to help our clients navigate the foreseeable tax considerations of their strategy and to endeavour to minimise tax bills where practical.

While the role of a Financial Advisor is not to replace your Accountant, we can help you develop your tax strategy in context of your broader financial plan, and thus can work productively together with your Accountant where it is applicable, to help make effective forward-looking choices.

As outlined at the beginning of this article, tax is likely to be the BIGGEST expense that you have in your life, so managing it, and where possible reducing it for your benefit, will help to reduce the amount of time that you have to work in your life to meet your financial needs and goals; this should be the aim of all good money decisions. Contact a Yield adviser today to start the conversation on how you could implement these strategies and minimise tax you pay.